Algorand’s ALGO token nosedives amid SEC classification and deflating DeFi activity

Algorand’s ALGO token nosedives amid SEC classification and deflating DeFi activity Algorand’s ALGO token nosedives amid SEC classification and deflating DeFi activity

Algorand's price and DeFi volume have suffered severely in the wake of its classification as a security by the SEC.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

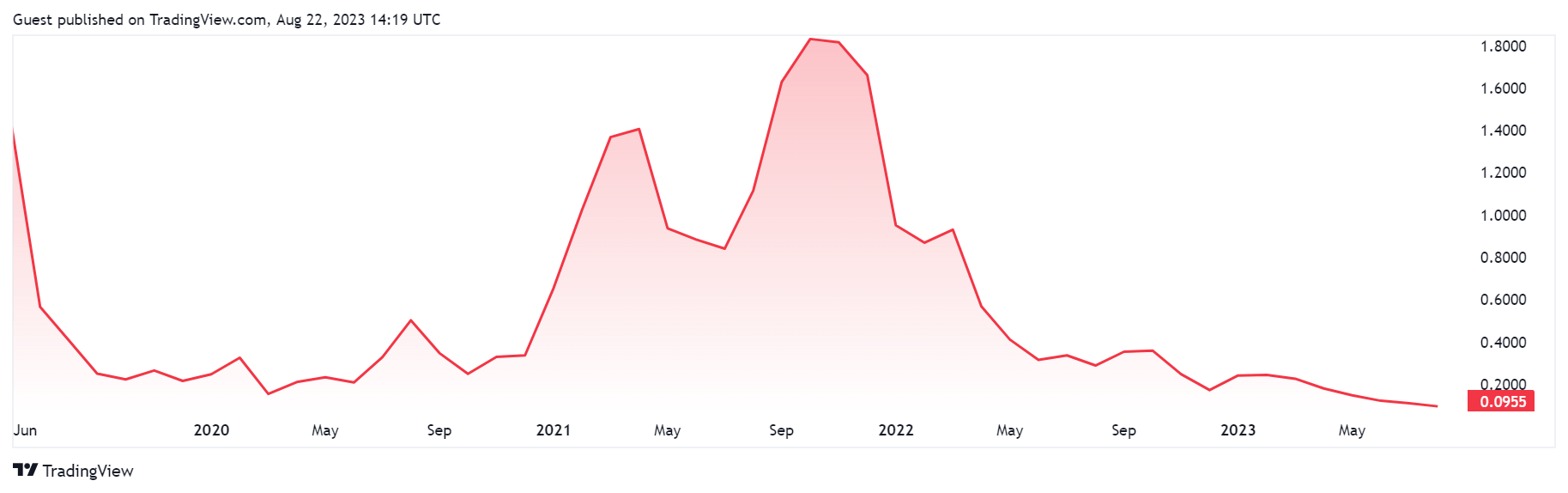

Algorand’s ALGO token price has plunged to new lows following the crypto market’s epic crash on Aug. 17.

According to CryptoSlate’s data, the digital asset fell to an all-time low of $0.08846 last Thursday. While its value has since rebounded to $0.09673 as of press time, market sentiments surrounding the asset remain negative.

Why is ALGO value dropping

Earlier in the year, the SEC classified the ALGO token as a security as part of its charges against the U.S.-based crypto exchange Bittrex. This classification has significant implications for the financial regulations that the token and its holders face.

Despite strong opposition from its Foundation, ALGO has seen a decline in demand due to investor hesitation around assets without clear regulatory status. This has resulted in the token’s value dropping by more than 87% since the classification.

Before the SEC classification, Algorand’s ecosystem faced challenges when MyAlgo, a prominent wallet in the ecosystem, was hacked in March. The incident resulted in losses of over $10 million, shaking confidence in the network’s security measures.

Despite the falling value of ALGO, Algorand Foundation CEO Staci Warden remains optimistic, believing that the network’s ability to continue attracting developers is a positive sign for its future.

DeFi activity stalls

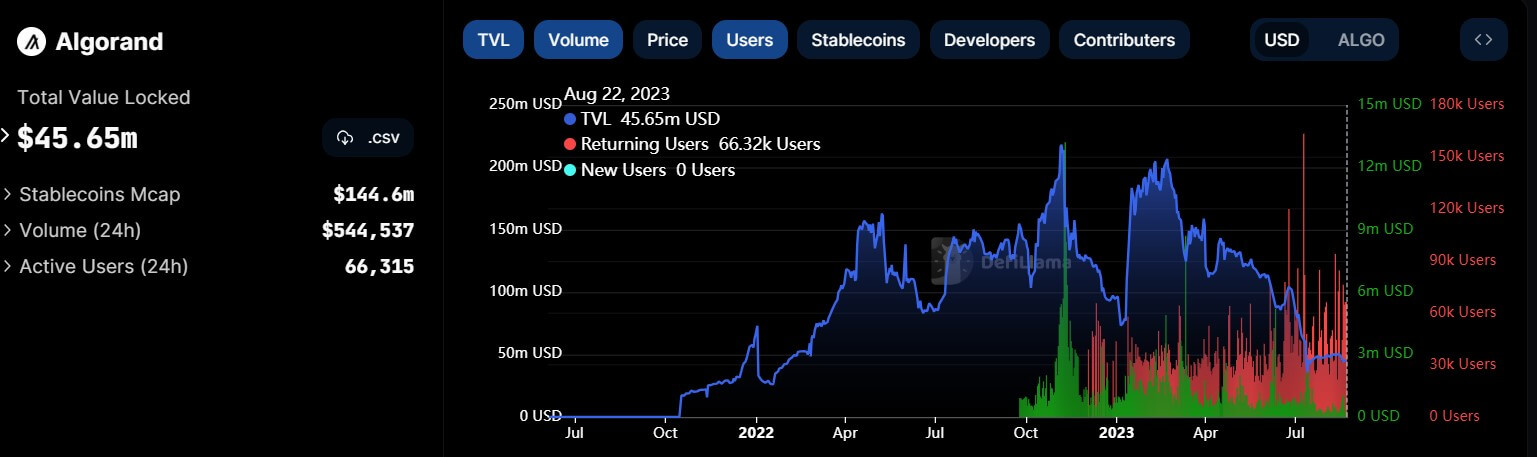

Meanwhile, the price decline is amid a falling DeFi activity on the network. Data from DeFillama shows that the total value of assets locked on the blockchain has fallen to less than $50 million after peaking at more than $200 million in February.

Interestingly, the drop in TVL is not merely a result of ALGO’s falling prices. In July, Algorand’s largest decentralized finance protocol, Algofi, said it would wound down its operations due to its inability to maintain the platform. At its peak, the DeFi platform contributed over 50% of Algorand’s DeFi activity.

Algofi’s sudden closure severely impacted confidence in other protocols, which were still striving to attract new users to their platforms.