Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin Show Signs of Recovery After Recent Downward Spirals

Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin Show Signs of Recovery After Recent Downward Spirals Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin Show Signs of Recovery After Recent Downward Spirals

Photo by Cédric Servay on Unsplash

Following a 72-hour period of descension for most cryptocurrencies, assets such Bitcoin, Ethereum, and Bitcoin Cash are showing signs of potential recovery, while Litecoin and Ripple are taking longer to reascend.

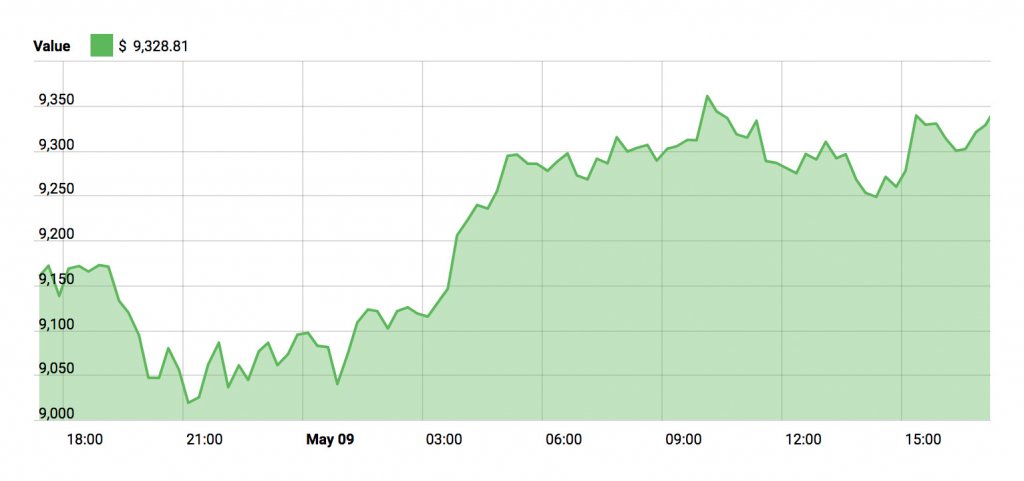

Bitcoin (BTC)

Bitcoin has undergone a rough-and-tumble period since the weekend. The currency had incurred several price hikes of $100 or more to bring it to a Sunday total of $9,800. The currency dropped by $300 to $9,500 within 24 hours, then fell to $9,300 and $9,100 respectively during yesterday’s early morning hours.

Today, however, the currency has jumped back to the $9,300 mark, and the MIT engineers and Wall Street analysts of Trefis say that based on their interactive Bitcoin Price Estimator, the asset could surpass $15,000 by the end of the year.

The team points to the new Bitcoin futures trading desk from Goldman Sachs as the main reason.

Additionally, the MIT engineers say that as more Wall Street players follow suit, mainstream acceptance amongst financial institutions will continue. Thus, the overall price and value of Bitcoin will undoubtedly spike.

In addition, many analysts – like BBC Apprentice winner and Bitcoin investor Mark Wright – disagree with Warren Buffett’s recent criticism of digital assets.

As a longtime opponent of Bitcoin, Buffett has stated he does not hold any cryptocurrency, and that he doesn’t understand how Bitcoin works. He is also “certain” that cryptocurrencies will come to a bad end.

Wright has gone against the claims, commenting:

“Despite its volatile nature, the cryptocurrency sector has soared in recent years, with experts predicting it will hit a market valuation of $1 trillion by the close of 2018. This figure proves that Buffett is wrong, particularly when one accounts for how the value of bitcoin has developed since 2014 – the time when Buffett first expressed negative opinions on the sector. Despite his years of experience in business, Buffett’s comments show a terrible lack of engagement in technology and innovation.”

