Wall Street trades a significant portion of the market’s bitcoin futures

Wall Street trades a significant portion of the market’s bitcoin futures Wall Street trades a significant portion of the market’s bitcoin futures

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Data shows that the Chicago Mercantile Exchange’s (CME) Bitcoin futures traded $563 million in volume on Apr. 4th while the top 10 crypto exchanges traded $685 million, suggesting Wall Street is now trading a significant portion of the BTC futures market.

CME Sees Massive Increase in Bitcoin Futures Trading Volume

Following the Chicago Board Options Exchange’s (CBOE) decision to delist Bitcoin futures the Chicago Mercantile Exchange (CME) stepped in and seized much of the market.

Any major stock exchange’s involvement in the digital asset-derivatives market will benefit the crypto industry, both in terms of liquidity and in and legitimizing the sphere.

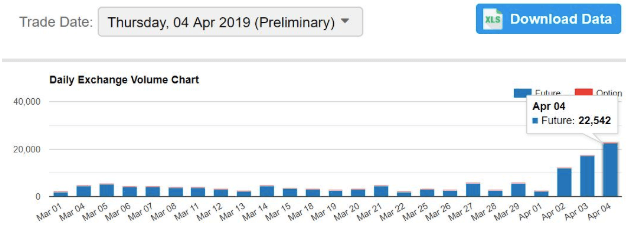

Recent data from Messari Crypto, a cryptocurrency research company, shows that CME has meaningful amounts of volume. According to CME, its BTC futures traded about $563 million on Apr. 4th alone.

While the exact amount wasn’t confirmed by CME, the company lists the number of contracts traded as well as the amount of Bitcoin in every contract. With 5 BTC per contract and yesterday’s $5,000 Bitcoin price, the 22,542 contracts traded over $500 million.

Trading Volume Puts CME on Par With Major Crypto Exchanges

Mati Greenspan, the senior market analyst at eToro, pointed out that this is significant for the Bitcoin markets:

“Even though Wall Street’s contracts are only paper, and not settled in bitcoin, they are still a significant part of this market now.”

The success of Bitcoin futures has pushed the CME to expand its futures offering and launch “Micro E-mini” Futures contracts for trading.

According to See It Market, the contracts should be ready for trading as early as May this year. The report also pointed out that the markets available for trading will be the S&P 500, NASDAQ 100, Russell 2000, and the Dow.

The new Micro E-mini contracts will be one-tenth the size of their respective equity indexes, enabling more control over a larger number of contracts for the same price. This will allow traders to scale out as they’ll be able to exit at multiple profit targets. The bitcoin futures market continues to thrive even after CBOE futures exchange delisted bitcoin futures.

As more investors and traders participate in BTC then derivatives and other complex instruments will become even more important for hedging against risk and volatility.