Terra is preparing to burn more than 9% of the total LUNA supply

Terra is preparing to burn more than 9% of the total LUNA supply Terra is preparing to burn more than 9% of the total LUNA supply

Burning almost 90 million LUNA in the community pool is expected to place upward pressure on the native token’s price.

Photo by CHUTTERSNAP on Unsplash

Do Kwon, co-founder and CEO of Terraform Labs, the South Korean company behind the blockchain project Terra (LUNA), recently announced on Twitter that the on-chain vote for the project’s proposal 44 will be initiated on Wednesday and will be in a voting period for two weeks.

The proposal to initiate the burn of 88,675,000 LUNA from the community pool to mint 3 – 4 billion UST will reduce the native token’s total supply by more than 9%.

Bootstrapping Ozone

Following the successful launch of the network’s cardinal upgrade, dubbed Columbus-5, the community pool will be swapped out for Terra’s native stablecoin, UST.

Burn proposal submitted on @terra_money Agora: https://t.co/Ufq6V9dofj

Onchain avail for voting in 48 hours. https://t.co/Ng2ds9RizS

— Do Kwon ? (@stablekwon) October 25, 2021

Minted UST will be used to bootstrap Ozone, an insurance mutual protocol that facilitates levered coverage of technical failure risks in the Terra ecosystem.

“Since the LUNA price and amount in the Community Pool has changed drastically since Prop 44, the resultant UST minted from the burn will go to the Community Pool, with the community deciding how much to deploy to bootstrap Ozone via a separate proposal once Ozone goes live,” Kwon added on Terra’s Agora, where he broke down the execution plan.

The proposal will also leave 10 million LUNA in the Community Pool.

According to Kwon, enacting the proposal will reflect on swap fees, “due to the changes implemented in Col-5, where all on-chain stablecoin swap fees are routed to the oracle_rewards_pool for validators.”

“A byproduct of this operation is that a lot of swap fees will accrue,” he explained in a tweet, adding that as a result LUNA staking rewards are expected to increase five times.

A byproduct of this operation is that a lot of swap fees will accrue, which we expect will result in $LUNA staking returns (minus airdrops) to 5 x.

— Do Kwon ? (@stablekwon) October 22, 2021

TVL on Terra reached an ATH

Following last week’s integration of the IBC protocol and launch of Wormhole V2 support for Terra, the total value locked (TVL) in protocols on the network reached a new all-time high.

Last week, TVL on Terra reached $10.22 billion, with protocols Anchor, Lido, Mirror and Terraswap accounting for more than 90% of the sum, according to data from DeFi Llama.

According to DefiLlama, the TVL on the Terra reached 10.08b, a record high, include Anchor ($4.09b), Lido ($3.01b), Mirror ($1.31b), Terraswap ( $1.21b).

— Wu Blockchain (@WuBlockchain) October 22, 2021

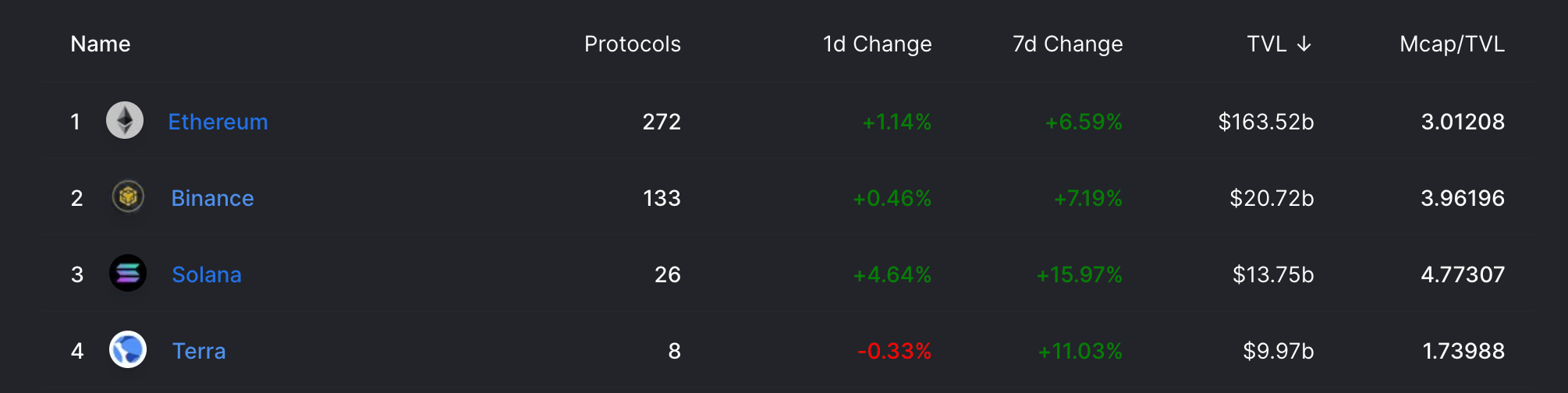

Currently, with $9,97 billion, Terra ranks as the fourth blockchain with the highest TVL, following Ethereum, Binance Smart Chain, and Solana.

CoinGlass

CoinGlass

Farside Investors

Farside Investors