Solana and ICP up over 49% against Bitcoin since SEC labeled them as securities

Solana and ICP up over 49% against Bitcoin since SEC labeled them as securities Solana and ICP up over 49% against Bitcoin since SEC labeled them as securities

All tokens embroiled in SEC's scrutiny, however, see mixed fortunes against Bitcoin amidst legal turmoil.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

With Bitcoin down some 20% from its year-to-date high, it’s often helpful to zoom out and look at the broader picture. I have a saved chart of all the tokens listed in the Coinbase and Binance lawsuits filed (C&B suits) on June 6 and June 5, 2023, respectively, and their prices as denominated in Bitcoin.

For context, both Binance and Coinbase are currently defending their positions in U.S. courts. The central issue in both lawsuits is whether the crypto assets offered by these exchanges should be classified as securities and, therefore, fall under SEC regulation.

The tokens described as potential securities in the abovementioned lawsuits included Alogrand, Solana, Cardano, Near, Filecoin, and others, as shown in the chart below. Let’s examine how these assets have performed compared to Bitcoin over the past 8 months and then look at some of the standout tokens’ performance in dollar terms.

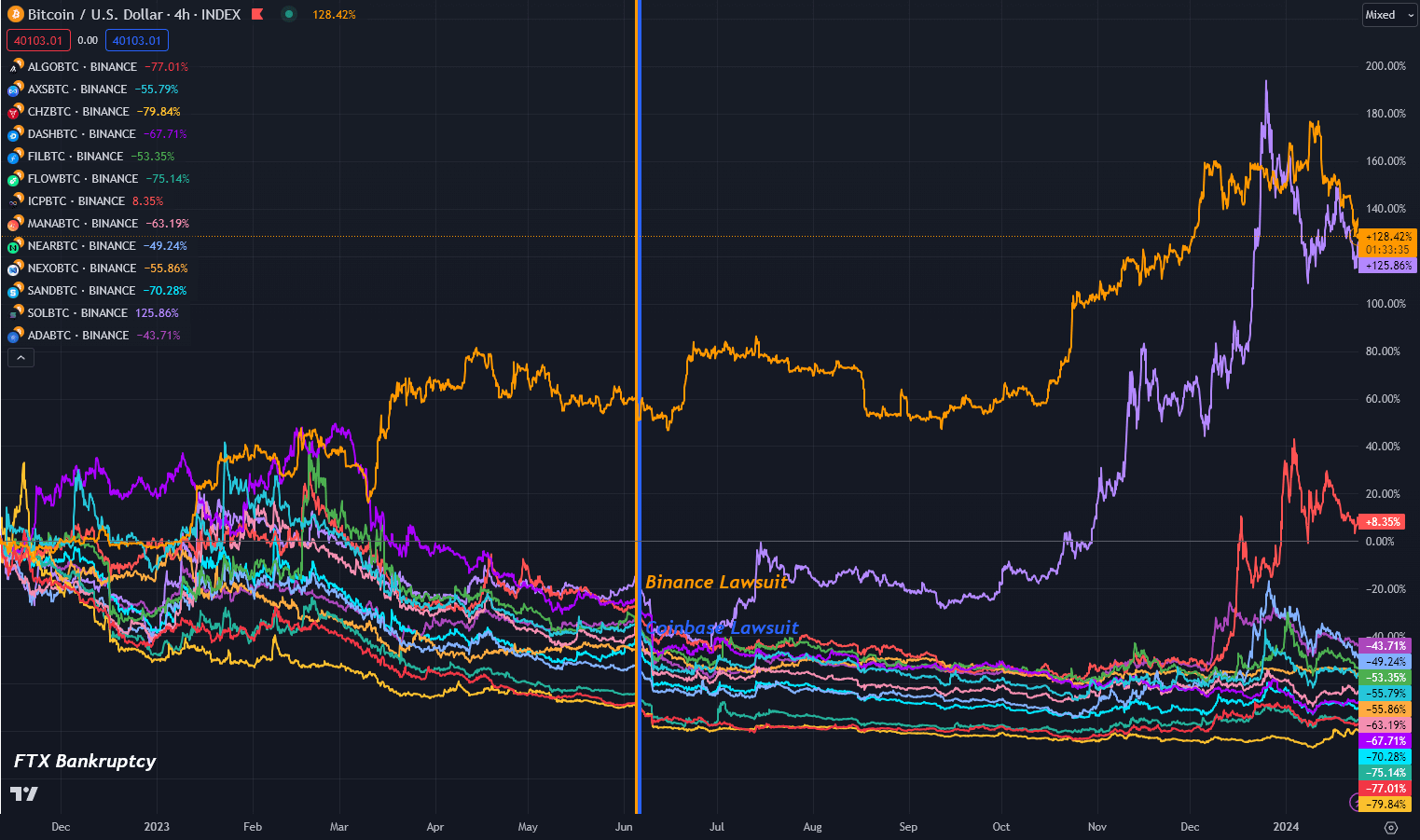

For context, we’ll first look at the performance of this cohort of digital assets since the black swan event that preceded the C&B suits, namely the bankruptcy filing and subsequent collapse of FTX. The exchange filed for Chapter 11 bankruptcy on Nov. 11, 2023, when Bitcoin was priced around $16,900. Since then, it has soared by approximately 140% against the dollar, with only two assets outperforming it.

Solana and ICP saw increases in their price in BTC terms, increasing 116% and 9% respectively. All other tokens listed as potential securities declined against Bitcoin between -41% and -80%

The best was Cardano, which lost 41% of its value against Bitcoin; the worst was Chilliz, which declined -80%. In dollar terms, Cardano is up 50%, while Chilliz is down -53%, showcasing the strength of Bitcoin over the past 15 months.

