Understanding Vitalik Buterin’s proposal to change Ethereum’s future staking rewards

Understanding Vitalik Buterin’s proposal to change Ethereum’s future staking rewards Understanding Vitalik Buterin’s proposal to change Ethereum’s future staking rewards

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Vitalik Buterin recently proposed a new reward scheme for staking Ethereum for when the protocol transitions to proof-of-stake consensus. The new scheme would provide scaling rewards based on the total amount of ETH locked up in staking.

Proposal to Change Staking Rewards

On Apr. 19th, 2019, Vitalik Buterin—the founder of Ethereum—proposed a change to the staking reward scheme for ETH.

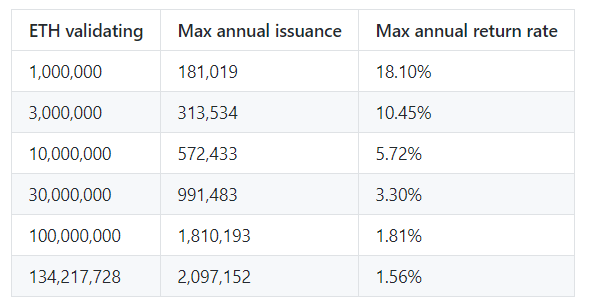

An increasing “max annual return rate” as the amount of “ETH validating” decreases acts as an incentive for more people to participate in staking when proof-of-stake is launched—a design that’s important for security, said one commenting developer.

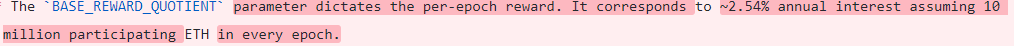

Another Ethereum developer, JustinDrake, commented “targeting… ~32M ETH [for staking] in the long term feels about right for strong security.” Previously, the base reward was set at a flat 2.54 percent annual interest based on the assumption of 10 million participating ETH:

The new scheme would change the reward and return on investment to reflect the total amount of ether participating in staking. As such, the change is an increase to the staking reward assuming less than 100 million ether participates in the process—a likely scenario, as a few commentators suggested.

Analyzing the Impact of the Change

One thing to note is that even though the interest on staked ETH decreases, the total amount of rewarded ETH, and consequently inflation, increases. 134 million staked ether—yielding interest of 1.56 percent—results in annual inflation of 1.6 percent. At the other end of the scale, 1 million staked ether would translate to annual inflation of less than 0.2 percent.

JustinDrake elaborates that roughly 32 million staked ETH seems healthy, which would give a yield of roughly 3.2 percent with annual inflation at approximately 1 percent. He goes on to say that half of the gas is burnt (assuming another proposal is passed) which would yield inflation of 0.5 percent and validator fees of roughly 5 percent.

In a scenario where less than 33 million ether is staked then “doubling base inflation wouldn’t be unreasonable,” stated JustinDrake.

So far, it is still uncertain when Ethereum will fully transition to a proof-of-stake consensus model. According to several Ethereum core developer meetings, it is possible that the protocol will exist in a hybrid proof-of-stake / proof-of-work consensus model for months, or even years.

Given that information, the above proposals are far from solidified. These particulars will continue to change as the Ethereum community makes progress towards the full implementation of proof-of-stake.