Venezuelans Trade Bolivars for Bitcoin Amidst Runaway Inflation

Venezuelans Trade Bolivars for Bitcoin Amidst Runaway Inflation Venezuelans Trade Bolivars for Bitcoin Amidst Runaway Inflation

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Venezuelans have taken to Bitcoin for liberation as the country struggles with runaway inflation. The transition serves as a testament to BTC’s core value.

Venezuela is in economic ruin. Corruption, a collapsing oil industry, and ill-conceived socialist policies have plunged the country into hyperinflation. President Nicolás Maduro, appointed successor to Hugo Chávez, who died in 2013—has clung to power by eliminating rivals and dismantling the judicial system.

The IMF estimates that Venezuela’s inflation stands at around 1.3 million percent for 2018, levels of inflation not seen since the Zimbabwean dollar. The insane levels of inflation mean that prices increase over twenty-fold in a single day.

Earlier this year, Maduro has attempted to fix the problem by creating a dubious cryptocurrency allegedly backed by oil, the Petro. However, nothing has made a noticeable difference in reversing the country’s runaway inflation.

Bitcoin Trades Surge

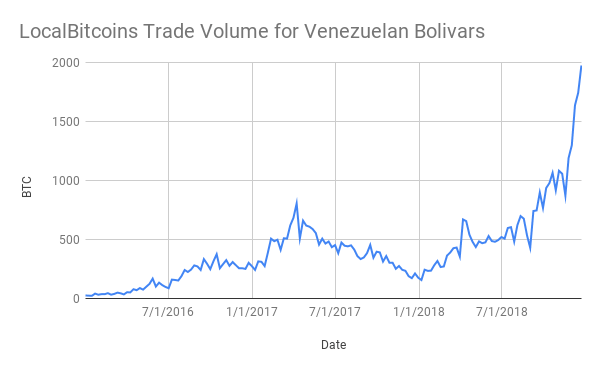

To combat the rapidly deteriorating Bolivar, Venezuelans have taken to Bitcoin. Trading volume on LocalBitcoins, a website for facilitating peer-to-peer BTC trades, has exploded.

In 2018, the weekly trade volume for Bitcoin rose from 170 to 2000 BTC, roughly $8 million a week at current prices.

For comparison, CNN reported in March that the monthly minimum wage in Venezuela is just over $6. At that rate, a single week of Bitcoin trades represents monthly wages for 1.3 million Venezuelans.

Harbinger of Adoption

The situation in Venezuela may be a harbinger for things to come. As Bitcoin adoption soars in the country, the innovation will make it harder for Maduro to extract wealth from his citizens through irresponsible fiscal policy.

It’s a profound change for people in the country—now, monetary freedom is within reach through the programmatic guarantees of cryptocurrency.