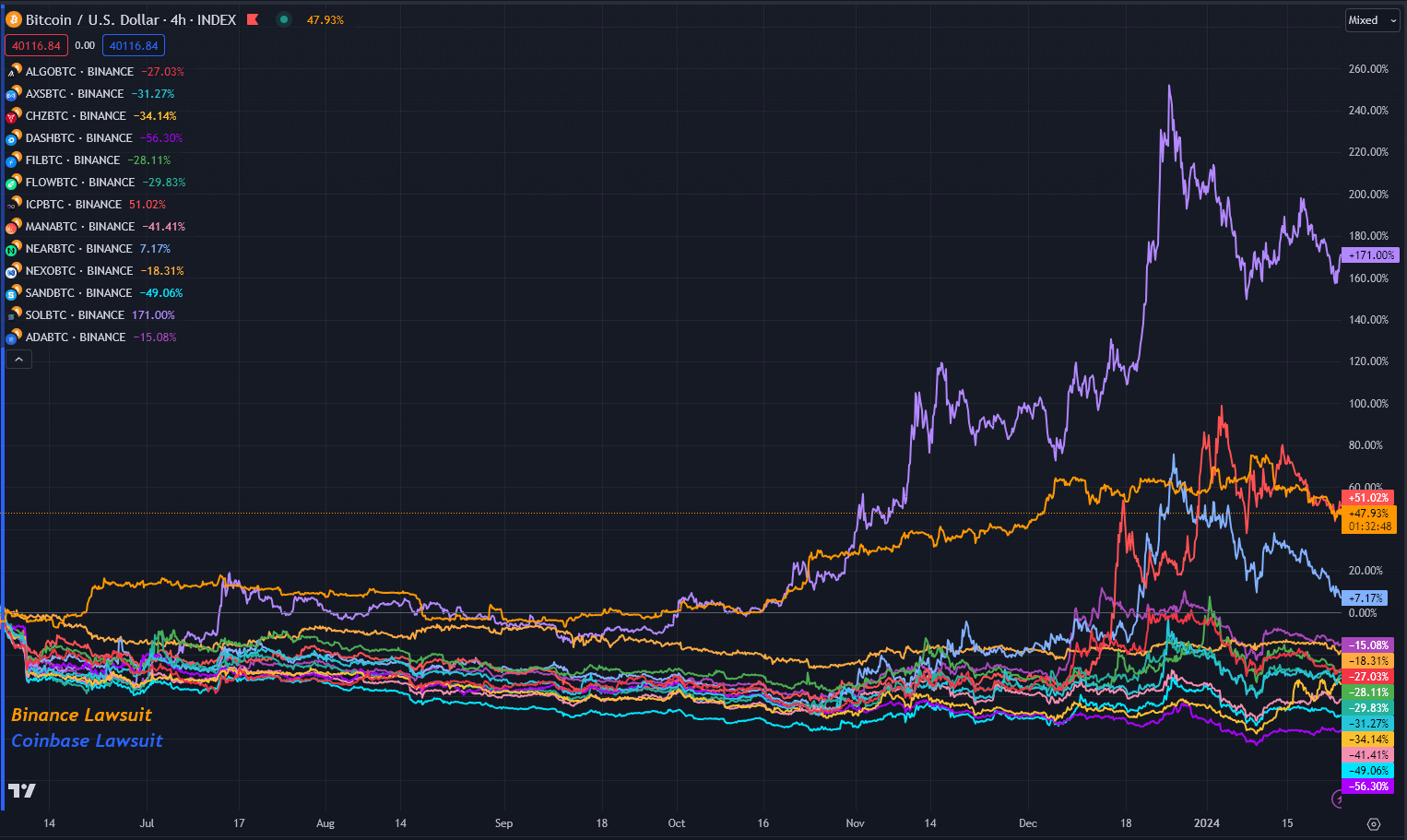

Performance since Coinbase and Binance SEC lawsuits.