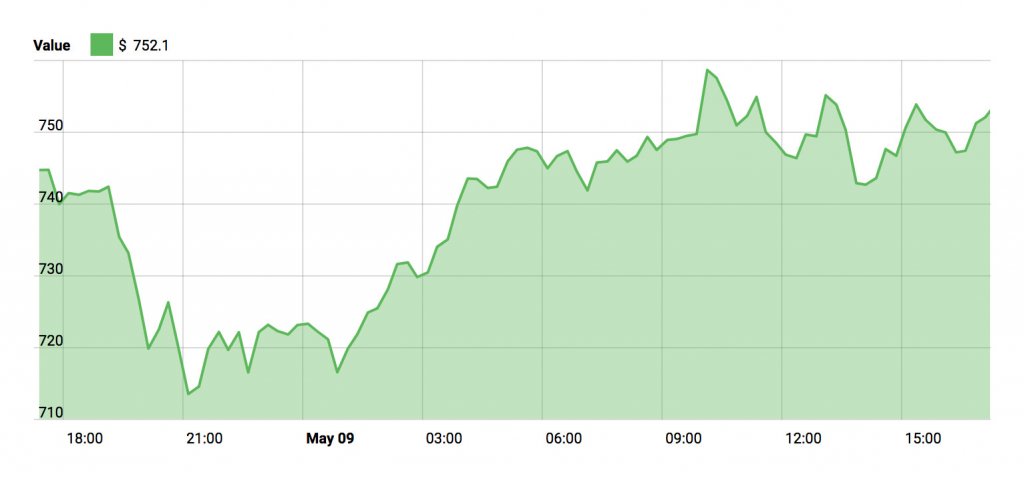

Ethereum (ETH)

At press time, Ethereum is trading for $752. The currency had recently dropped to $745 from an $833 high following the news that the SEC had scheduled a May 7 meeting regarding Ethereum’s potential classification as a security.

This impending news of an announcement ultimately proved to be misrepresented by the Wall Street Journal, as mentioned on Twitter. The currency has since begun to incur steady rises back to the solid green territory.

Furthermore, a new edition of the Casper algorithm behind Ethereum is slated for release today May 8, which could help boost the price even further. First released in October, Casper works to solve open questions of economic finality through validator deposits and crypto-economic incentives.

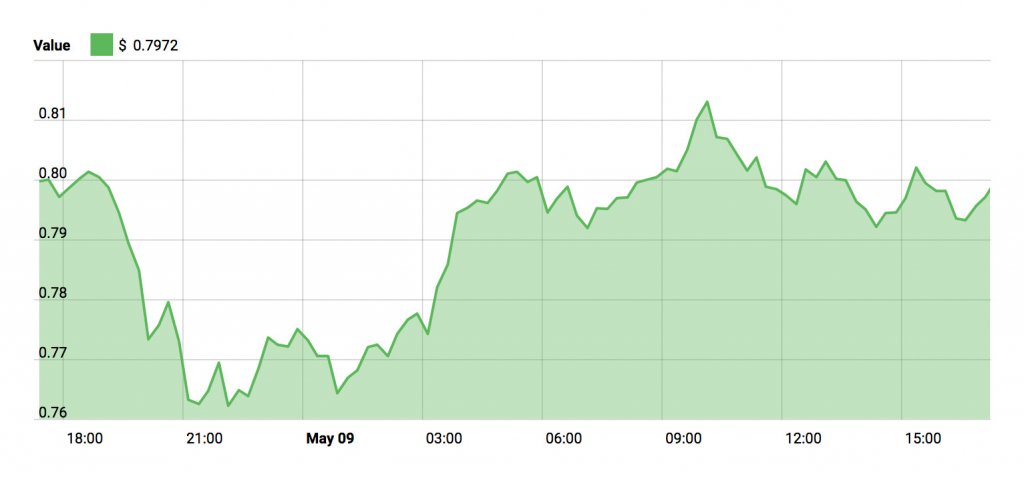

Ripple (XRP)

Ripple has fallen by about ten cents from its recent $0.90 high. At press time, the currency has lost over ten percent of its value since the announcement of a class action lawsuit against Ripple Labs.

Despite this, the bank-focused currency is continuing to promising partnerships in the worlds. The most recent partnership comes by way of Coinone.

As one of South Korea’s largest cryptocurrency exchanges, Coinone has announced plans to join RippleNet and use xCurrent, the company’s blockchain solution for cross-border payments.

