Q2 historically generated large gains for Bitcoin, but this time may be different

Q2 historically generated large gains for Bitcoin, but this time may be different Q2 historically generated large gains for Bitcoin, but this time may be different

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

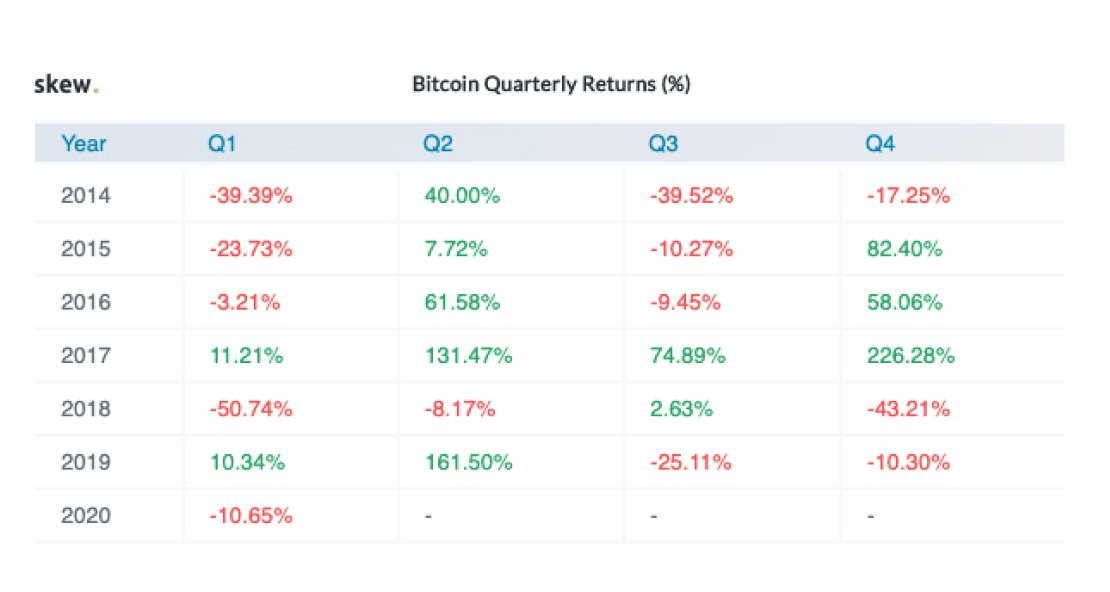

Historically, the Bitcoin price has tended to increase in the second quarter of every year. In the past six years, with the exception of 2018, BTC’s price has increased by 80 percent on average from April to June.

However, 2018 was an odd year out during which the Bitcoin price dropped by 8 percent in its second quarter. There is a possibility that 2020 replicates its performance two years ago given the gloomy macro outlook in the U.S. and the declining sentiment around high-risk assets.

Sentiment is gloomy: a scenario in which Bitcoin ends Q2 with a positive

The short-term trend of the Bitcoin price remains dim as the decline in the volume of cryptocurrencies across futures and spot exchanges leaves the market vulnerable to a sudden sell-off.

When the Bitcoin price sees an abrupt capitulation-esque drop to some of the lowest support levels and recovers, it typically suggests that a long accumulation phase or consolidation phase is likely to follow.

For instance, in Sept. 2019, the Bitcoin price plunged from around $10,900 to $7,330. The following month, the Bitcoin price suddenly spiked to over $10,000, only to fall to a lower area of support at $6,410. A similar trend was also seen in previous years, most notably in 2018.

Some prominent investors, like Placeholder’s Chris Burniske, have argued that technical indicators and structures point toward the bottom not being in for Bitcoin.

1/ Lots of people asking where $BTC bottoms. The short of it is I wouldn’t be surprised to see a retest of our 2018 lows near $3000. To explain:

— Chris Burniske (@cburniske) March 16, 2020

That means the $3,600 to $3,800 range the Bitcoin price plummeted to on March 12 may not be the bottom, based on certain data points.

For a strong extended rally to materialize heading towards the end of 2020, a firm support area has to be established. Often, such support can only be formed through months of consolidation at a low price range.

An abrupt spike up to high resistance levels can create an environment wherein traders and whales aggressively begin to take profits and market sell large amounts of Bitcoin.

But, even if the Bitcoin price falls to the $3,000 to $4,000 range in the short-term, it is highly probable for BTC to still end Q2 with a gain or a minimal loss like in 2018.

Much of the weakness in the trend of crypto assets in the past month has been attributed to the prolonged sell-off of the U.S. stock market.

A major progress in containing the coronavirus pandemic, especially in heavily affected countries including the U.S. and Europe could lead to a general recovery of all markets, providing newly found momentum to the cryptocurrency sector.

Historical data may make little sense in 2020

Bitcoin has never been tested during a global economic slowdown that is bordering a a worldwide recession like the Great Depression in 1929.

As such, 2020 is significantly different than the previous ten years for Bitcoin in that the price trend of BTC is being primarily affected by geopolitical risks.

As CryptoSlate previously reported, the plunging oil market also presents a unique threat to cryptocurrencies, increasing the level of caution of investors in the crypto market.

Bitcoin Market Data

At the time of press 7:44 pm UTC on Apr. 2, 2020, Bitcoin is ranked #1 by market cap and the price is up 10.16% over the past 24 hours. Bitcoin has a market capitalization of $125.42 billion with a 24-hour trading volume of $48.91 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 7:44 pm UTC on Apr. 2, 2020, the total crypto market is valued at at $191.51 billion with a 24-hour volume of $153.08 billion. Bitcoin dominance is currently at 65.49%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)