The dark side of the NFT market

The dark side of the NFT market The dark side of the NFT market

According to a recent report, NFTs are becoming increasingly used for money laundering, while wash trading continues to plague the emerging market.

Photo by KAL VISUALS on Unsplash

As new and exciting use cases for NFTs emerged, so did their potential for abuse, revealed a recent report by Chainalysis.

The blockchain research and analysis company investigated two forms of illicit activity in the NFT market–wash trading and money laundering–uncovering worrying stats.

Wash traders collectively made $8.9 million in profit

Wash trading implies fictitious sales in which the seller is on both sides of the transaction–a practice intended to deceive the market, aka potential buyers, into believing there is a high demand for the asset–inflating its price.

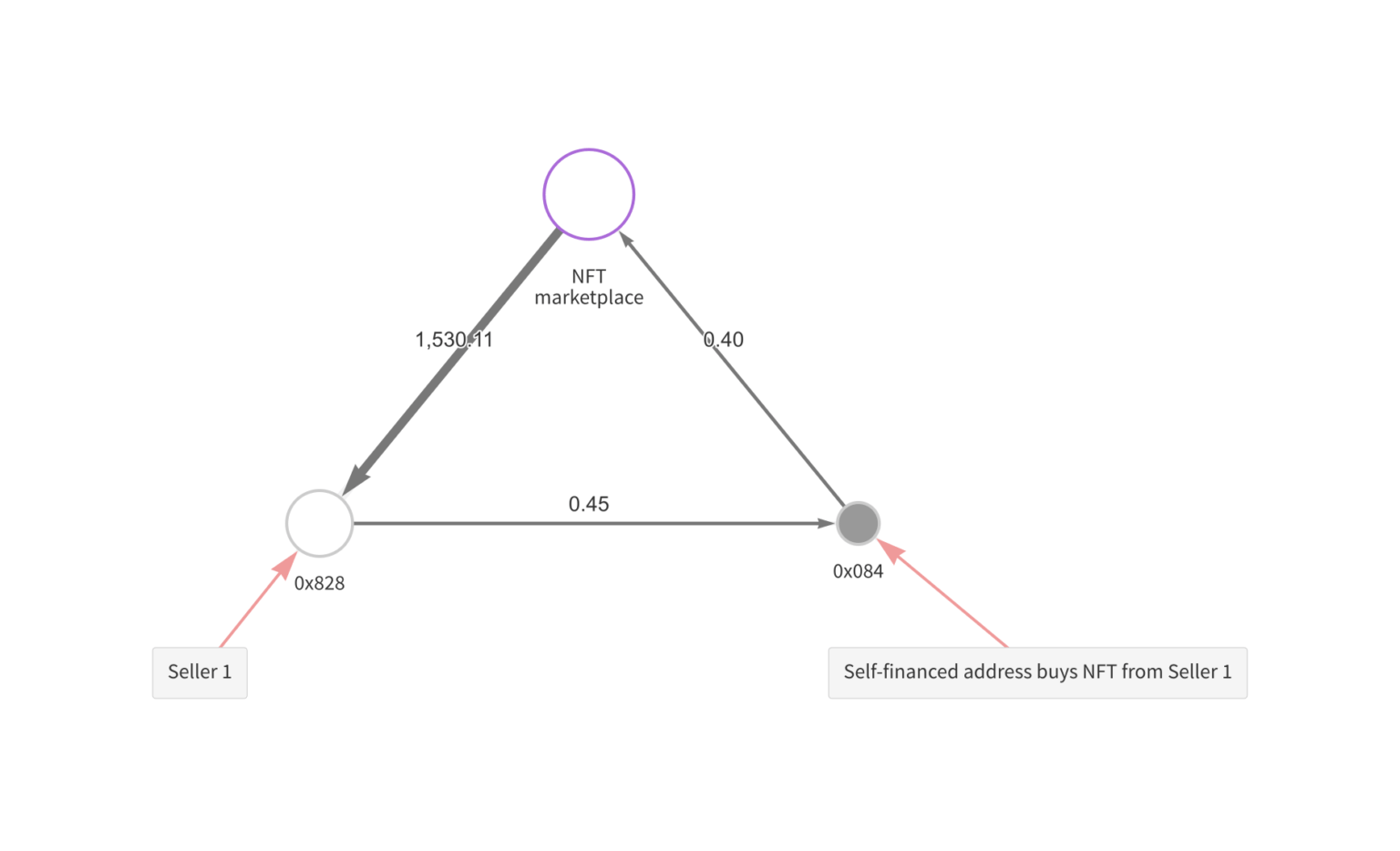

NFT wash traders are making their digital collectibles appear more valuable by selling them to new wallets, which they finance themselves.

