Bitcoin is the strongest performing major asset of 2020 and the past decade

Bitcoin is the strongest performing major asset of 2020 and the past decade Bitcoin is the strongest performing major asset of 2020 and the past decade

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

There’s no question that 2020 has been a volatile year for Bitcoin, with the relatively small and immature crypto market incurring some significant turbulence alongside that seen by virtually all traditional markets.

In spite of this micro-volatility and recent downturn, Bitcoin still remains the best performing major asset of both 2020 and the past decade, with the benchmark cryptocurrency’s strength in the face of global adversity bolstering its safe-haven narrative.

Bitcoin sees strong micro and macro performance against global markets

Ever since both Bitcoin and the equities market saw a capitulatory decline in mid-March, bulls have stepped up and fought back, propelling both BTC and the stock market higher.

This rebound has been particularly strong for Bitcoin, which has nearly doubled from its lows within the upper-$3,000 region, with its recent uptrend allowing it to climb slightly from where it started the year.

Of all the major markets, Bitcoin is one of the best performing in 2020. While it is trading up marginally this year, the Dow Jones – and all the other benchmark indices – are still trading down 20 percent or more from where they started 2020.

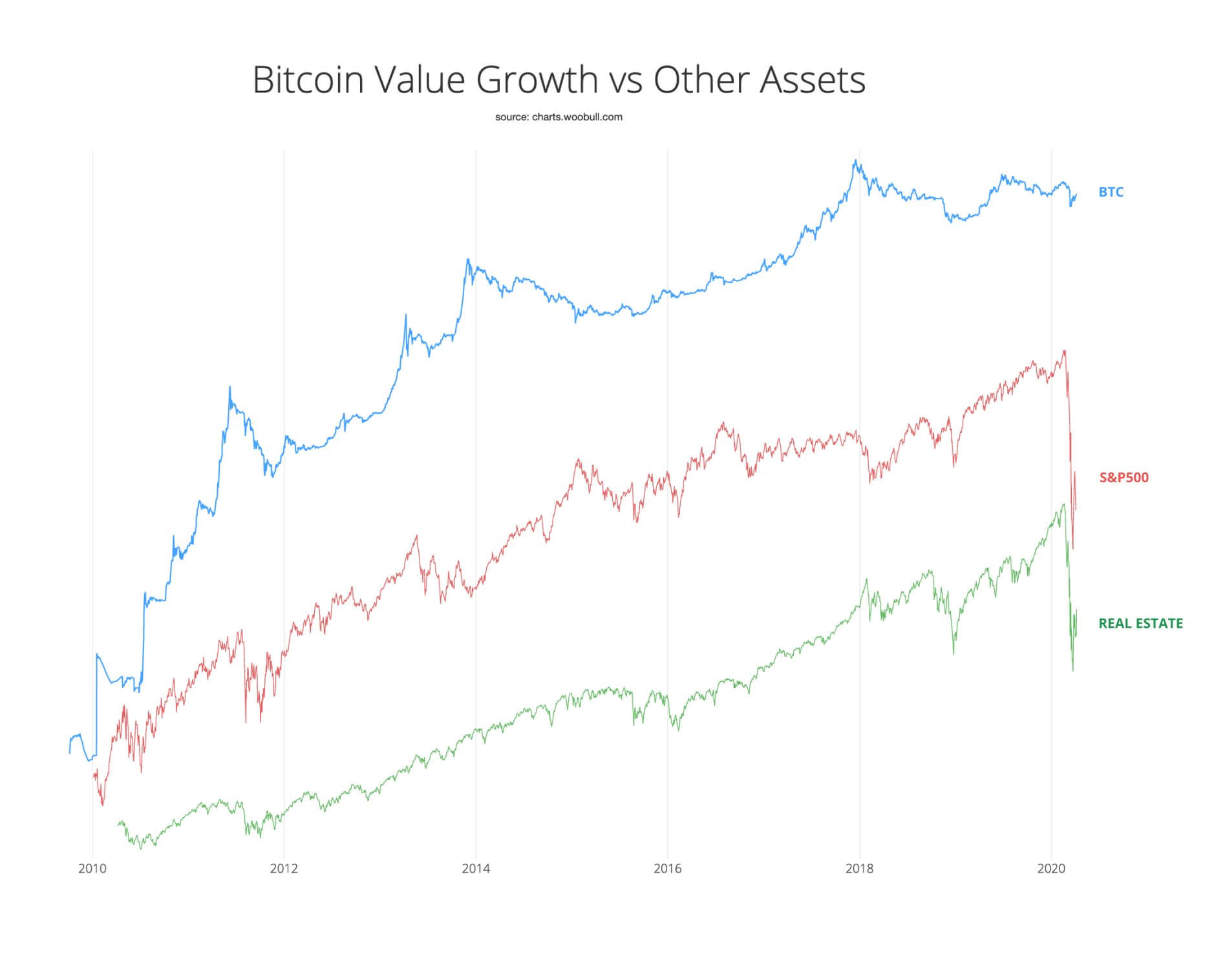

A similar trend of BTC being the strongest major asset is seen while looking at its macro performance, as a comparison of the crypto’s logarithmic chart to that of the S&P 500 and aggregated real estate market shows just how strong it really is.

