Worldcoin jumps 10% despite Alameda Research’s WLD token transfer to Binance

Worldcoin jumps 10% despite Alameda Research’s WLD token transfer to Binance Worldcoin jumps 10% despite Alameda Research’s WLD token transfer to Binance

Alameda Research makes first Worldcoin transfer in over a year.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Alameda Research, the sister company of the defunct FTX crypto exchange, has moved part of its Worldcoin WLD holding for the first time since receiving it in September 2023.

Crypto Intelligence platform SpotOnchain reported that the failed crypto trading firm transferred 205,387 Worldcoin (WLD) tokens, valued at $352,000, to Binance. It stated:

“Nine hours ago, Alameda Research moved the very first 205,387 $WLD ($352K) to Binance, after vesting them from the Worldcoin a year ago.”

Such transfers typically indicate bearish sentiment, suggesting holders may want to sell. However, WLD’s value remained stable as a broader crypto market rally boosted its price by approximately 10% to $1.79, according to CryptoSlate’s data.

WLD is the native token of the proof-of-personhood project Worldcoin. Due to its facial data collection practices, the crypto project has faced global scrutiny and controversy. However, it continues to score significant adoption, with more than 6 million people verified across different countries on its platform.

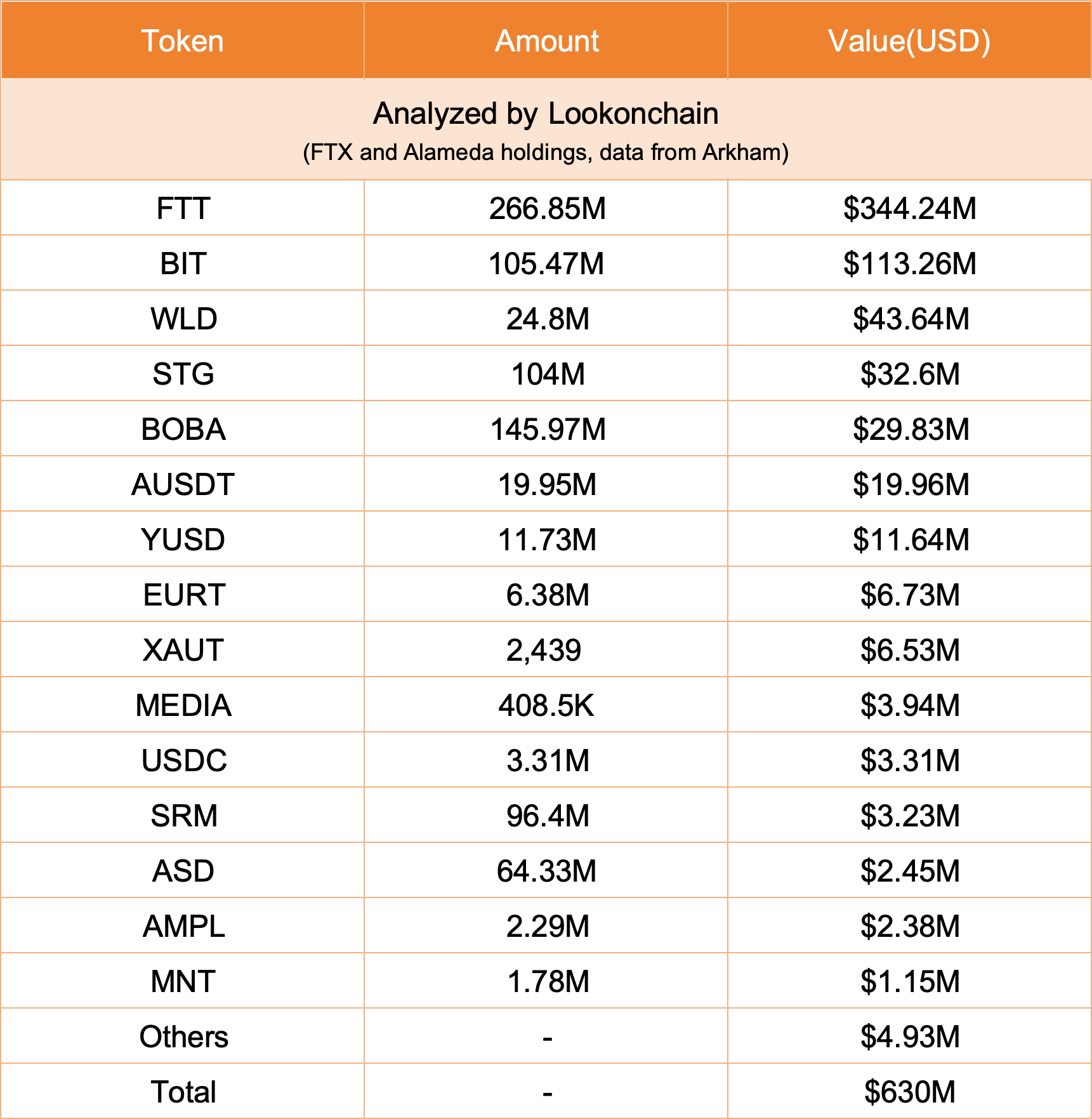

Meanwhile, despite these recent transfers, FTX and Alameda still retain significant digital assets. They hold 24.8 million WLD, worth around $45.6 million, along with 266.85 million FTT ($344.24 million), 105.47 million BIT ($113.26 million), 104 million STG ($32.6 million), and 145.97 million BOBA ($29.83 million).

FTX bankruptcy

This asset movement is the latest development in the ongoing FTX bankruptcy process.

On Aug. 7, US District Judge Peter Castel approved a $12.7 billion settlement agreement between the CFTC and the bankrupt crypto firms FTX and Alameda.

The settlement requires the firms to pay investors $8.7 billion in restitution and $4 billion in disgorgement. No civil monetary penalties were imposed, so the entire $12.7 billion will go to the exchange’s creditors.

Meanwhile, the settlement occurred against FTX, informing creditors about its reorganization plans. However, some creditors have argued that the proposed plan undervalues their claims because the value of most digital assets has substantially increased since the firm’s bankruptcy.