Bitcoin longs hit record high on Bitfinex, long squeeze incoming?

Bitcoin longs hit record high on Bitfinex, long squeeze incoming? Bitcoin longs hit record high on Bitfinex, long squeeze incoming?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

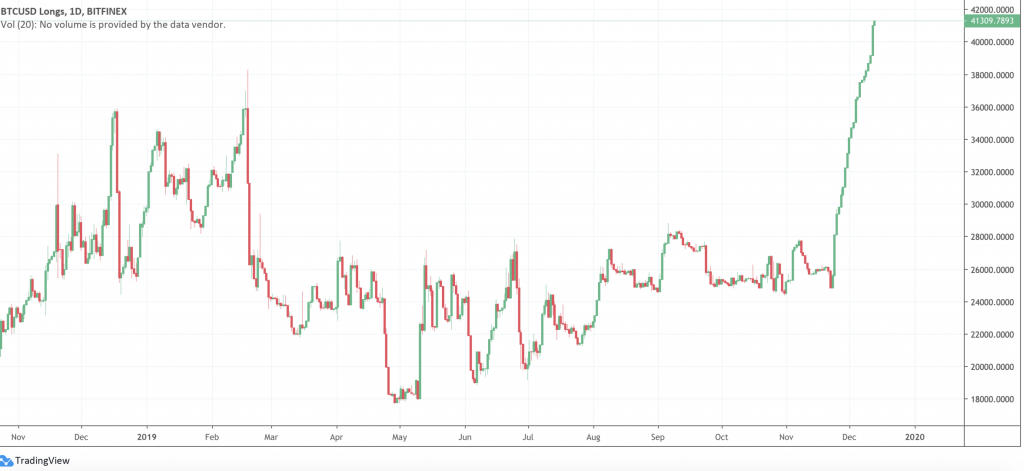

The number of Bitcoin long contracts on margin trading platform Bitfinex has exploded in December to reach the highest level in years, far exceeding the levels of BTC’s late 2017 bull market.

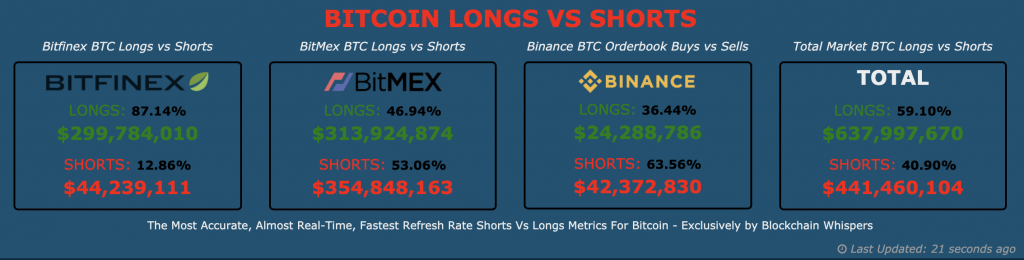

Traders currently hold more than 43,000 long positions, worth $299,784,000, on Hong Kong-based Bitfinex. The ratio is overwhelmingly skewed in favor of the bulls, who hold 87.1 percent of all positions.

This is a stark contrast to BitMEX and Binance, two of the largest exchanges by daily volume. The bears are the majority on both exchanges, with short-sellers holding 53 percent and 63.5 percent of total Bitcoin positions respectively.

Long squeeze incoming?

In all likelihood, a break below $7,000 — the support level of the 20-day trading range — could stop out many of the long holders on Bitfinex and place a substantial amount of sell pressure in the market.

Longs on Bitfinex have been rocketing since Nov., seemingly permitted by BTC’s tight trading range. Volatility fell sharply around the same time the Bitfinex bulls started to amass long positions, Nov. 22, and has remained unusually low since.

Unlike the 100x leveraged futures exchange BitMEX, Bitfinex offers comparatively low leverage of 3.3x on Bitcoin — accordingly, its traders are significantly less affected (in theory up to 30 times less affected) by fluctuations in BTC’s price.

Small breakouts to the downside can lead to highly explosive price movements, collapsing price as leveraged long holders outrun their margin and exacerbate declines — considering the colossal number of long contracts on Bitfinex, the platform’s low level of leverage may be a saving grace for Bitcoin bulls.