Why DeFi majors Yearn.finance, Aave, SNX plunged amid overnight BTC rally

Why DeFi majors Yearn.finance, Aave, SNX plunged amid overnight BTC rally Why DeFi majors Yearn.finance, Aave, SNX plunged amid overnight BTC rally

Photo by Blake Guidry on Unsplash

Overnight, on November 11, the price of Bitcoin rallied by nearly 4% as it neared $16,000. While BTC showed strengthening momentum, decentralized finance (DeFi) majors, like Yearn.finance (YFI), Aave (AAVE), and Synthetix (SNX), underperformed.

The trend spotted in DeFi in the last 24 hours, where it corrects while Bitcoin surges, was reminiscent of October.

Throughout the month of October, top DeFi cryptocurrencies struggled against Bitcoin. When BTC rallied, DeFi tokens actually declined in price against both BTC and the U.S. dollar.

The timing of the abrupt DeFi market correction is noteworthy because it comes after a strong short-term resurgence. Depending on the perception, the recent correction could be considered a healthy pullback or the start of a new market slump.

The short-term bull case for DeFi tokens Yearn.Finance, SNX, and Aave

Before the overnight pullback, Yearn.finance, SNX, and Aave all saw significant upside momentum.

YFI and AAVE, in particular, rallied strongly following the overall recovery of the DeFi market. Both are considered bluechip assets by investors within the DeFi space due to their technological edges and active communities.

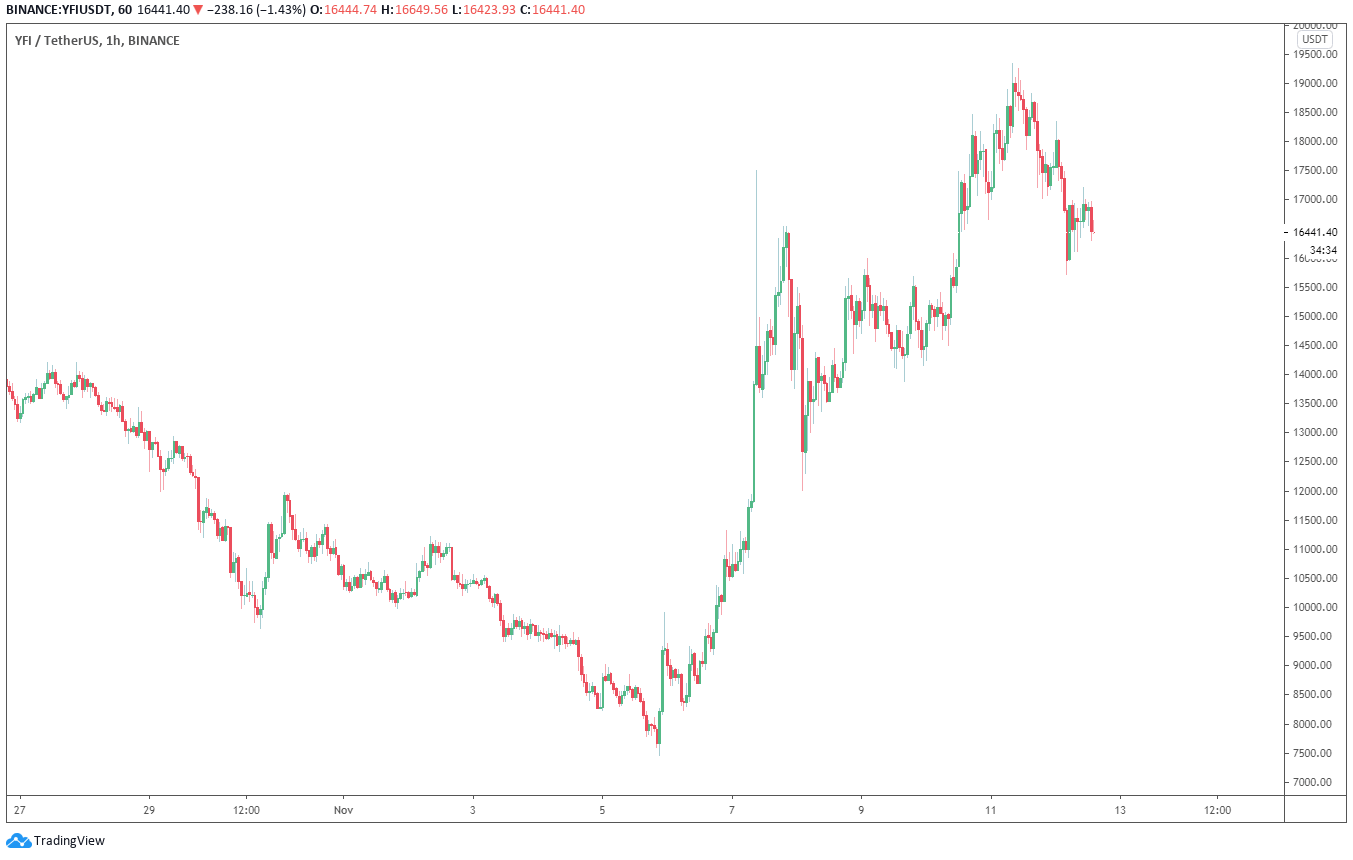

YFI recorded a 152% gain from November 5 to 11. Within six days, YFI increased from $7,671 to as high as $19,350.

