Ongoing Minting and Dumping: RusGas (RGS) Allegedly Scamming Token Holders

Ongoing Minting and Dumping: RusGas (RGS) Allegedly Scamming Token Holders Ongoing Minting and Dumping: RusGas (RGS) Allegedly Scamming Token Holders

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

On Nov. 28th, 2018, MonitorChain detected a potential scam: RusGas (RGS) is minting billions of tokens, diluting the value of investor’s tokens and driving the price down to nearly nothing.

RusGas is a project using blockchain to “transform the gas industry.” According to ICO Bench, the company raised $2.2 million during its ICO.

On Nov. 28th, MonitorChain detected the first incident of suspicious token minting. Initially, RusGas ICOed with a 10 billion token supply, as stated in the company’s whitepaper.

However, on Nov. 28th the company minted another 100 billion tokens, diluting the original supply. Within a matter of hours, these tokens were sent to the Russian exchange Crex24, and then sold.

So far, token minting has accelerated, and within the last eight days a total of 850 billion additional RGS tokens were created—86 times the original supply. These tokens were dumped on Crex24, with 220 billion in sell orders currently outstanding. The massive influx of supply drove the price down to the lowest possible trading price on the exchange, with each token trading for one one-billionth of a Bitcoin.

What Experts Have to Say

CryptoSlate reached out to Seth Hornby, the Zenchain Inc. CEO and co-founder of the Canadian security and development company that runs MonitorChain.com, to better understand the circumstances surrounding the dumping.

Hornby first explained that MonitorChain immediately caught wind of a potential exit scam when the system detected such a large number of RGS tokens got minted. Hornby and his team traced these tokens to where they were getting dumped—on the exchange Crex24.

“At a glance, it was either a third-party hack or an insider exit scam. There is no way around it.”

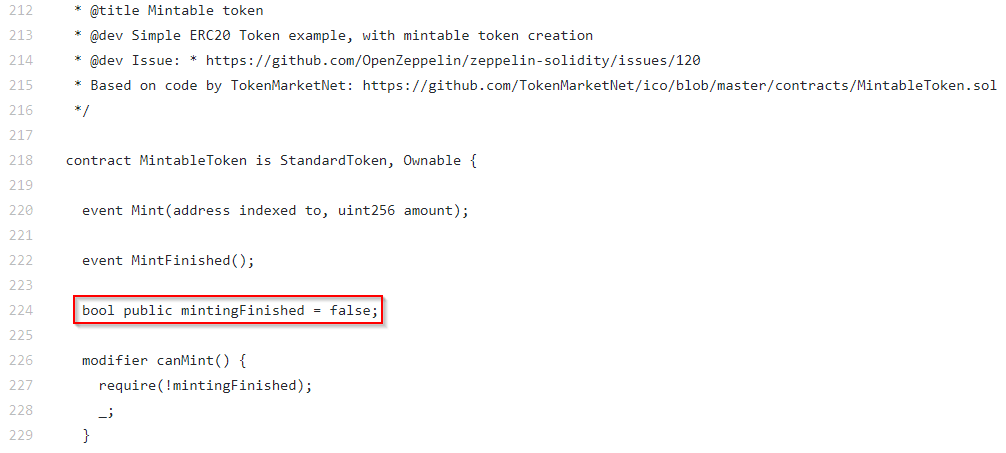

To further investigate the incident, Hornby had one of his analysts take a closer look at the underlying smart contract backing the token, claiming “We couldn’t find any vulnerabilities, but one thing that we did find is that there was a function to disable the minting of new tokens, and they never disabled it.”

According to Hornby, the minting was likely an inside job, stating:

“The only way that this could have been done for someone outside of the private team, is if someone got their private keys.”

Evidence of an Inside Job

What’s more troubling is that Hornby claims that the perpetrators may be actively trying to deceive token holders:

“This [ongoing scam] was known, and an announcement on December 1st [from RusGas] was so far from the actual truth and the facts of the matter, it indicates that there is a high likelihood that it is an insider job.”

As stated in an announcement on Dec. 1st on the RusGas’s website, as well as on Medium and Twitter, the company announced:

“RGS is changing and getting better! We announce reboot!” and asked holders to “transfer all available RGS tokens to the cryptocurrency exchange CREX24.com,” promising that a “network swap will happen automatically.”

