Rumors swirl around $100k/hr front running on Binance listings

Rumors swirl around $100k/hr front running on Binance listings Rumors swirl around $100k/hr front running on Binance listings

One trader made over $100,000 exiting less than an hour after GNS listed on Binance.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

On Feb. 17, a wallet that had been previously engaged in front-running token listings on Binance made another trade, this time purchasing and selling the Gains (GNS) token just before listing on the world’s leading exchange.

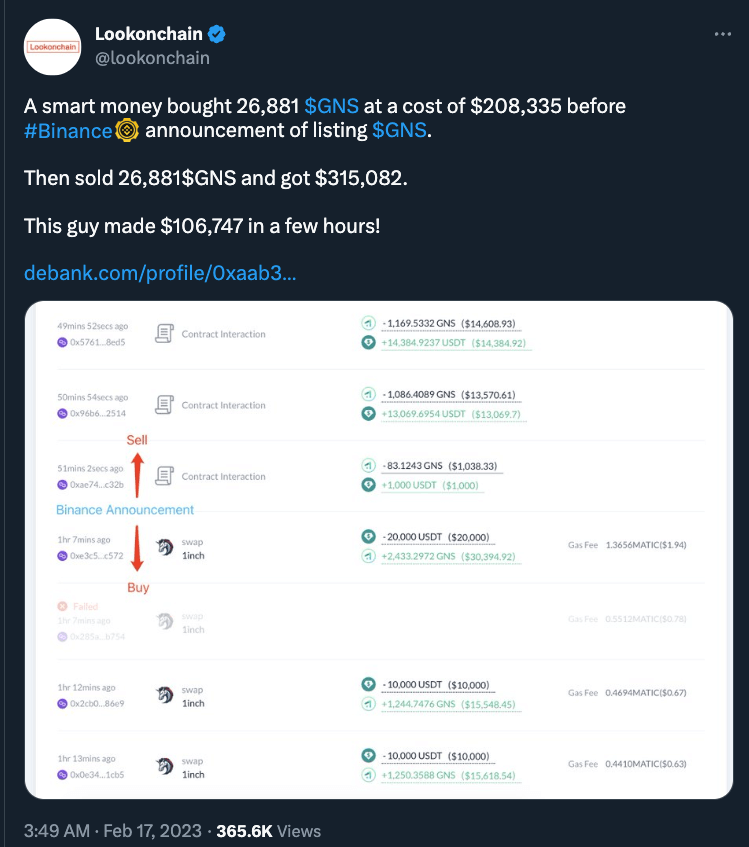

According to an analysis by Lookonchain, the crypto trader, whose identity remains unknown, made a profit of more than $100,000 by purchasing a token just a few minutes before it was listed on Binance.

The on-chain sleuth found that just before being listed on Binance, a trader bought Gains Network (GNS) tokens worth $208,335 just 30 minutes prior. Following the listing, GNS increased by 51%, from $7.92 to $12.01, and the trader sold their GNS holdings for a profit of $106,747, a flip made in just under one hour.

Lookonchain satirically referred to the trade as “smart money” in the Twitter post. However, it’s a practice few find funny, as insider trading is illegal in most countries, including the United States, Canada, the European Union, and many other jurisdictions worldwide. In general, trading on non-public information, such as information about a pending listing, is considered dishonest and can harm the integrity and fairness of the markets.

What is front running?

In the context of crypto exchanges, front running can occur when a trader or an exchange employee uses confidential information about a customer’s trade to place their trade before the customer’s trade is executed, which can result in a profit at the expense of the customer.

Front running gives the person engaging in it an unfair advantage in the market. It is also a violation of trust, as it breaches the duty of confidentiality that may exist between the person with insider information and the other parties involved in the transaction.

Over the past year, numerous prominent crypto exchanges have faced scrutiny for alleged or confirmed instances of front-running, where traders, armed with insider knowledge, take significant positions in tokens that are highly likely to appreciate, often due to being listed on a centralized crypto exchange such as Binance.

Front running at Coinbase

In a recent case, former Coinbase product manager Ishan Wahi pleaded guilty to participating in an insider trading scheme that generated $1.1 million in profits. Federal prosecutors regarded the case as the first insider trading case involving cryptocurrencies.

In Aug. 2022, one academic research report found that 10-20% of new crypto listings on CoinBase were subject to front running.

Binance CEO responds to front running, says most happens on the token side

In July, when charges were initially brought against Wahi, Changpeng Zhao (CZ), the CEO of Binance, condemned the actions of the Coinbase employee, stating that “insider trading and front running should be criminal offenses in any country,” whether they involve cryptocurrencies or not.

Binance maintains that it enforces a policy of self-regulation to prohibit employees from engaging in short-term trading. However, Coinbase’s Wahi, for example, shared insider information about tokens that were about to be listed with his brother and friend, which led to the charges.

In a recent AMA, CZ said that many of the leaks and front runs do not come from within Binance but rather from the project/token side. Binance is clear that anyone who tries to front run on news that they will get listed on Binance will be put on a blacklist.

“We try not to tell project teams when they will be listed on Binance to the point where we can. But when we have those kind of discussions, sometimes the project teams do know that, okay, we integrated the wallet already, so we’re probably pretty close to listing or launch or something. And then the news, the news sometimes leaks on the project side. So we want to prevent that as much as possible. It’s not 100%, but I think we do a better job than most other exchanges.”