Institutions are buying Litecoin (LTC) at a 1,200% price premium

Institutions are buying Litecoin (LTC) at a 1,200% price premium Institutions are buying Litecoin (LTC) at a 1,200% price premium

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Litecoin demand among institutional investors on Grayscale Investments surged last week ahead of the protocol’s Mimblewimble upgrade and as fears of inflation have risen among US investors, as per reports.

Litecoin sees 1,000% premiums

Data from on-chain analytics firm Arcane Research showed Litecoin briefly traded at a 1,200% premium on Grayscale’s newly launched Litecoin trust. The occurrence also led some market observers to question if the broader cryptocurrency had indeed matured after the 2017 ICO mania.

Grayscale’s litecoin fund was briefly trading at a premium of over 1,200% on the underlying litecoin price, data produced by analysts at @ArcaneResearch showed. It's now down to a mere 600% premium https://t.co/8rfQ1P92oH via @ForbesCrypto

— Billy Bambrough (@BillyBambrough) August 30, 2020

The Litecoin fund is a part of Grayscale’s crypto products meant for accredited investors to gain exposure to cryptocurrencies. They are collectively worth billions of dollars and can be traded on the open market as an over-the-counter product, similar to traditional stocks.

Since Arcane’s report, the premium for Litecoin has gone down to 600% — which is still massively high compared to the asset’s spot prices on crypto exchanges.

Arcane Research analyst Vetle Lunde explained the high premiums, “These trusts are based solely on single assets, and should thus not outperform its underlying asset over time,” he wrote.

Lunde added that the funds’ premiums emerge as public investors buy into existing shares of the fund, with the original accredited investors being the sellers.

However, the huge and wildly swinging premiums have caused some concern for bitcoin and cryptocurrency market watchers who fear investors might be unaware of the premium they’re paying, explained Lunde:

Bitcoin exposure as an inflation hedge amidst the current financial instability seems to be a trending topic among some of the most renowned macro investors.

“This could make new investors more open to allocating some of their portfolios into Bitcoin,” the analyst added.

Investors wary of economic turmoil

Premiums on Grayscale’s crypto products are indicative of a wider trend in the institutional crypto industry, which has seen a number of high-profile investors, such as famed hedge fund manager Paul Tudor Jones and MicroStrategy CEO Michael Saylor tout Bitcoin and other cryptocurrencies as a “global hedge.”

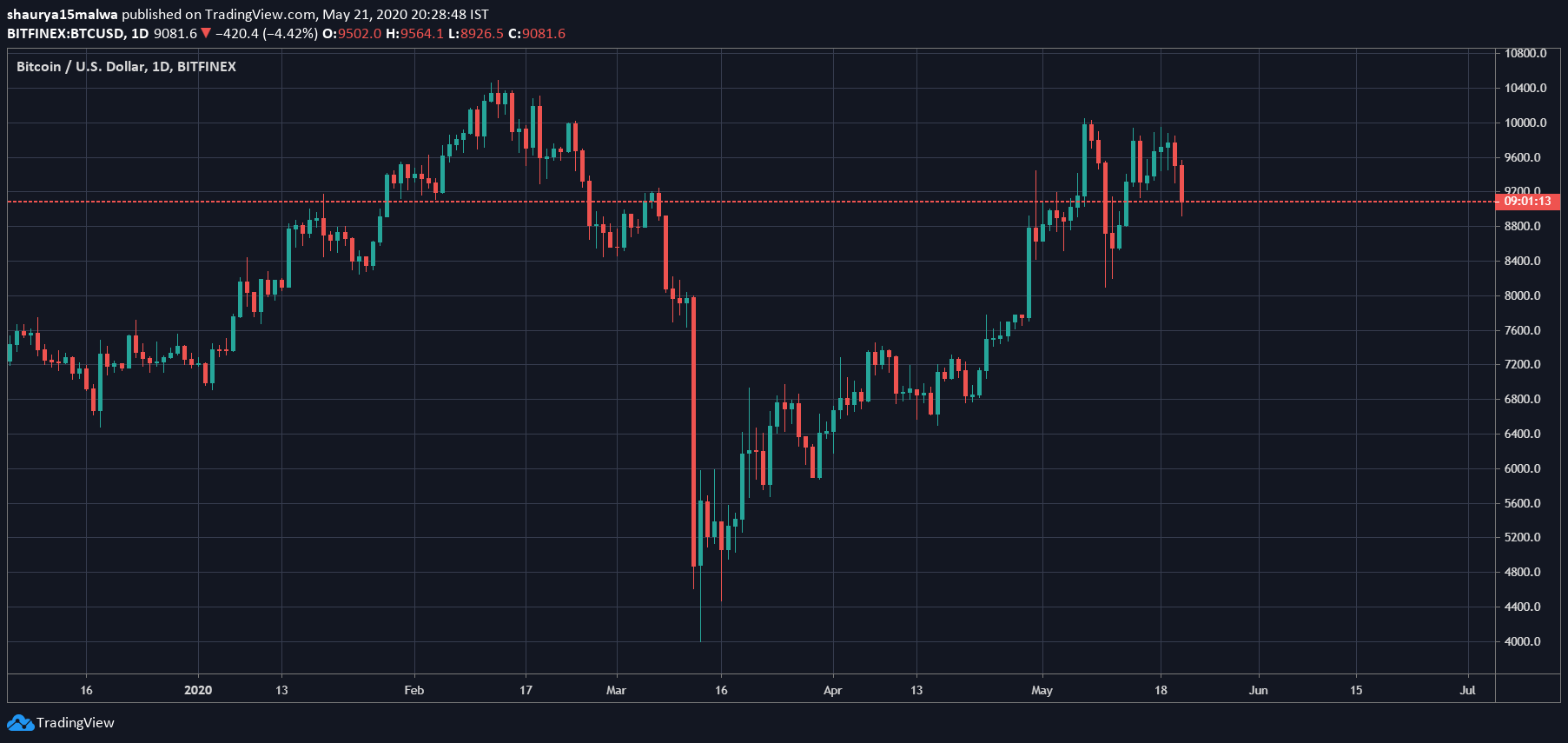

In their view, the decentralized nature of digital assets means they are not affected by any political and (in theory) economic action. But that said, the performance of cryptocurrencies remains to be gauged when global markets tumble — they fell over 40% in March after a market crash gripped global equity markets.

For now, however, the demand for cryptocurrencies is not stalling. Meanwhile, Grayscale’s managing director Michael Sonnenshein said that while his funds’ shares are high, he argued the asset manager “has no control over that market.”

“We’re creating the ability for these markets to happen,” Sonnenshein told Forbes. “But it’s not something we’re directly making or facilitating.”