The minting was allowed to happen because a function in the token’s smart contract that disables minting was never triggered:

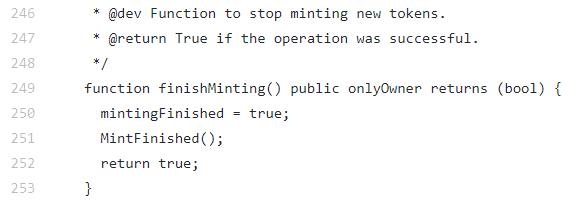

However, had it been a hack, a ‘finishMinting’ function could have been invoked at any time, halting the continued minting of the coin and further suggesting the team that conducted the ICO are likely the perpetrators:

According to Hornby, the tokens recently sold on Crex24 were the highest volume traded asset on the exchange for the day, with over $350 thousand of visible volume—most of which is likely involved in this exit scam. The result is “defrauding buyers” of their Bitcoin in exchange for worthless tokens.

As iterated by a developer from Zenchain:

“…field mintingFinished is initially set to false. It was supposed to be set to true once the initial sale was completed, but the function was never triggered which can be seen on their main net contract when the mintingFinished is invoked. Therefore, the modifier canMint, that is relying on that field, can’t block new mints. [The] owner is the only one who can trigger the minting. Since the same address 0x00a23c7a560be9caa9c2fba8d79122e09bdf7a04 is the contract owner since the beginning, it was used again in the latest excessive mints.”

Hornby hammers the fact home, saying:

“…[RusGas] has had the ability to stop this at any time if it was done by a 3rd party, and have not done so, even after their December 1st announcement of a token swap.”

After CryptoSlate published this article, RusGas responded with a Medium post on Dec. 7th, stating the following:

“The RGS team confirms an 86-fold increase in the number of tokens . This is the maximum magnification. We’re switching to the new chain on 20th of December. After that the asset will be denominated. This decision was made by the majority of users registered in the system.”

Crex24 Complicit in Scam?

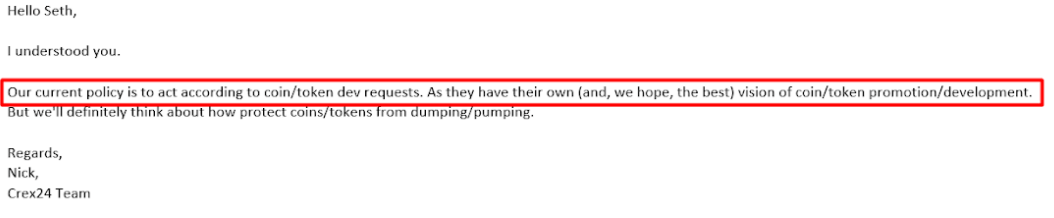

Hornby reached out to the Crex24 exchange, warning them of the ongoing dumping in an attempt to prevent other buyers from getting deceived. In response to the warning, Crex24 said that they “trust that the token teams know best,” and in Hornby’s professional opinion, “that makes them complicit.”

The lack of regard for users of the exchange is evidenced by an email exchange between Crex24 and Hornby:

At the moment, Crex24 holds 99 percent of all outstanding tokens. Hornby said with that “I can say 100 percent definitively that they [Crex24] are profiting from fraudulent activity on their exchange and they are refusing to take action.” Whether Crex24 is conspiring with RusGas to commit this alleged fraud is still uncertain.

After publishing this story, Crex24 reached out to Seth Hornby again. According to Hornby, the platform stated that they are “reconsidering their stance,” however, trading is still enabled for RusGas on the platform.

The minting is still ongoing, with an additional 500 billion tokens minted within the last eight hours. In all, Seth Hornby has caught a couple of bigger scams in the past, but according to him, “this is the most blatant to date.”

CryptoSlate reached out to RusGas for comments and has yet to receive a response.

Takeaways

Although buyers and investors in the token are apparently losing their investment, the incident reinforces that investors need to be diligent. Any project that claims that they are “going to the moon!” brings up major red flags.

Of the several problems facing this project, the identity of the team was unverified, the whitepaper was questionable, the plan for investor funds were vague, and there was a lack of supporting evidence to suggest the company had an ability to execute on its grand promises.

These kinds of incidents are not limited to RusGas. As the bear market continues, it is likely that other projects with unstable foundations may begin to engage in questionable activity. CryptoSlate will continue to follow this story as it develops, and as can be said of any cryptocurrency, potential participants should remain vigilant.