Mounting utility may be driving massive Ethereum accumulation trend

Mounting utility may be driving massive Ethereum accumulation trend Mounting utility may be driving massive Ethereum accumulation trend

Photo by Matt Sclarandis on Unsplash

Ethereum’s lackluster price action hasn’t stopped large investors from accumulating.

New data shows that the cryptocurrency’s largest investors have been busy at work purchasing massive amounts of ETH throughout the past year.

This accumulation trend has led so-called “whale addresses” to rocket to a 10-month high, with these investors now collectively owning over 21.8 million Ethereum.

Whales aren’t the only ones accumulating ETH either, as recent data shows that the cryptocurrency had also seen massive institutional inflows throughout the early part of the year.

Ethereum’s top 100 wallets now own over $4.5 billion worth of ETH

Ethereum’s price action throughout 2019 and 2020 has largely favored sellers, as the cryptocurrency has struggled to garner any decisive uptrend – leading it to post large losses against its Bitcoin trading pair.

The crypto’s largest investors don’t seem to believe that this recent price action is emblematic of its mid and long-term outlook, however, as the amount of ETH within the top 100 non-exchange wallets just hit a fresh 10-month high.

Blockchain data platform Santiment spoke about this in a post, offering data showing just how striking this accumulation trend has been.

“ETH whale addresses have just hit a 10-month high with the cumulative holdings of the top 100 non-exchange wallets now owning over 21,800,000 Ethereum (About $4.5 billion at current price). This is the largest collective balance held within the top 100 addresses since May, 2019.”

One interesting factor that Santiment also points to is that a fraction of this Ethereum accumulation has taken place over the past two days – despite there being few technical or fundamental changes for the cryptocurrency.

“In the last two days alone, these top ETH whale addresses have added an additional 145,000 ETH (about $30,300,000) as the price of Ethereum grew by a bit over 4% in this timeframe.”

Whales aren’t the only ones accumulating ETH

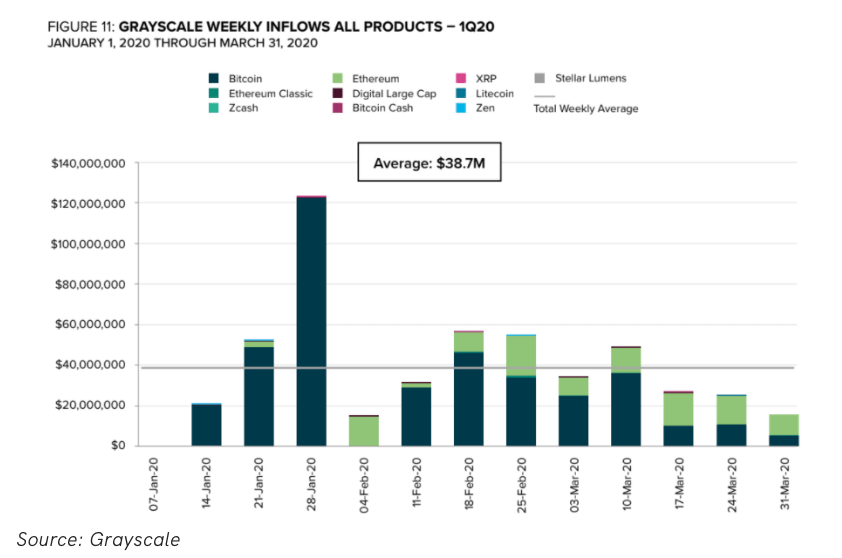

CryptoSlate previously reported that Ethereum saw massive institutional inflows in Q1 of this year.

This trend is clearly elucidated while looking towards data from Grayscale Investment’s Ethereum Trust, which saw $110 million worth of institutional inflows.

Although the company’s Q2 report has not yet been released, there is a strong possibility that this trend will have continued strong throughout the past several months.

One factor that could be driving the accumulation trend seen amongst both whales and institutions is Ethereum’s rocketing utility.

Spencer Noon – the head of crypto investments at DTC Capital, recently explained that there is a link between the crypto’s utility and its demand.

If this is the case, then the growing number of stablecoin issuance on the blockchain and the rapidly evolving DeFi market could further perpetuate the ongoing accumulation pattern.