As Chainalysis pointed out, most NFT trading platforms allow users to trade by simply connecting their wallet, without additional identification needed, which greatly facilitates this form of abuse.

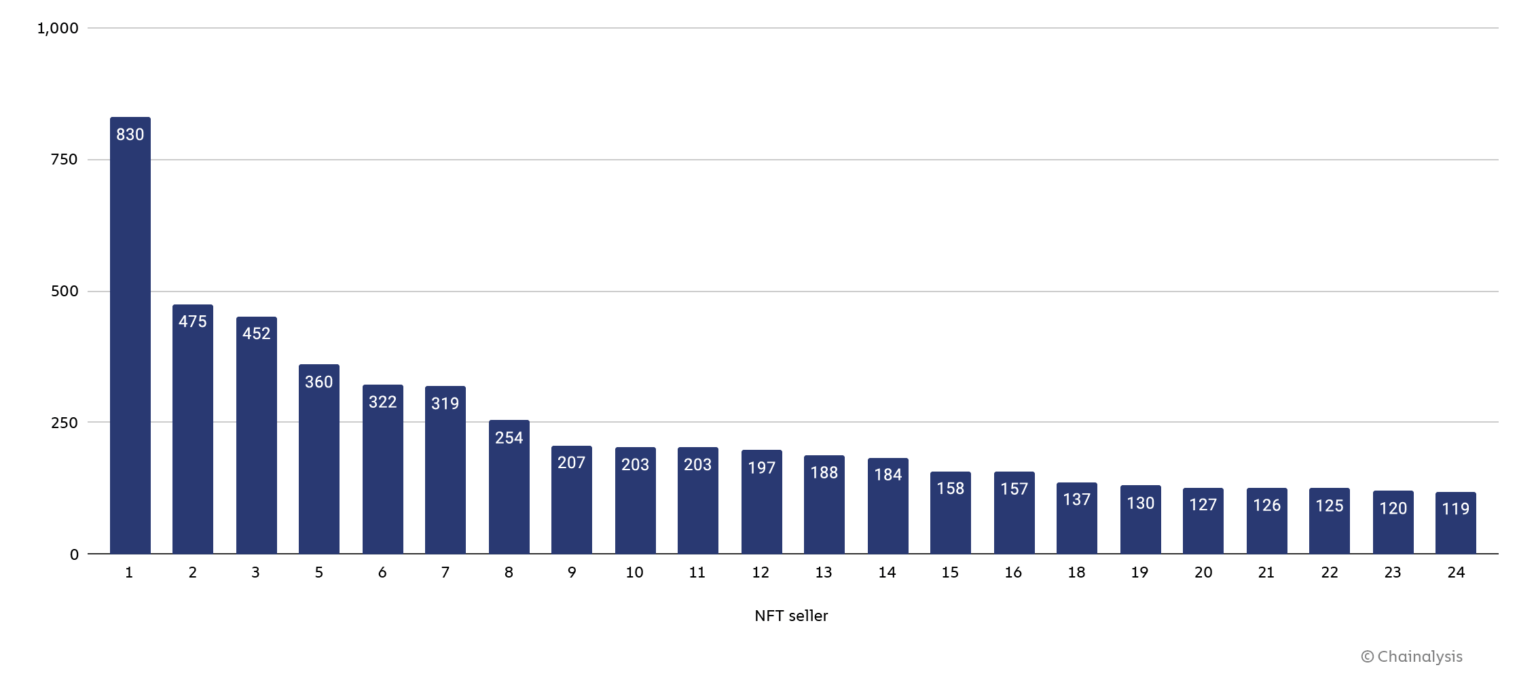

The report dove into NFT sales to self-financed addresses and uncovered that some NFT sellers have executed hundreds of wash trades.

NFT wash trading can be tracked by analyzing sales of NFTs to addresses that were self-financed–meaning funded by the selling address or by the address that funded the selling address.

