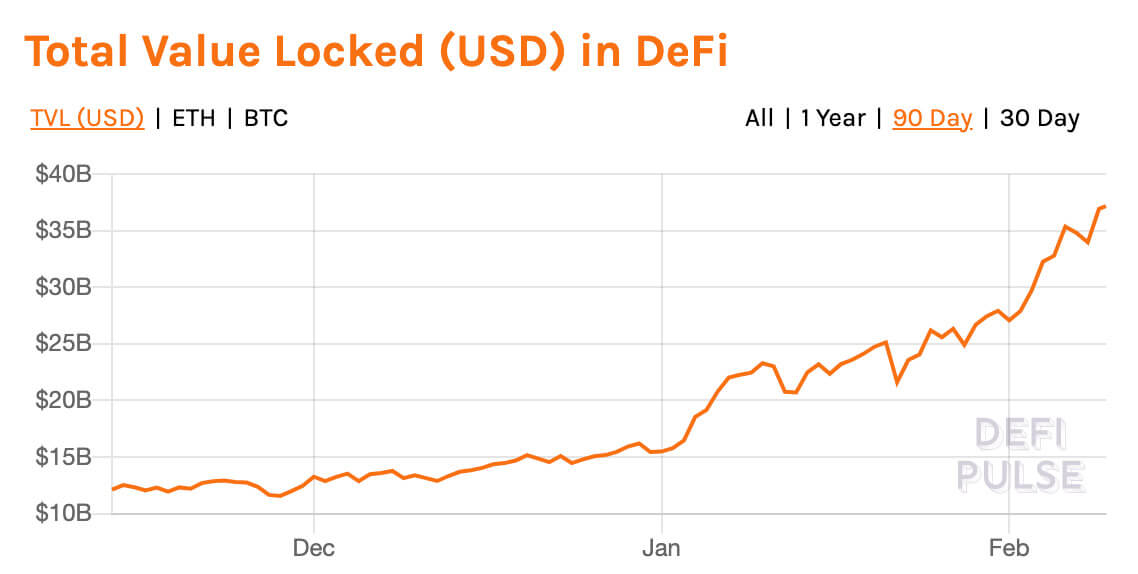

Parabolic growth puts Total Value Locked (TVL) in DeFi at record $37.17 billion

Parabolic growth puts Total Value Locked (TVL) in DeFi at record $37.17 billion Parabolic growth puts Total Value Locked (TVL) in DeFi at record $37.17 billion

The U.S. dollar value of cryptocurrency liquidity locked in decentralized finance (DeFi) hit $37.17 billion. What’s more, this growth came about not from the usual suspects, such as Link or Aave. Instead, a raft of lesser-known DeFi protocols has been dominating the market over the last seven days.

The Total Value Locked (TVL) in DeFi

The Total Value Locked (TVL) in DeFi serves as a high-level valuation metric to determine the amount of assets currently staked in the DeFi space as a whole.

“TVL measures the total value of the tokens locked within these dapps with the argument going that the higher the value locked up in a DeFi dapp, the better.”

Since DeFi burst onto the scene back in August 2017, the TVL has risen exponentially. At the end of 2018, TVL was around $300 million. By 2019 it was $800 million. However, the end of 2020 saw an astonishing year-end close of around $15 billion.

The rate of growth over time has shocked many observers leading some to believe DeFi is a bubble primed to pop. But Justin Banon, CEO of Boston Protocol, argues that its disruption of centralized finance is what will continue to drive growth.

“It is all about unbundling the tightly controlled monoliths of the incumbents and allowing the brightest and the best to build the products that are useful to them, while opening up access for everyone — not just the privileged few — to gain access to the data and opportunities that can give them the best returns.”

Today’s $37.17 billion valuation represents +132% growth in the five weeks since the start of 2021.

Currently, the top three protocols are Maker, Aave, and Compound, which account for $6.03B, $5.66B, and $4.15B of the TVL in DeFi. Interestingly, all three are lending protocols.

Decentralized exchanges make up the next biggest category. With Curve Finance ($3.85B), Uniswap ($3.67B), and SushiSwap ($3.13B) way ahead of the rest of the pack.

Which DeFi tokens are riding high at the moment?

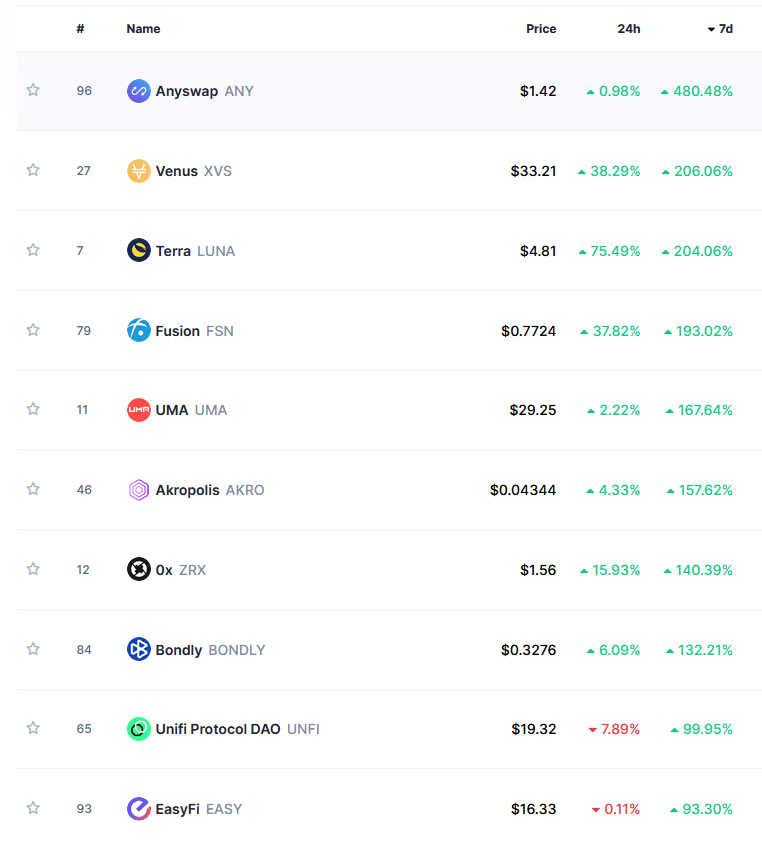

The total crypto market cap pushed to a new all-time high today at $1.3 trillion. A good proportion of this growth has come from the performance of DeFi tokens over the last week or so.

While Maker and Aave have done their part, gaining 79% and 78% respectively since last Monday, small-cap offerings led the charge.

In the top spot is Anyswap, a fully decentralized cross-chain swap protocol, with close to 500% gains. It recently registered a new all-time high, at $1.51 on February 5th. At the start of 2021, ANY was trading for just $0.16.

In amongst the mix of small-caps is Fusion, which describes itself as an all-inclusive blockchain-based financial platform offering cross-chain, cross-organization, and cross-data source services through smart contracts. FSN also posted unbelievable gains this past week, with almost 200% growth in its price.

Today, average Ethereum gas fees are down to $16.27. The YTD high was $25.19 on February 5th.

For more information, explore all DeFi coins on CryptoSlate.