Safe haven narrative re-emerges following brief invalidation

Although Bitcoin’s recent uptrend has come about as the equities market shows some signs of stabilizing, it is important to note that it does appear that its coupling with the global economy is showing some early signs of breaking.

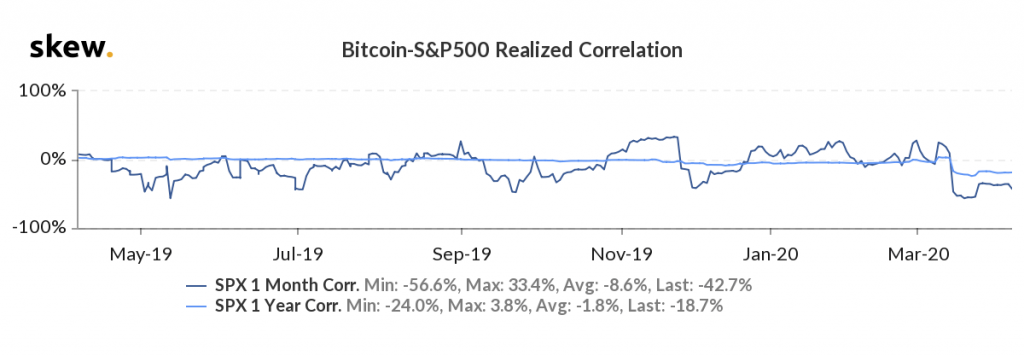

Data from analytics platform Skew elucidates that Bitcoin’s realized correlation with the S&P 500 has declined significantly from where it was in March.

This has led the safe haven narrative that many analysts believed was invalidated last month to reemerge, with Willy Woo – a prominent analyst who focuses on on-chain data – noting that he does believe BTC is exhibiting safe haven properties.

“Do I think BTC is exhibiting safe haven properties? Yes. I think this is in part due to the nuances of Bitcoin production costs creating a floor in price, and partly due to it getting an uplift in price due to its adoption s-curve (other assets are at adoption saturation).”

Watching the crypto’s realized correlation with the benchmark stock indices in the coming weeks and months will offer significant insight into its status as a potential safe-haven asset.

Bitcoin Market Data

At the time of press 8:54 pm UTC on Apr. 7, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.4% over the past 24 hours. Bitcoin has a market capitalization of $134.14 billion with a 24-hour trading volume of $44.21 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 8:54 pm UTC on Apr. 7, 2020, the total crypto market is valued at at $208.4 billion with a 24-hour volume of $156.48 billion. Bitcoin dominance is currently at 64.37%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)