Linear calculation suggests ETH 2.0 in Jan 2021—will Ethereum price react?

Linear calculation suggests ETH 2.0 in Jan 2021—will Ethereum price react? Linear calculation suggests ETH 2.0 in Jan 2021—will Ethereum price react?

According to CryptoQuant’s linear calculation of ETH 2.0 deposits, the mainnet release could occur in January 2021. If so, whether the price of Ethereum would stagnate due to expectations of a December mainnet launch remains to be seen.

For the ETH 2.0 mainnet to launch, over 400,000 ETH have to be deposited into the ETH2 deposit contract address. For now, around 105,000 ETH have been staked into the address.

By linear calculation,

we'll see the $ETH 2.0 mainnet on Jan 15, 2021.#eth #eth2 #phase0 pic.twitter.com/A2z6YO1o30— CryptoQuant.com (@cryptoquant_com) November 19, 2020

Linear calculation suggests ETH 2.0 in January 2021, but there are variables

Albeit the linear calculation of deposits indicates a likely mainnet launch in three months, there are variables that could change the trajectory of the network upgrade.

ETH 2.0 is a critical network upgrade for the Ethereum blockchain network because it expands its transaction capacity.

Currently, Ethereum can handle about 15 transactions per second. After ETH 2.0, the network could handle hundreds to potentially thousands of transactions per second. Such a large transaction capacity expansion would create a more efficient environment for DeFi and other decentralized applications.

There are several arguments as to why the number of deposits into the eth2 deposit contract address is lagging.

The most convincing argument is that Ethereum holders might be waiting for the very last moment to deposit. With the resurgence of major decentralized finance (DeFi) tokens, the DeFi space has seen an uptick in user activity.

According to data from DefiPulse, the total value locked across DeFi protocols now exceed $13.6 billion.

There is a possibility that Ethereum holders would continue to lock their ETH into DeFi protocols until the date for ETH2 deposit contract threshold nears.

Ethereum price could slow down, but fundamentals look strong

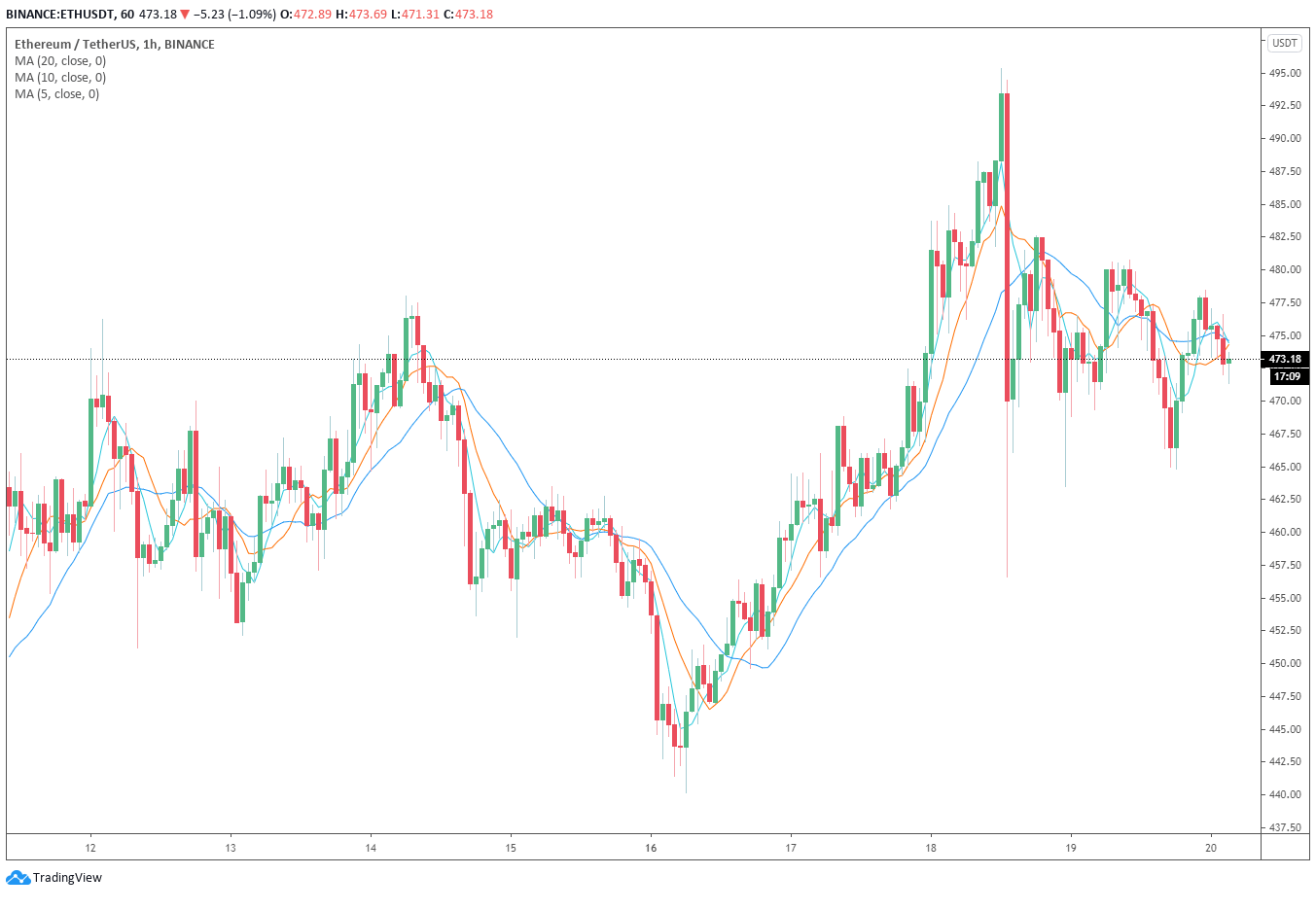

Technically, the $480 level remains the key resistance area for Ethereum to reclaim.

Consolidation above $480 would indicate strength across both low and high time frame charts, suggesting the formation of a new uptrend.

Although technicals signify stagnating momentum for ETH in the near term, fundamentals are strengthening.

According to IntoTheBlock, the number of Ethereum active addresses has consistently increased. The analysts at the on-chain analysis firm hinted how high active addresses could spike to after the launch of ETH 2.0. They wrote:

“The number of active addresses in #Ethereum has been on a consistent uptrend. Similarly, the increasing number of addresses holding $ETH point to network adoption trending bullish, hitting a new high yesterday with 48.81m addresses How high can we go once ETH 2.0 goes live?”

If the initial December 1 deadline for ETH 2.0 deposits is not achieved, the price of Ethereum could react with a minor pullback.

However, in the medium term, the strong fundamentals of the Ethereum blockchain and the prospect of ETH 2.0 would likely buoy the market sentiment around ETH.