Prominent investor speculates why Terra’s algo-stablecoin (UST) triumphed over Synthetix (sUSD)

Prominent investor speculates why Terra’s algo-stablecoin (UST) triumphed over Synthetix (sUSD) Prominent investor speculates why Terra’s algo-stablecoin (UST) triumphed over Synthetix (sUSD)

While UST challenges the hegemony of DAI–a question of what exactly sets the Terra native stablecoin apart from the competition hit the nerve.

Photo by Daniel Leone on Unsplash

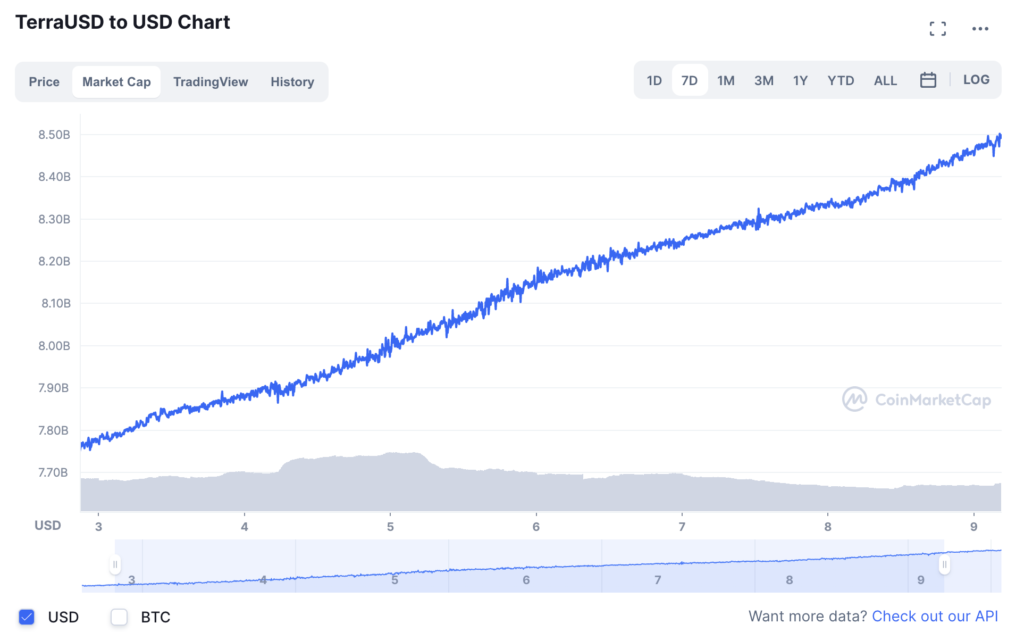

As the market capitalization of Terra’s algorithmic stablecoin that tracks the value of the US dollar topped $8.5 billion–investors speculate what is driving the adoption and how exactly did UST manage to leave the competition lagging so far behind?

While fueling the DeFi market, the decentralized stablecoin sector continues to rapidly grow.

By leveraging unparalleled usage, this particular breed of crypto surfaced as an unarguably vital part of the ecosystem.

Adoption

The blazing adoption rate of UST has spurred the debate on Twitter, as Kyle Samani, co-founder of crypto investment firm MultiCoin Capital, asked his followers’ for their opinion on what sets Terra’s decentralized stablecoin apart from its peers–Synthetix’s stablecoin sUSD in particular.

What’s your best theory on why sUSD didn’t take off, where UST did?

— ksam.sol (@KyleSamani) December 8, 2021

Terra’s native stablecoin uses LUNA as a reserve asset, and every time someone mints UST, a dollar-equivalent amount of LUNA is burned.

Terra’s native token LUNA rose to the top 10 of cryptos, rallying more than 8% during the past seven-day period–despite the market pullback.

The UST market cap, which increased 10.5% during the same time frame, grew 197% during the past month, according to CoinMarketCap.

While the mint–burn mechanism is tying the two cryptocurrencies in a scalable monetary policy, UST leverages yield-bearing and interchain capabilities.

Utility

“However, what UST has in its favor that other decentralized stablecoins do not have is that its not playing DAI on its home turf”–argued Ryan Watkins.

However, what UST has in its favor that other decentralized stablecoins do not have is that its not playing DAI on its home turf.

Instead of attempting to challenge DAI on Ethereum, UST is building it’s own ecosystem on Terra and aggressively expanding multichain.

— Ryan Watkins (@RyanWatkins_) September 15, 2021

According to the Messari’s researcher, “instead of attempting to challenge DAI on Ethereum, UST is building its own ecosystem on Terra and aggressively expanding multichain.”