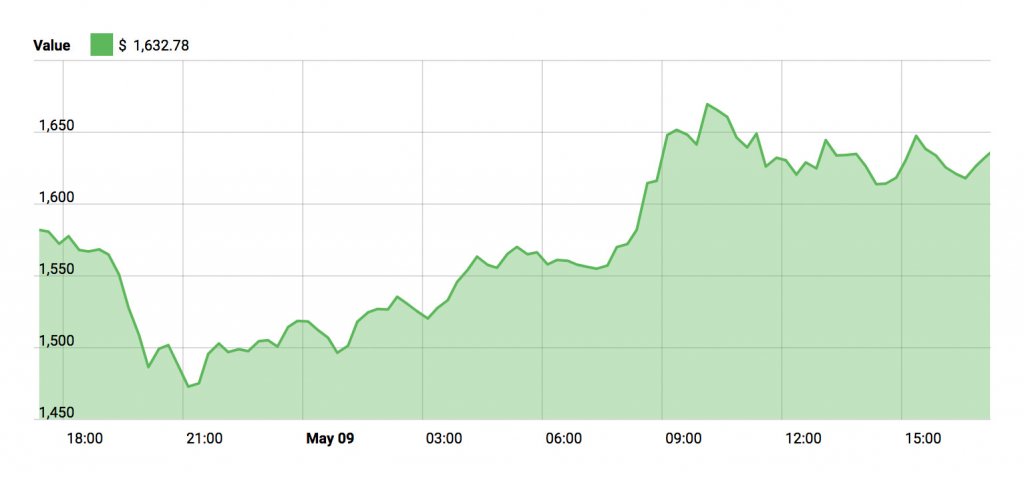

Bitcoin Cash (BCH)

Bitcoin Cash is trading for roughly $1,632 at press time. This marks a jump of nearly $130 since BCH’s recent high of $1,500 – a four percent increase.

Analyst Manoj B. Rawal of FX Street calls BCH the “biggest gainer of the day,” though he suggests the currency may experience newfound resistance at $1,700. For now, support sits at $1,615, suggesting that Bitcoin Cash will remain above $1,600 over the coming days.

Litecoin (LTC)

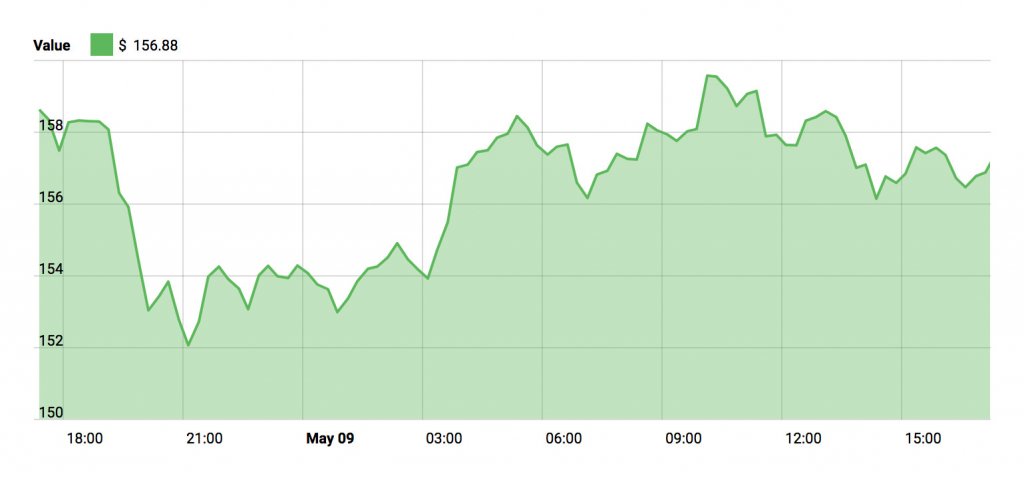

At press time, Litecoin is trading for roughly $157. This marks a five percent drop from Litecoin’s previous high of $167. Litecoin now sits as the sixth-largest cryptocurrency by market cap behind EOS.

The recent introduction of two Twitter campaigns – #PayWithLitecoin and #LitecoinAcceptedHere are designed to build Litecoin awareness and payment systems by the network may help to spike Litecoin’s overall value in the coming days, and analyst John Isinge of FX Street believes the currency could jump as high as $180.

Market Summary

The present cryptocurrency market cap stands at $436 billion, marking no significant difference in value since our previous price article. The market is managing to stand its ground, though not all major cryptocurrencies are traveling a green path.

As always, investors are advised to do their research and proceed with caution when investing in what remains a relatively volatile market.