Why one trader thinks Bitcoin may begin a mega bull run and reach $50k by July 2020

Why one trader thinks Bitcoin may begin a mega bull run and reach $50k by July 2020 Why one trader thinks Bitcoin may begin a mega bull run and reach $50k by July 2020

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

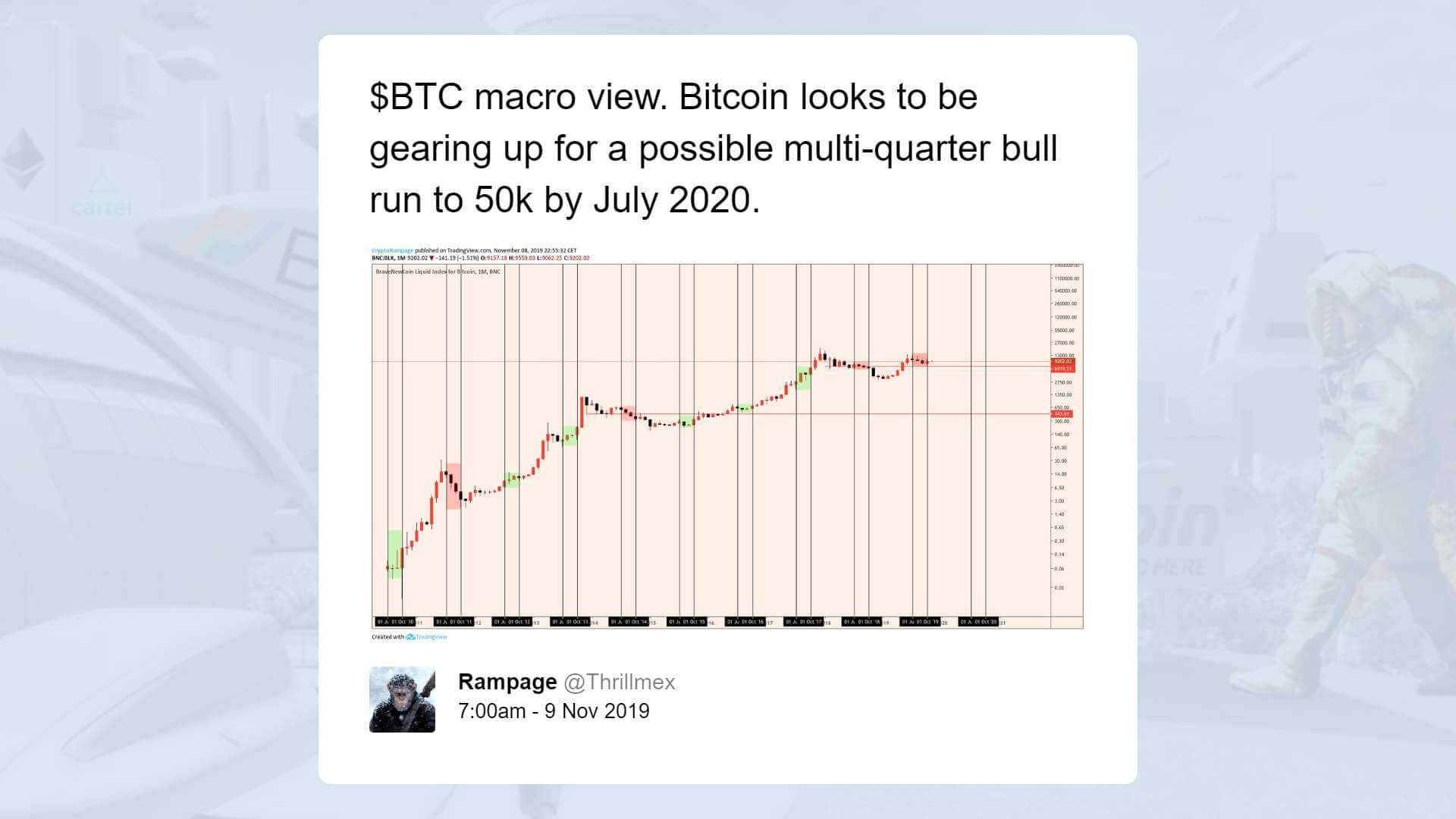

According to a cryptocurrency trader, the Bitcoin price may be set for an extended rally to $50,000 by mid-2020, based on its macro trend.

Throughout the past two weeks, despite the brief breakout of the Bitcoin price to $10,600, many technical analysts have generally geared towards a bearish short term outlook.

Still, with the block reward halving of Bitcoin set to occur in May 2020, most analysts remain bullish on the medium to long term trend of the dominant cryptocurrency.

Bottom likely to soon occur for bitcoin

Traders and technical analysts who have consistently favored a bearish short term trend for bitcoin, like Dave the Wave, have said that the bitcoin price is getting closer to its lower support level or a “buy zone.”

The trader said that if a pullback occurs in the cryptocurrency market after the decline of bitcoin from around $9,200 to $8,800 in the upcoming days, it is likely to be the last leg down for BTC.

This could be it. The last move down, and then off to the races. Dry powder left? Buy in the buy zone [grey shaded area]. pic.twitter.com/KYYT6vT2VF

— dave the wave (@davthewave) November 11, 2019

As the short term trend of Bitcoin begins to demonstrate signs of a bottom, the macro trend of the asset is expected to become more optimistic, especially considering strong fundamentals including growing hash rate and strengthening infrastructure supporting the asset class.

Will block reward halving have the same effect as previous years?

In 2012 and 2016, when the block reward halving of Bitcoin occurred, a mechanism that drops the BTC reward of miners by half, the Bitcoin price went on to reach new highs a year and a half after.

The Bitcoin price increased by more than 10-fold after the 2016 halving, but it occurred over a long period of time, with BTC achieving its peak in December 2017.

Hence, the block reward halving may not have an immediate effect on the Bitcoin price as soon as it occurs in May, and it could see a 2016-esqe scenario in which it takes the asset a year or longer to see the real impact of halving.

However, as said by Blocktower Capital co-founder James Todaro, the majority of investors are not aware of the halving and that the theory that the halving is already priced in may be premature.

Grayscale Investments, a cryptocurrency investment firm with over $2 billion in assets under management, also reported that the firm was surprised to see that many investors are not anticipating the event.

The report read:

“In fact, based on anecdotal conversations with market participants, we were surprised to learn that many of them were not even aware of this event. Moreover, according to Unchained Capital, less than 32% of the bitcoins in circulation have remained in the same wallet addresses since July 2016.”

If the block reward halving is not priced into the market, as the market gets closer to May 2020, it may begin to see upside momentum affecting major cryptocurrencies.