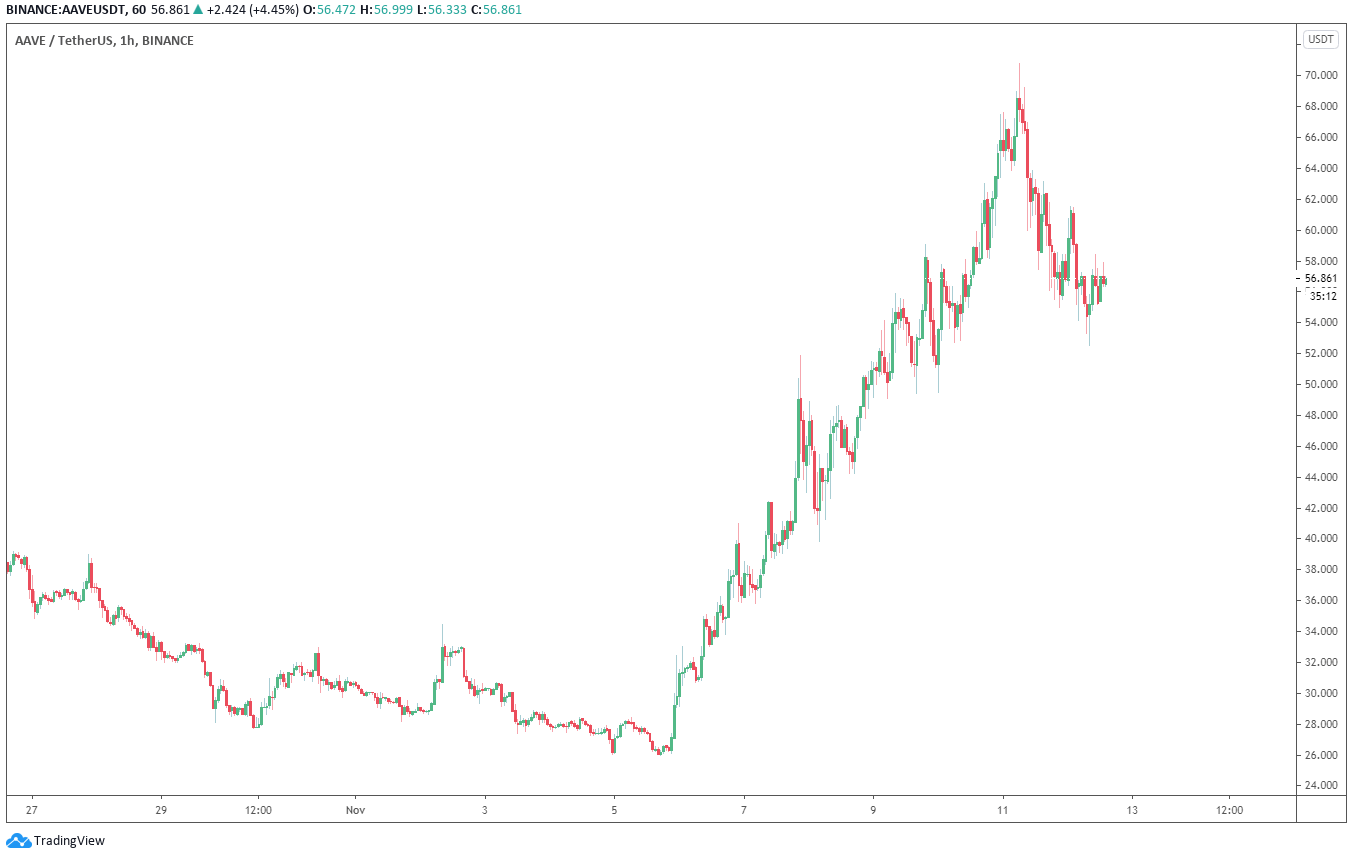

In the same period, AAVE demonstrated a 171% gain, from $26.045 to 70.825 on the November 11 peak.

Given the magnitude of the rallies of YFI and AAVE, both assets needed a pullback to neutralize the market.

In that sense, a pullback could strengthen the overall sustainability of the rally in the short to medium term.

The total value locked (TVL) in DeFi has also surged past an all-time high above $13.5 billion. It shows that there is significant confidence from investors that the DeFi market would continue to see sustainable growth.

