US Congressman says SEC’s Gensler allegedly had dubious ties to FTX, promises investigation

US Congressman says SEC’s Gensler allegedly had dubious ties to FTX, promises investigation US Congressman says SEC’s Gensler allegedly had dubious ties to FTX, promises investigation

The crypto community is questioning the relationship between SEC Chair Gary Gensler and the FTX founder, with many labeling it shady.

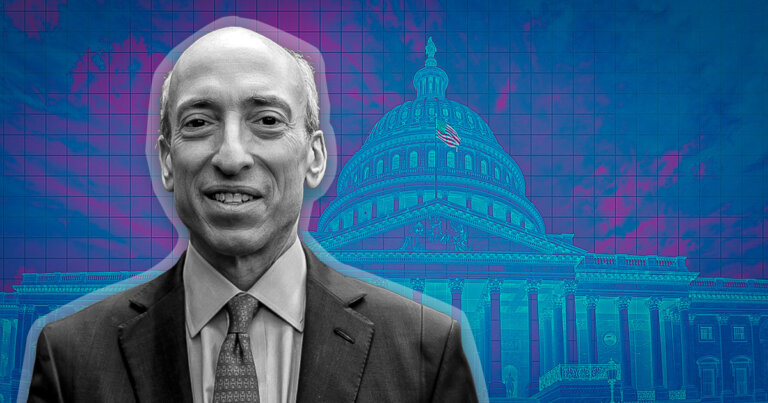

Gary Gensler, chair of the SEC / SEC.gov. Public Domain.

U.S. Congressman Tom Emmer said in a tweet that he had received reports that the SEC chairman Gary Gensler was allegedly helping Sam Bankman-Fried and FTX “work on legal loopholes to obtain a regulatory monopoly.”

Interesting. @GaryGensler runs to the media while reports to my office allege he was helping SBF and FTX work on legal loopholes to obtain a regulatory monopoly. We're looking into this. https://t.co/SznowgcP6V

— Tom Emmer (@GOPMajorityWhip) November 10, 2022

Crypto community questions Gensler and SBF relationship

The crypto community has questioned the relationship between Gensler and the FTX founder, with many labeling it shady.

Speculation within the community alleged that SBF’s regulation drive was fueled by attempts to control the crypto space. Some also speculated that the SEC chairman was influenced by relationships from his time at the Massachusetts Institute of Technology (MIT).

A tweet from RH Cult stated that Gensler’s boss at MIT was Alameda CEO Caroline Ellison’s father. SBF’s Wikipedia page shows he graduated from the school in 2014.

Gary Gensler's boss at MIT Glenn Ellison is the father of the Co-CEO Caroline Ellison of #Alameda Research. @SBF_FTX also went to MIT and helped to create #AlamedaResearch . This is looking like a setup to crack down on #crypto and control the system.

— RH CULT (@HEXCULT1) November 10, 2022

It is worth noting, the ties between FTX and the SEC go beyond in-person meetings.

The general counsel of FTX US had served as lead counsel to Chairman Gensler at the CFTC.

By all accounts, he is a standup and excellent attorney.

The point is that the SEC was pretty close. https://t.co/ohez0oXSjo

— Dane Lund (@lund_dane) November 11, 2022

Additionally, SBF met with Gensler earlier this year, which caused the community to scrutinize his donations to politicians.

General Counsel at Delphi Digital, Gabriel Shapiro, labelled the money FTX spent as “political bribes.”

`The recent collapse of a major crypto exchange proves that the bill we were colluding with the owner of that crypto exchange to draft after he spent $40M in political bribes to get it done is the best path forward`

Jesus. Fucking. Christ. https://t.co/LeOZxrKkRB

— _gabrielShapir0 (@lex_node) November 11, 2022

Popular crypto lawyer Jake Chervinsky said FTX was close to making a deal with the financial regulator, which would have set a harmful precedent for everyone else. Chervinsky thanked Congressman Emmer for looking into these allegations.

Meanwhile, reports revealed that US lawmakers are pushing the SBF-backed bill forward with plans to increase oversight over the crypto space. Several crypto industry leaders have criticized the bill.

The Stabenow-Boozman-FTX (SBF) bill would not have prevented this disaster because FTX helped write it!

And did so in a way that would’ve allowed them to hide the problems indefinitely, while raising MORE money from US institutional investors.

— Ryan Selkis 🥷 (@twobitidiot) November 11, 2022

SEC reportedly investigating SBF

In a separate development, Bloomberg News reported that the SEC is investigating whether SBF and his firms violated securities regulation, citing anonymous sources.

According to the report, the regulator was scrutinizing SBF’s role in the recent liquidity crisis. It added that the watchdog was also investigating whether FTX.US and its crypto-lending activities violated the law.

FTX has come under intense regulatory scrutiny following its implosion. U.S. regulators are probing the relationship between SBF’s myriad businesses and whether the crypto exchange mishandled customer funds.