This data metric suggests the crypto market could soon see another “altseason”

This data metric suggests the crypto market could soon see another “altseason” This data metric suggests the crypto market could soon see another “altseason”

Photo by Franki Chamaki on Unsplash

The crypto market has taken a beating throughout the past few days and weeks, with sellers taking full control over altcoins as Bitcoin oscillates within a relatively wide trading range between $10,200 and $11,200.

This has created an air of uncertainty amongst investors, who are now fleeing what are referred to as “beta assets” in order to preserve their capital in case further downside is imminent.

The crypto market has been dealt multiple blows throughout the past week, starting with the $150m KuCoin hack, followed by news surrounding the CFTC’s pursuit of the BitMEX co-founders on charges of violating multiple regulations.

Turbulence in the traditional market as a result of President Donald Trump’s Coronavirus diagnosis added to the crypto market’s weakness and may continue creating fear amongst investors.

Until Bitcoin is able to stabilize around its current price region or begin pushing higher, there’s a possibility that altcoins will continue seeing intense selling pressure.

That being said, one fundamental metric does seem to indicate that upside could be imminent for altcoins, and particularly those residing within the DeFi sector.

DeFi crypto tokens hit hard by market-wide turbulence

The digital assets within the decentralized finance sector have been particularly struck by the recent crypto market downturn.

This is partially due to the highly accelerated bubble cycle that these tokens underwent throughout July and August, as many of them saw returns of 100 percent or more throughout the span of just a few months.

According to CryptoSlate’s proprietary data, the DeFi coin sector has shed 11 percent of its value throughout the past seven days.

Over the past 24-hours alone, this sector has declined by 4 percent. As long as there is turbulence throughout the broader market, these crypto assets will likely continue seeing a pattern of underperformance.

This indicator suggests the DeFi sector may soon kick off another uptrend

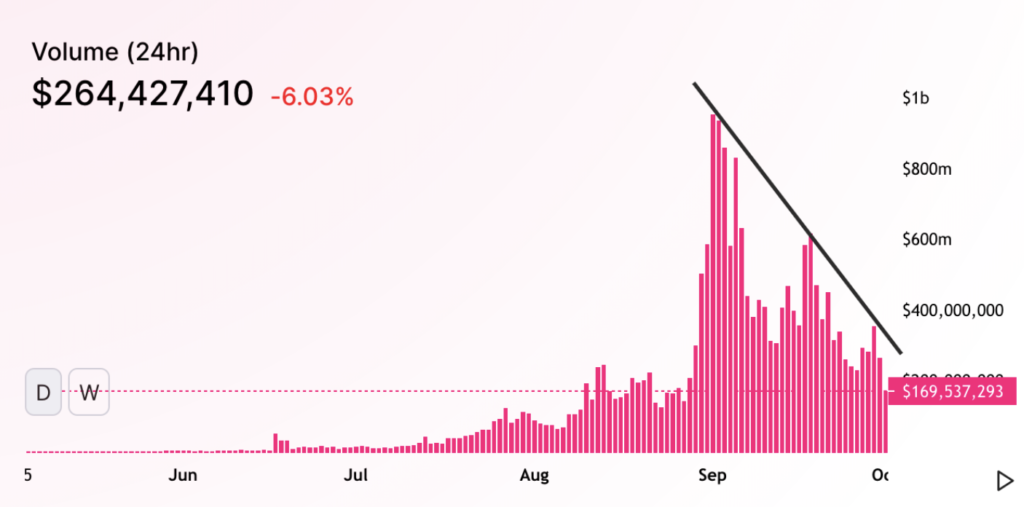

Analytics platform Santiment explained in a recent post that trading volume on decentralized exchanges like Uniswap provides insight into future trends within the DeFi sector.

They note that there is an obvious downtrend in volume that, once broken, could be a sign that a leg higher is imminent for this fragment of the crypto market.

“We believe there is fundamental metric that could possibly confirm the altcoin season quite early… DEX volumes are kind of a proxy of people gambling. More people trading means the crowd gets excited. In the middle of the cycle people will be talking about it everywhere again.”

Once the trendline in the above chart is broken above, it could be a sign that another round of DeFi mania is imminent for these crypto assets.