LocalBitcoins volumes hit all-time-high in Argentina after Trump tariff announcement

LocalBitcoins volumes hit all-time-high in Argentina after Trump tariff announcement LocalBitcoins volumes hit all-time-high in Argentina after Trump tariff announcement

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

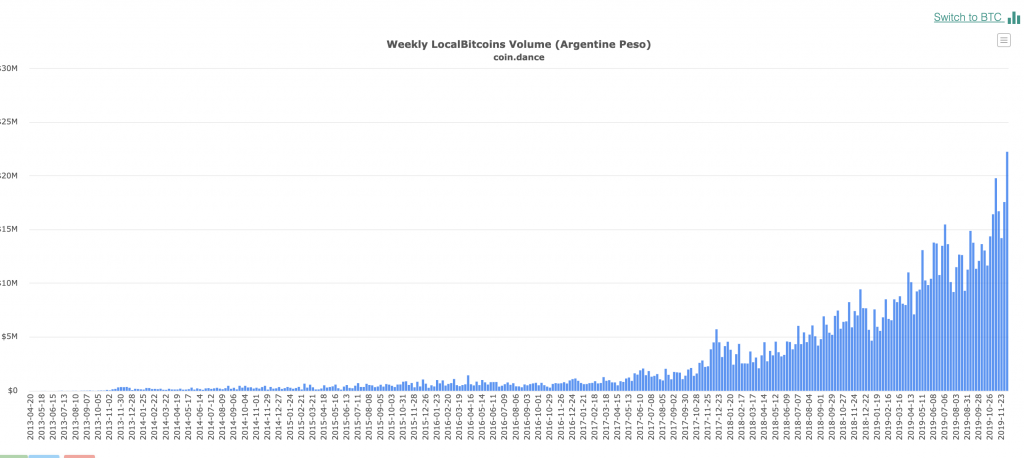

Trade volumes on LocalBitcoins (LBC) have hit a new all-time-high in Argentina, having spiked days after President Trump’s announcement that the U.S. intends to place tariffs on Argentinian metal imports.

The new high comes as the climax to a year of rising BTC volumes on local exchanges in Argentina, widely assumed to have been triggered by the hyperinflation and spiraling national debt that characterize the nation’s ongoing economic crisis.

President Trump added to the nation’s already-substantial list of economic woes last Monday, reinstating steel and aluminum tariffs against Argentina and Brazil on the alleged grounds they have been devaluing their currencies. On Dec. 2, President Trump tweeted:

“Brazil and Argentina have been presiding over a massive devaluation of their currencies. which is not good for our farmers. Therefore, effective immediately, I will restore the Tariffs on all Steel & Aluminum that is shipped into the U.S. from those countries”