That was the plan and, thus far, Do Kwon executed without a hiccup– the co-founder and CEO of Terraform Labs, the South Korean company behind the blockchain project Terra, predicted two months ago that the demand for UST in cross-chain environments would accelerate at this rate.

He didn’t over-exaggerate when saying that the protocol’s native stablecoin could potentially reach the $10 billion market cap mark by this year’s end.

Following the network’s cardinal Col-5 upgrade, the blockchain’s development was stirred towards maximizing the cross-chain interoperability, as well as attracting an army of projects–all with the agenda of boosting UST usage and adoption.

Osmosis is the third largest exchange (both CEX and DEX) for $UST by volume.

The 🌊 is just beginning… https://t.co/7z9JJCEYvf

— Osmosis (@osmosiszone) December 8, 2021

Competition

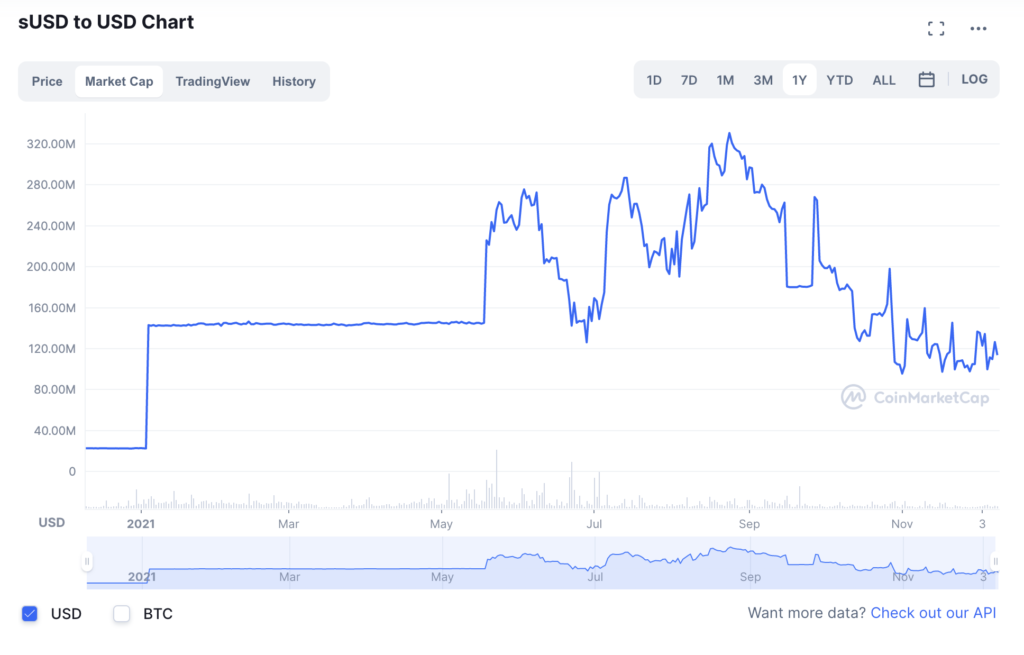

In the case of sUSD–a synthetic stablecoin on the Synthetix protocol that tracks the value of the US dollar–the adoption stalled. It’s market cap, currently at $142 million, has been in decline since August, according to CoinMarketCap.

The protocol’s governance token, SNX, is an ERC-20 token, whose staking enables the issuance of synthetic assets, or Synths, on the Ethereum chain–by using the Mintr dapp.

Although the price of SNX rose 109% during the past year, the protocol’s governance token recorded a 19% drop in value during the past month.

The fact that sUSD, which is over collateralized by SNX, stepped to the scene when the demand for decentralized stablecoins was on the rise, wasn’t enough to grab the attention of investors, like UST did. Those chiming in to answer Samani’s question pointed out a few facts.

In comparison to UST, they argued, sUSD just doesn’t compete–being a more gas invasive option that promises a smaller yield.

capital efficiency of collateral, good yield for UST, cheap tx fees

— Jason Choi (@mrjasonchoi) December 9, 2021

“Second and more important is the activation energy required is immense. It was applied behind UST, but not in the case of sUSD,” argued Jon Kol, Director at Galaxy Digital’s Principal Investment group.

Two reasons, first, try minting one vs the other.

Second and more important is the activation energy required is immense. It was applied behind UST, but not in the case of sUSD.

— Jon Kol (🏴☠️,🏴☠️) (@thePalenimbus) December 9, 2021