Research: Bitcoin and Ethereum correlation at nearly 90% for 2 years is not a bullish sign

Research: Bitcoin and Ethereum correlation at nearly 90% for 2 years is not a bullish sign Research: Bitcoin and Ethereum correlation at nearly 90% for 2 years is not a bullish sign

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

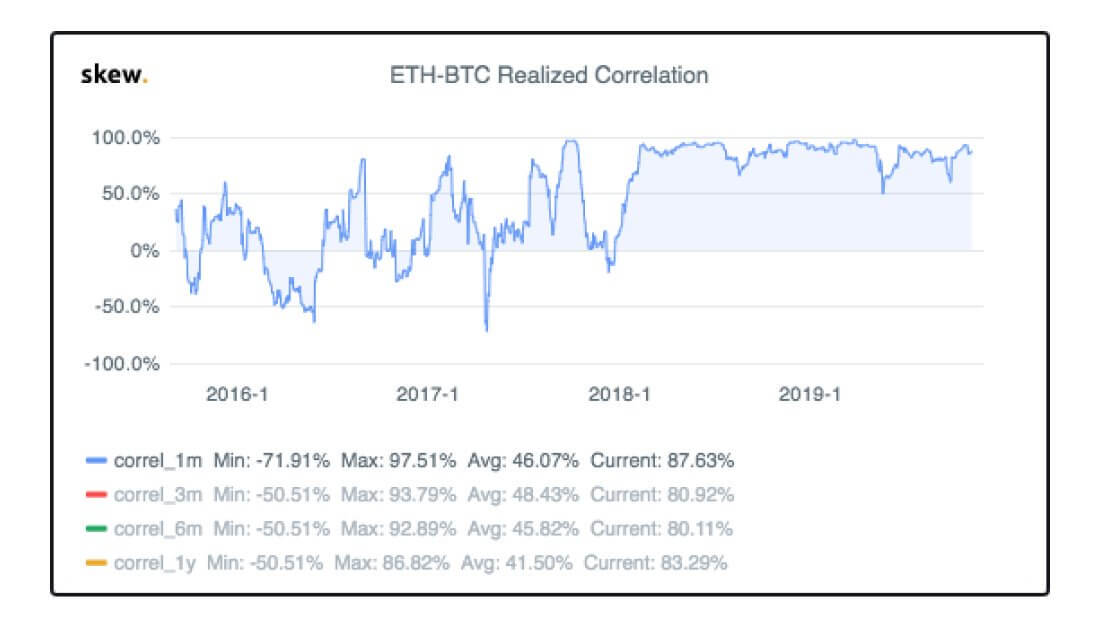

Based on the data released by researchers at Skew, the correlation between Bitcoin (BTC) and Ethereum (ETH) has been at around 90 percent for two years.

Since the end of the 2017 bull market during which the Bitcoin price achieved $20,000, most cryptocurrencies have fallen by 80 to 95 percent against the U.S. dollar.

The high level of correlation between Bitcoin and Ethereum indicates that most major cryptocurrencies have been following the price trend of the dominant cryptocurrency.

Why is it a sign of a bearish trend for bitcoin, Ethereum, and crypto in general?

In amidst a bull market or an extended rally, cryptocurrencies tend to see independent movements to either the upside or the downside.

Early on in 2017, for instance, the correlation between Bitcoin and Ethereum was hovering in the range between -50 percent and 50 percent, as both cryptocurrencies moved purely based on the demand from their respective markets.

However, as cryptocurrencies moved into the bear market territory, the entire market started to fall in tandem, forcing most cryptocurrencies to move up and down in a correlated manner.

When the bitcoin price saw a spike to $14,000 in June, the Ethereum price also saw its yearly high at $366.

Depending on the interpretation of various data, it is arguable whether the cryptocurrency market is currently in a bear market or a bull market.

Engagement wise, considering data from social media platforms and search engines surrounding crypto-related keywords, the interest surrounding the market has noticeably dropped over the past two years.

In terms of price, Bitcoin is up by more than two-fold since January 2019 and Ethereum has also recovered relatively well, which some may consider being a bull market.

As long as the correlation amongst major cryptocurrencies remains substantially high, it is difficult to conclusively state that cryptocurrencies are in a bull market.

Fundamentals are still strengthening

Despite the sluggish trend of cryptocurrencies, the fundamentals for both bitcoin and Ethereum seem to be strengthening.