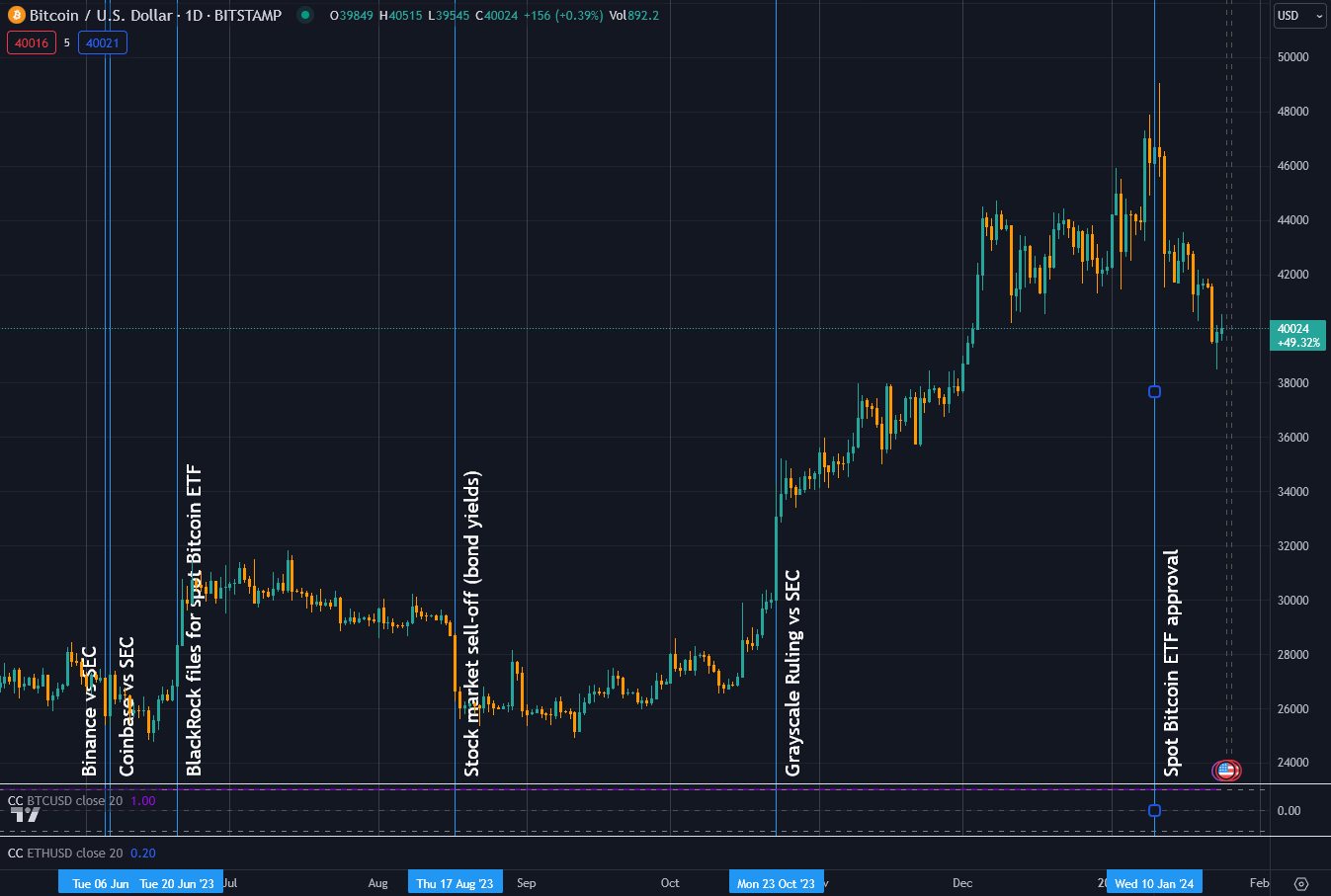

When Binance and Coinbase were hit with SEC lawsuits within a day of each other last June, the market reeled from the impact of the two most prominent names in crypto exchanges being so directly targeted. On June 5, when Binance was served, Bitcoin fell to $25,300 from around $26,800. However, on the day Coinbase was served, it regained its value before slowly bleeding out to around $25,00 mid-way through the money.

On June 20, 2023, BlackRock filed its application for a spot in Bitcoin ETF, which saw Bitcoin’s price elevate to over $30,000 until a stock market sell-off in August reversed the gains. From there, it traded sideways until Grayscale’s victory in court against the SEC, when the price took off toward its eventual 2-year high of $49,000 on the day the spot Bitcoin ETFs launched. At this peak, Bitcoin was up 90% since the C&B suits.

As of press time, having retraced somewhat, Bitcoin is up 47% since the C&B suits, with three assets having performed better. Solana and ICP outdid Bitcoin, this time by 169% and 49%, respectively. However, Near Protocol is also up 8% on Bitcoin.

All other tokens threatened with categorization as a Security fell against Bitcoin within the timeframe, the worst now Dash declining -56%, with the least affected being Cardano, down -15%.

Notably, against the dollar, Solana, ICP, and Near are up 286%, 265%, and 145%, respectively, over the same timeframe. Moreover, even the biggest loser against Bitcoin, Dash, is up 4%, and Cardano is up 87% against the dollar.

When you price everything in dollars in crypto, you can miss that your assets have declined in Bitcoin terms.