The bear scenario for the DeFi market in the near term

The bearish outlook on DeFi in the near term comes from two main factors. First, the futures market was not necessarily overheated when the pullback occurred. Funding rates were heavily negative, which means the majority of the market was shorting Yearn.finance.

Second, on-chain analysis shows that the transaction and social volume of Ethereum is declining. Given that DeFi tokens tend to trail along the uptrend of Ethereum, a potential ETH underperformance could cause a further DeFi slump.

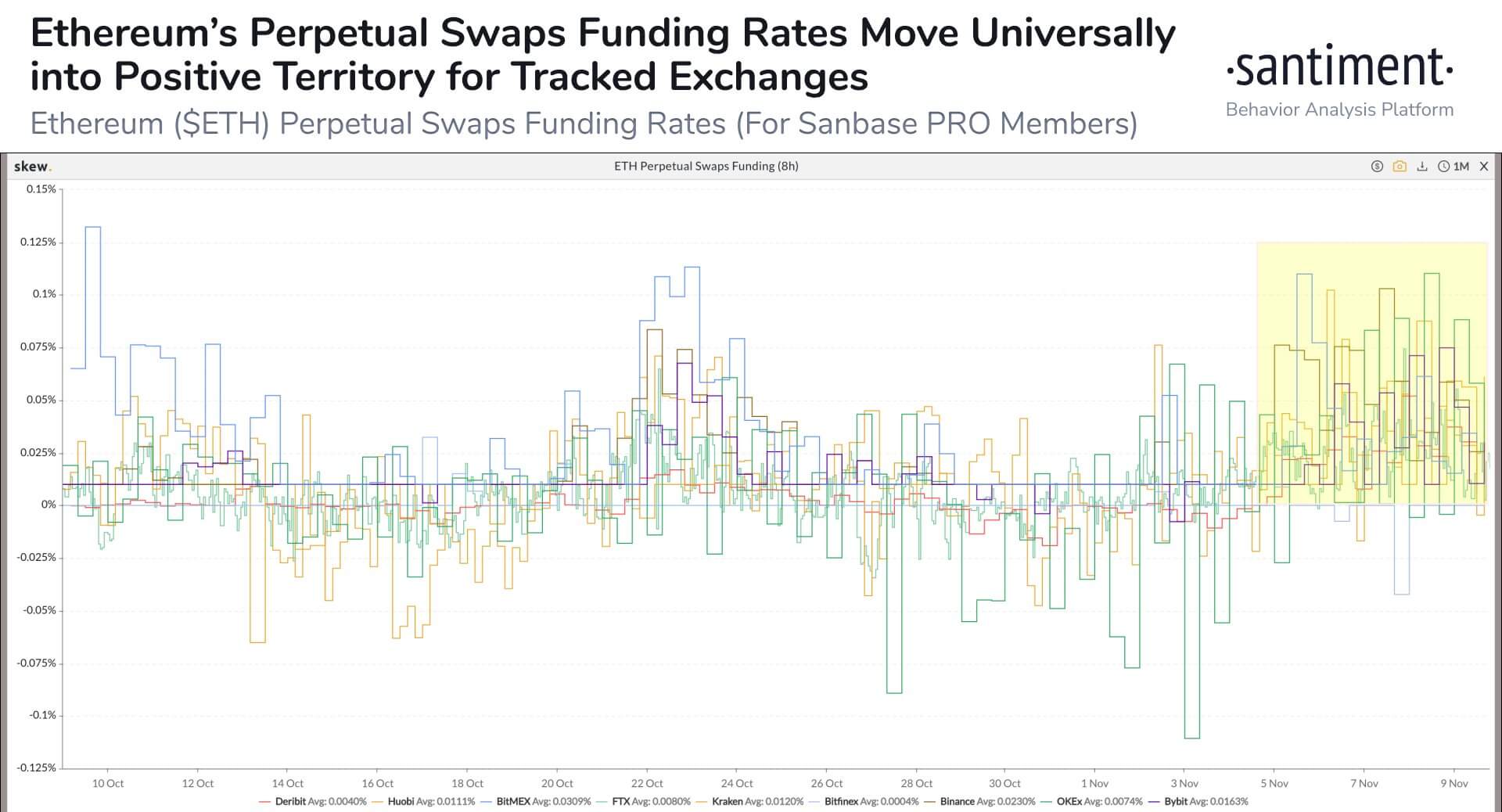

The analysts at the on-chain cryptocurrency market analysis firm Santiment wrote:

“Both the transaction and social volume of #Ethereum are beginning to decline, and it appears that $ETH has moved to positive funding rates. These signs, combined with a lack of serious bearish commentary, is a caution flag for shorter-term traders.”

Ethereum has been lagging behind Bitcoin in the past 48 hours but its funding rates have been substantially higher.

If ETH struggles to outperform Bitcoin in the short term, it could lead to a slower momentum in the DeFi space.