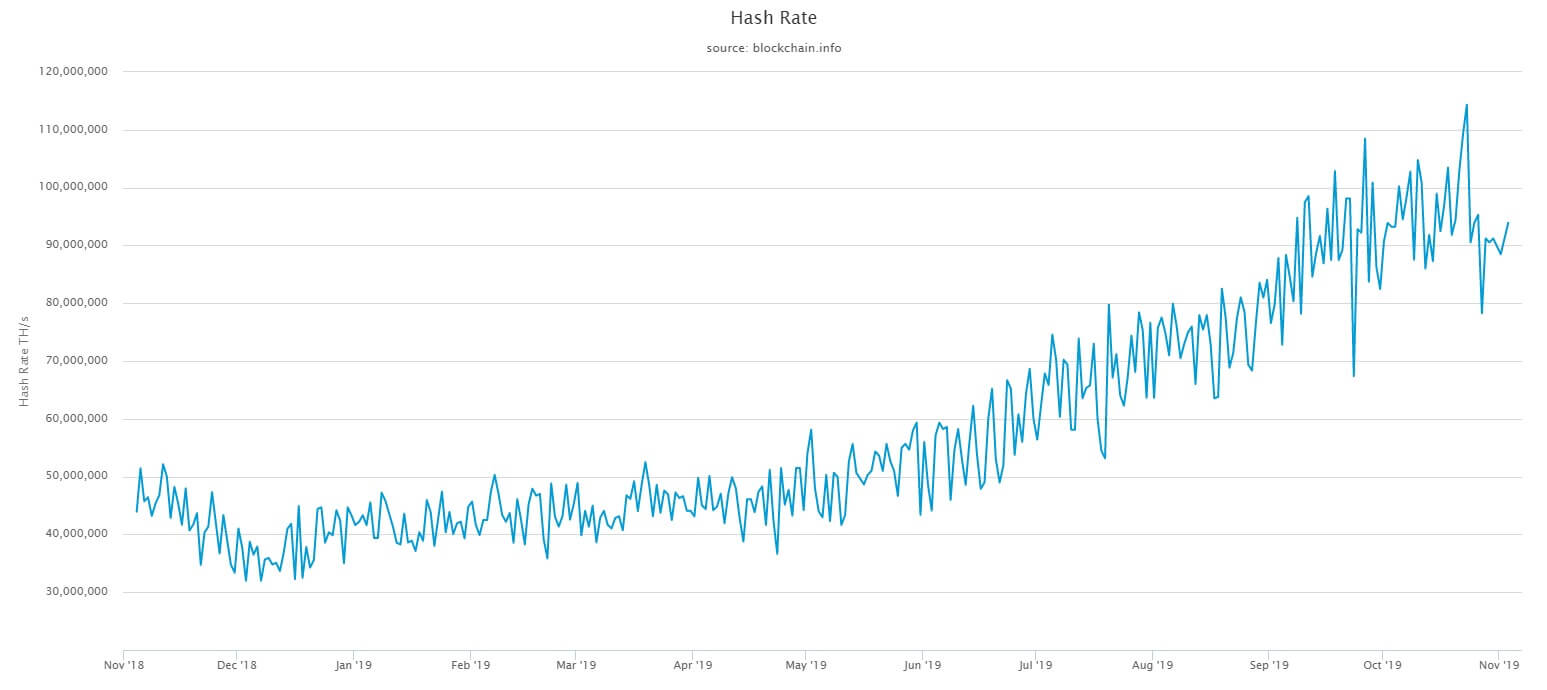

The hash rate of bitcoin is still near record highs with six months to go for the block reward halving in mid-2020 and the user activity of Ethereum is on the rise due to various factors including rising decentralized finance (DeFi) activity and the usage of stablecoin Tether.

As reported by CryptoSlate, the volume of newly emerging strictly-regulated platforms targeting accredited investors such as Bakkt has also begun to see a large increase, indicating rising demand for cryptocurrencies from a broader base of investors.

Technical analysts generally favor a deeper pullback in the short term but over the medium to long term, optimism continues to surround the cryptocurrency market.

Ethereum Market Data

At the time of press 4:09 pm UTC on Dec. 7, 2019, Ethereum is ranked #2 by market cap and the price is up 0.88% over the past 24 hours. Ethereum has a market capitalization of $19.99 billion with a 24-hour trading volume of $8.9 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 4:09 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $247.99 billion with a 24-hour volume of $72.46 billion. Bitcoin dominance is currently at 67.25%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)