Binance and Coinbase defend their positions in court.

Although most of the industry has been focused on ETFs this year, Binance’s case was heard on Jan. 22 in a Washington courtroom, with Judge Amy Berman Jackson of the District of Columbia presiding, and Coinbase appeared in a New York court on Jan. 17, with Judge Katherine Polk Failla overseeing the proceedings.

The SEC’s argument against Binance focused on Binance’s BUSD stablecoin and BNB token, suggesting that at least the BNB token might have initially been sold as an investment contract. Binance’s defense challenged the applicability of the Howey test to cryptocurrencies and disputed the SEC’s comparisons to other court cases, such as Zakinov v. Ripple Labs.

Coinbase also contested the relevance of the Howey test for cryptocurrencies. The SEC’s broad approach raised concerns about extending the definition of securities to encompass categories typically outside its purview, such as collectibles. Judge Failla acknowledged the complexity of the issue and deferred her decision.

Elliott Stein, a senior litigation analyst at Bloomberg, assessed a 70% likelihood of the SEC’s June 2023 lawsuit against Coinbase being dismissed. However, a victory for the SEC in either case could have significant implications for the cryptocurrency industry. It could mandate crypto exchanges to treat digital tokens as securities, fundamentally altering how these assets are handled and regulated in the U.S.

The outcomes of these cases will set precedents for the future regulation of digital assets in the country and will likely have a tangible impact on the tokens named in the C&B suits.