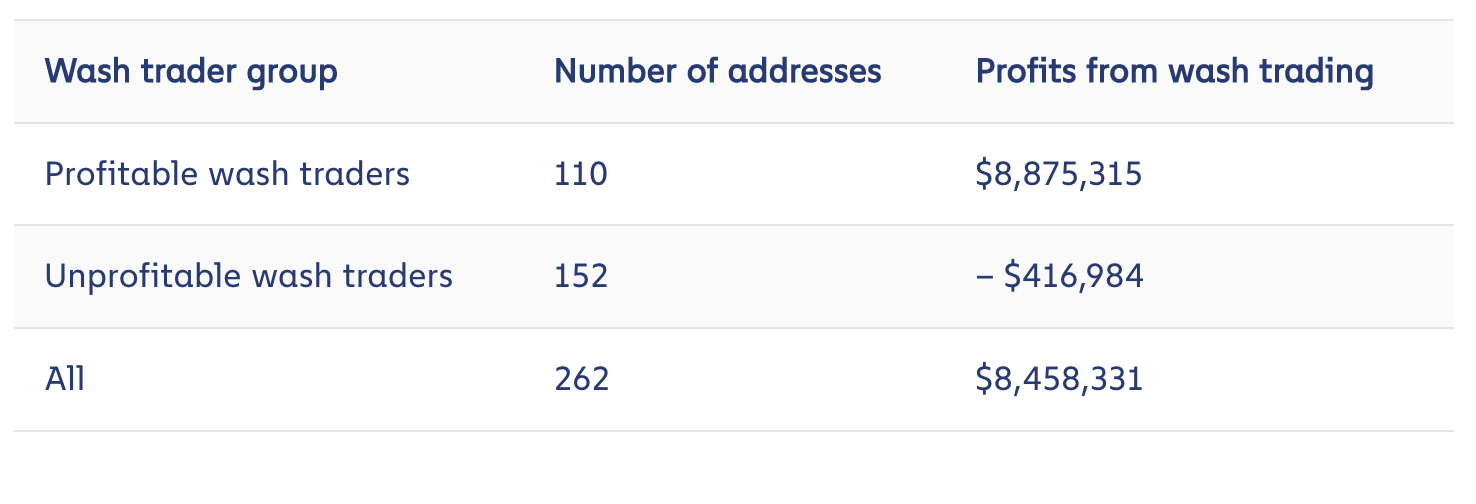

Using blockchain analysis, Chainalysis identified 262 users who sold an NFT to a self-financed wallet more than 25 times. Their overall profits were further calculated by subtracting the amount they’ve spent on gas fees from the amount they’ve made selling NFTs.

“Most NFT wash traders have been unprofitable, but the successful NFT wash traders have profited so much that, as a whole, this group of 262 has profited immensely overall,” read the report.

The applied analysis only captured trades made in Ethereum and Wrapped Ethereum, pointed out Chainalysis, adding that the assessment of wash trading could be considered conservative.

The 110 profitable wash traders collectively amassed nearly $8.9 million in profit, trivializing the $416,984 in losses made by the 152 unprofitable wash traders.

“Even worse, that $8.9 million is most likely derived from sales to unsuspecting buyers who believe the NFT they’re purchasing has been growing in value, sold from one distinct collector to another,” the report concluded.

Blockchain data and analysis facilitates identifying this type of abuse, and as Chanalysis pointed out, “marketplaces may want to consider bans or other penalties for the worst offenders.”

NFTs are becoming increasingly used for money laundering

Although not as significant as wash trading, the use of NFTs for money laundering is on the rise, revealed the second part of the report.

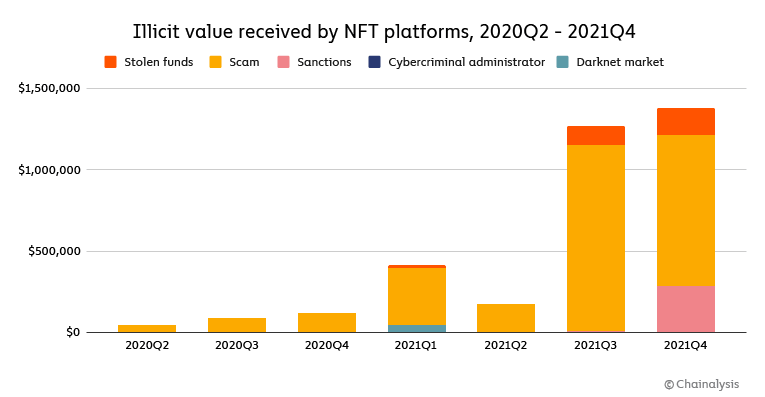

The data shows that illicit funds are becoming increasingly involved in NFT purchases–with value sent to NFT marketplaces by flagged addresses jumping significantly in the third quarter of 2021, crossing $1 million.

The value further increased in the fourth quarter, reaching almost $1.4 million.

In both quarters, the biggest portion of this activity came from scam-associated addresses sending funds to NFT marketplaces to make purchases.

Both quarters also saw significant amounts of stolen funds sent to marketplaces.

Meanwhile, addresses with sanctions risk became increasingly involved in Q4–a bump directly connected to P2P cryptocurrency exchange Chatex, which was indicted and sanctioned for involvement in ransomware operations.

Although on the rise, this activity still represents “a drop in the bucket”–compared to the $8.6 billion worth of cryptocurrency-based money laundering Chainalysis tracked in 2021.

“Nevertheless, money laundering, and in particular transfers from sanctioned cryptocurrency businesses, represents a large risk to building trust in NFTs, and should be monitored more closely by marketplaces, regulators, and law enforcement,” the report concluded.