Bitcoin frenzy? Coinbase surpassing $9 billion in daily volume shows big demand

Bitcoin frenzy? Coinbase surpassing $9 billion in daily volume shows big demand Bitcoin frenzy? Coinbase surpassing $9 billion in daily volume shows big demand

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The demand for Bitcoin is increasing as the rising volatility shows. Coinbase, the largest cryptocurrency exchange in the U.S., recorded $9 billion in daily volume on Jan. 11.

Yesterday, Coinbase, Kraken, and several other exchanges and data providers saw technical difficulties amid record-high trading volume.

The explosive increase in the trading volume of Bitcoin led to extreme volatility, causing BTC to drop to around $30,500.

Coinbase recording $9 billion in volume on a single day is noteworthy because it is equivalent to the total volume for Q1 2020.

There is big demand for Bitcoin at $30ks, what’s next?

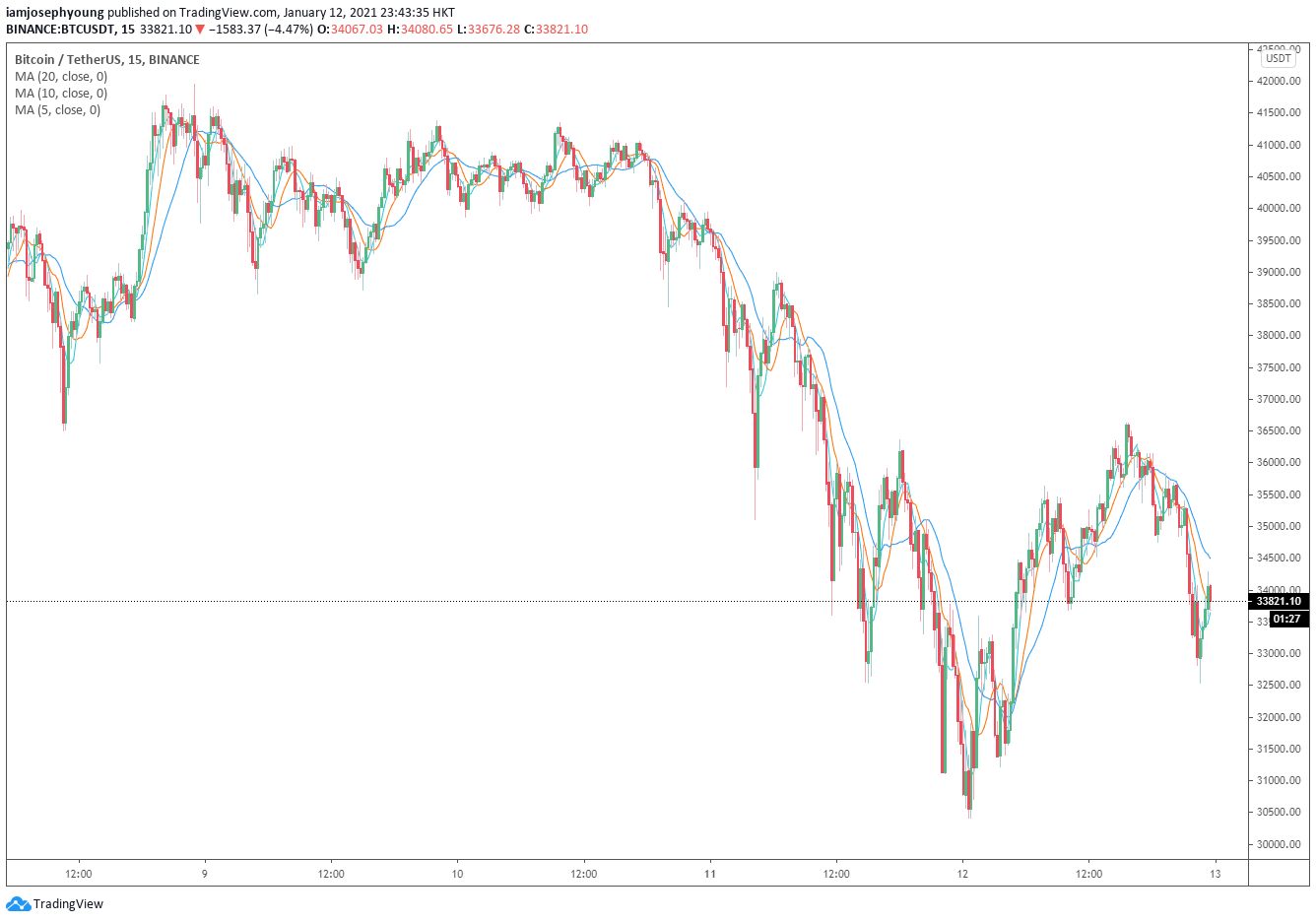

The price of Bitcoin briefly dropped below $33,000 yet again on Jan. 12, demonstrating weakening momentum after its initial recovery to $37,000.

Traders remain divided on the market sentiment around Bitcoin. The uncertainty around the short-term price cycle of Bitcoin might be the primary driver of the volatility and high exchange volume.

A pseudonymous trader known as “Salsa Tekila” said that BTC could easily drop to the $31,000 to $32,000 range once again. He said:

“I think we can easily dive back down to $31K-$32K. I wouldn’t bet on it, but I’d consider buying depending on the context. So, not chasing current prices without another dive, setting alert below 33k and above 36k to pay attention, in between I don’t care. Good luck, don’t chase.”

Based on the high volatility around Bitcoin and the high daily volume of Coinbase, cryptocurrency researcher Larry Cermak said he expects Coinbase to reach a valuation of around $100 billion. He wrote:

“You really can’t ask for much more than the growth that Coinbase is experiencing right before the IPO. At this point, I am expecting the stock to trade at more than $100 billion this year. The momentum is there and the mania will happen IMO”

Will this trend get sustained?

At least in the foreseeable future, major cryptocurrency exchanges are expected to see a massive trading volume.

After Bitcoin surpassed $40,000, it has been demonstrating 10% to 20% price swings on a daily basis.

On Jan. 11, as an example, Binance recorded an $8.5 billion daily trading volume for the Bitcoin-to-USDT (Tether) trading pair alone. This is close to Coinbase’s daily trading volume on the same day.

Considering that Bitcoin is moving back and forth between the $31,000 support area and the $36,000 resistance area, the high level of volatility would likely continue.

Below $30,000 would likely indicate the start of a short-term bearish trend. Consolidation under $30,000 could cause the volatility to drop and the daily trading volume of exchanges to slow down in tandem.

However, until the bullish market structure invalidation occurs, the Bitcoin market is expected to see extreme volatility in the foreseeable future.

Bitcoin Market Data

At the time of press 4:21 pm UTC on Jan. 12, 2021, Bitcoin is ranked #1 by market cap and the price is up 4.54% over the past 24 hours. Bitcoin has a market capitalization of $640.68 billion with a 24-hour trading volume of $89.5 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:21 pm UTC on Jan. 12, 2021, the total crypto market is valued at at $937.87 billion with a 24-hour volume of $183.69 billion. Bitcoin dominance is currently at 68.38%. Learn more about the crypto market ›