VC: Ethereum has “negative” network effects, needs scaling solutions “NOW”

VC: Ethereum has “negative” network effects, needs scaling solutions “NOW” VC: Ethereum has “negative” network effects, needs scaling solutions “NOW”

Photo by Joshua Rawson-Harris on Unsplash

One of the biggest narratives over recent weeks has been Ethereum’s extremely high transaction fees.

Although the blockchain has seen a strong uptick in active users, transactions, and network utilization due to DeFi, the cost to send transactions has risen as a result. And risen dramatically at that.

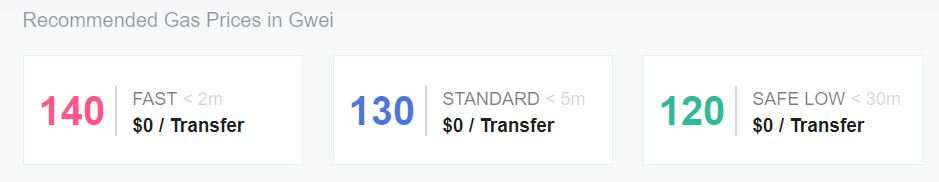

Below is a screenshot I took of EthGasStation — an Ethereum transaction fee tracker — on Jul. 27, as Bitcoin shot over a dozen percent higher in a single 24-hour period.

At 130 Gwei — a measurement of the cost of Ethereum transactions — simple transfers of ETH cost over $1.00 while complex smart contract transactions cost upwards of dozens of dollars.

Although transaction fees have dropped since I took this screenshot, the issue of high transaction costs remain.

Ethereum’s negative network effect

When you hear the term “network effect(s),” most think it’s an inherently positive thing.

Bitcoin’s growth is predicated on network effects, as is that of Facebook, Youtube, and any other social media platform or monetary asset.

Yet according to Tushar Jain, a managing partner of crypto venture and hedge fund Multicoin Capital, Ethereum has reached a point where it has “negative” network effects. That’s because with every new user, with every new application, the blockchain slows down and becomes more expensive.

“Ethereum 1.0 is now facing *negative* network effects. Every new user raises the transaction cost for other users,” Jain explained in a tweet published Jul. 27.

Ethereum 1.0 is now facing *negative* network effects. Every new user raises the transaction cost for other users.

Ethereum needs scaling solutions NOW or the negative network effects will drive many devs and users away.

— Tushar Jain (@TusharJain_) July 27, 2020

Jain’s comment is one reminiscent of that made by two executives of Exponential Investments, a global investment firm with interests in cryptocurrency.

As reported by CryptoSlate previously, Leah Wald and Steven McClurg from the firm said that the way Ethereum is structured is that the fundamental case for the asset weakens as prices rise and when demand for transactions increases:

“In summation, as more users join, the cost of gas increases, the network clogs, there are potential security issues, which decreases the value of the service, leading to poor user experience, and therefore users drop off and move to other blockchains.”

Solutions are needed ASAP

According to Jain, this unfortunate trend indicates Ethereum “needs scaling solutions NOW or the negative network effects will drive away many devs and users.”

This comment has been echoed by Qiao Wang, a crypto analyst. Referencing how he personally spent lots of money and time trying to use decentralized finance products based on Ethereum, Wang recently remarked:

“So long as ETH 2.0 is not fully rolled out, there’s an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX.”

Scaling solutions that are being rolled out include ETH2, arguably the furthest solution away, and so-called Ethereum “roll ups,” a near-term solution that migrates transaction data off the main chain to decrease costs and increase speeds.