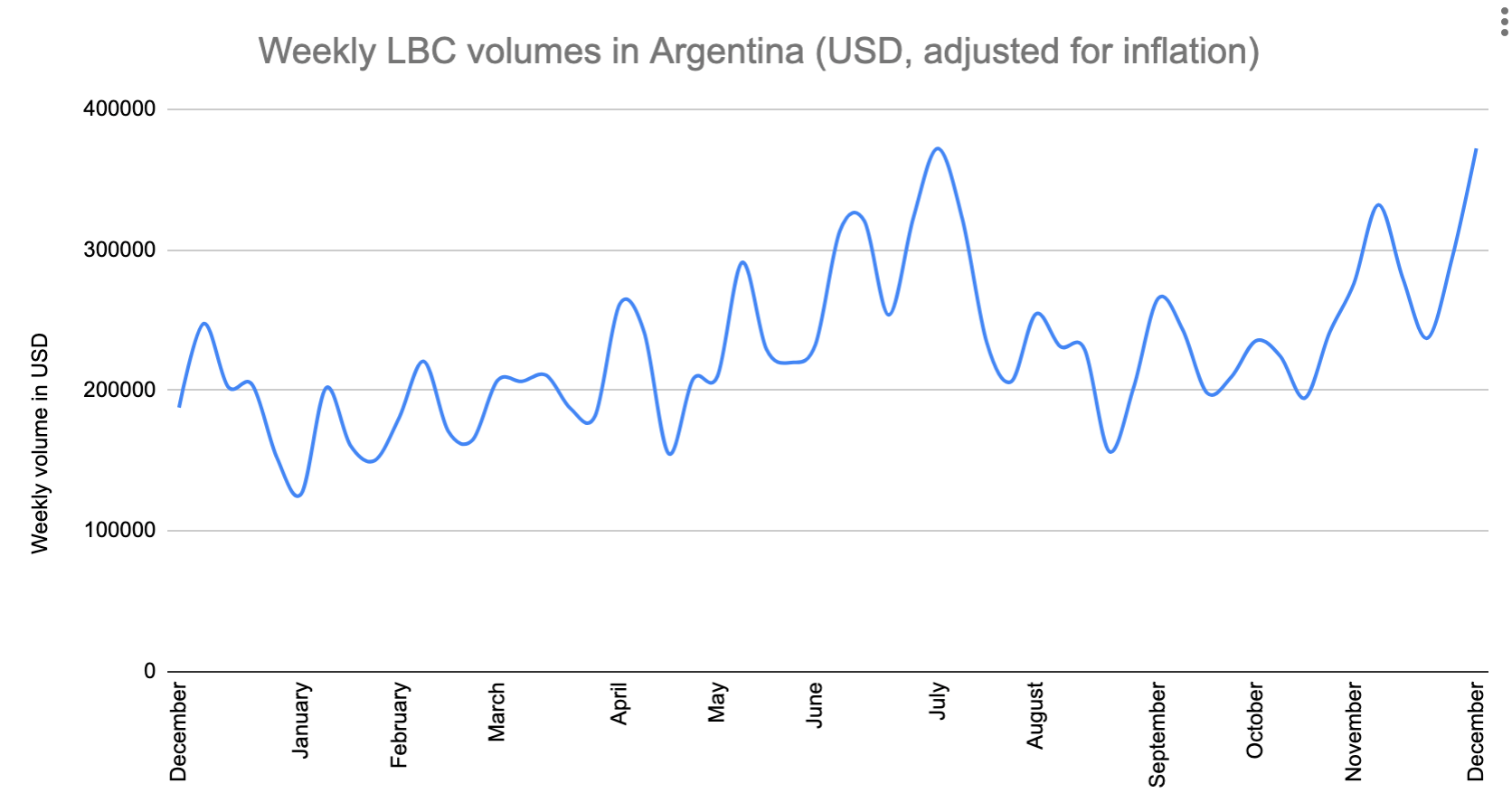

Argentinians bought more than 22.2 million Argentine Pesos (ARS) worth of Bitcoin on LBC in the wake of the Trump announcement. This is a new high even when factoring in inflation rates (the ARS has lost 38% of its value against the U.S. dollar this year).

Bitcoin, Argentina’s hottest safe-haven asset?

Time and time again, Argentinians have appeared to flock to Bitcoin in response to economic shocks. In August, BTC rocketed to a $900 premium above Coinbase on one of Argentina’s top exchanges after an unexpected election result cast doubts over whether the nation would receive a $57.4 billion bailout package, and sent Argentinian markets plunging in one of their biggest intra-day losses in history.

Once again, in September, volumes erupted across Argentina’s exchanges when President Mauricio Macri announced a plan to reinstate capital controls — this time BTC was sent to a staggering $2,250 premium above the market.

As reported previously by CryptoSlate, LocalBitcoins is seeing exceptionally high usage in nations with low economic freedom — indicating Bitcoin is increasingly being bought as an unconfiscatable, deflationary hedge against fiat. This thesis was probed last week by Deutsche Bank, who suggested crypto could replace fiat by 2030 in the event of global hyperinflation.