Whale entities withdraw 100,000 BTC from exchanges in two weeks

Whale entities withdraw 100,000 BTC from exchanges in two weeks Quick Take

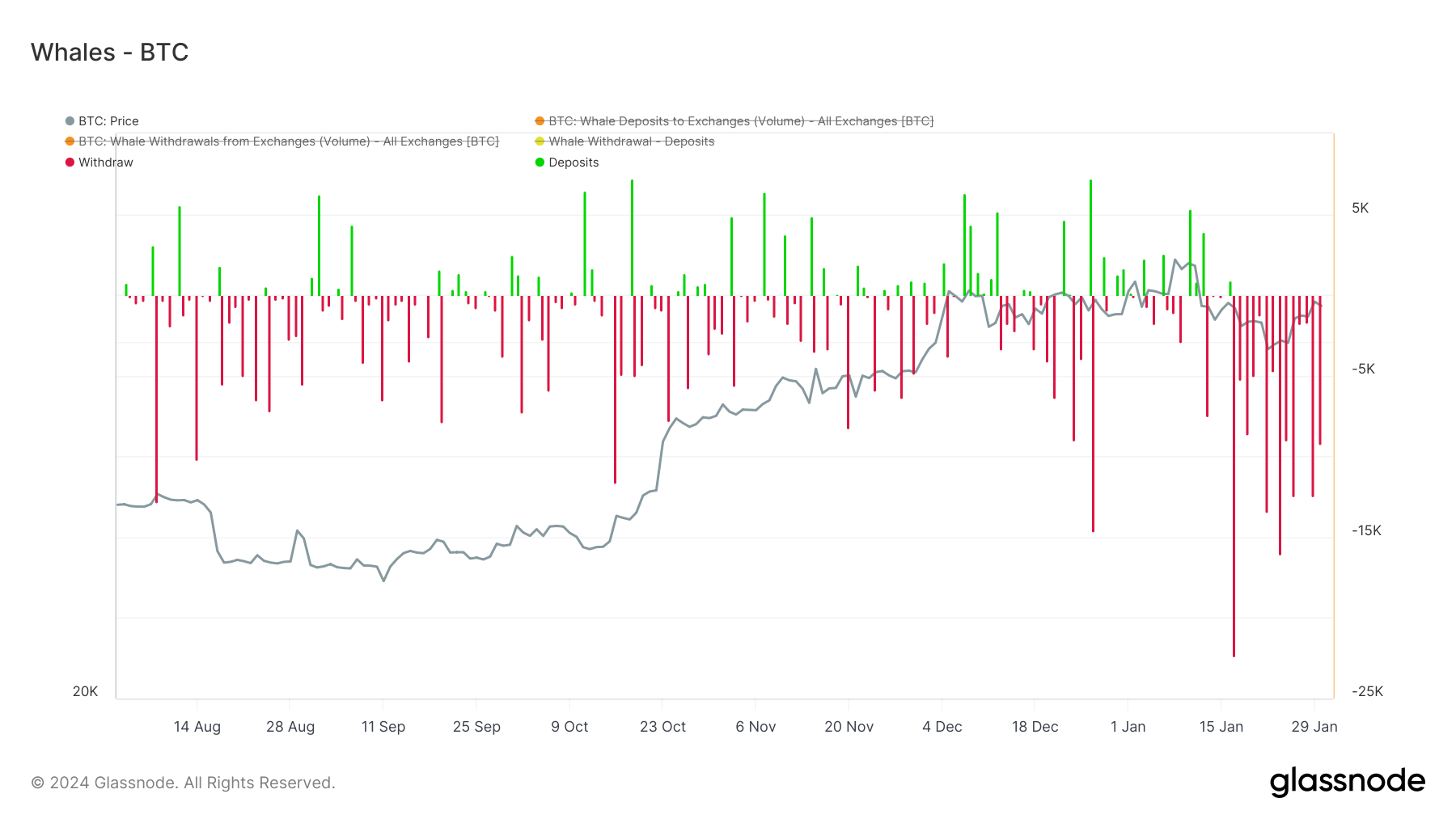

The Bitcoin landscape has witnessed a compelling shift over the past two weeks, with whale entities, defined as network clusters holding at least 1,000 BTC, consistently withdrawing more from exchanges than depositing.

As per the data collated from Glassnode, approximately 100,000 BTC have been withdrawn, marking a scarcely seen trend sustained for 14 uninterrupted days. These transactions accounted for only direct transfers from exchange wallets to whale entities.

This uptick in whale activity was initiated approximately on Jan. 16, shortly after Bitcoin had its most significant daily drawdown of 7.5%, the most significant one-day drawdown since the FTX collapse in November 2022. The momentum of this trend has maintained its course since then, exhibiting no indications of deceleration.

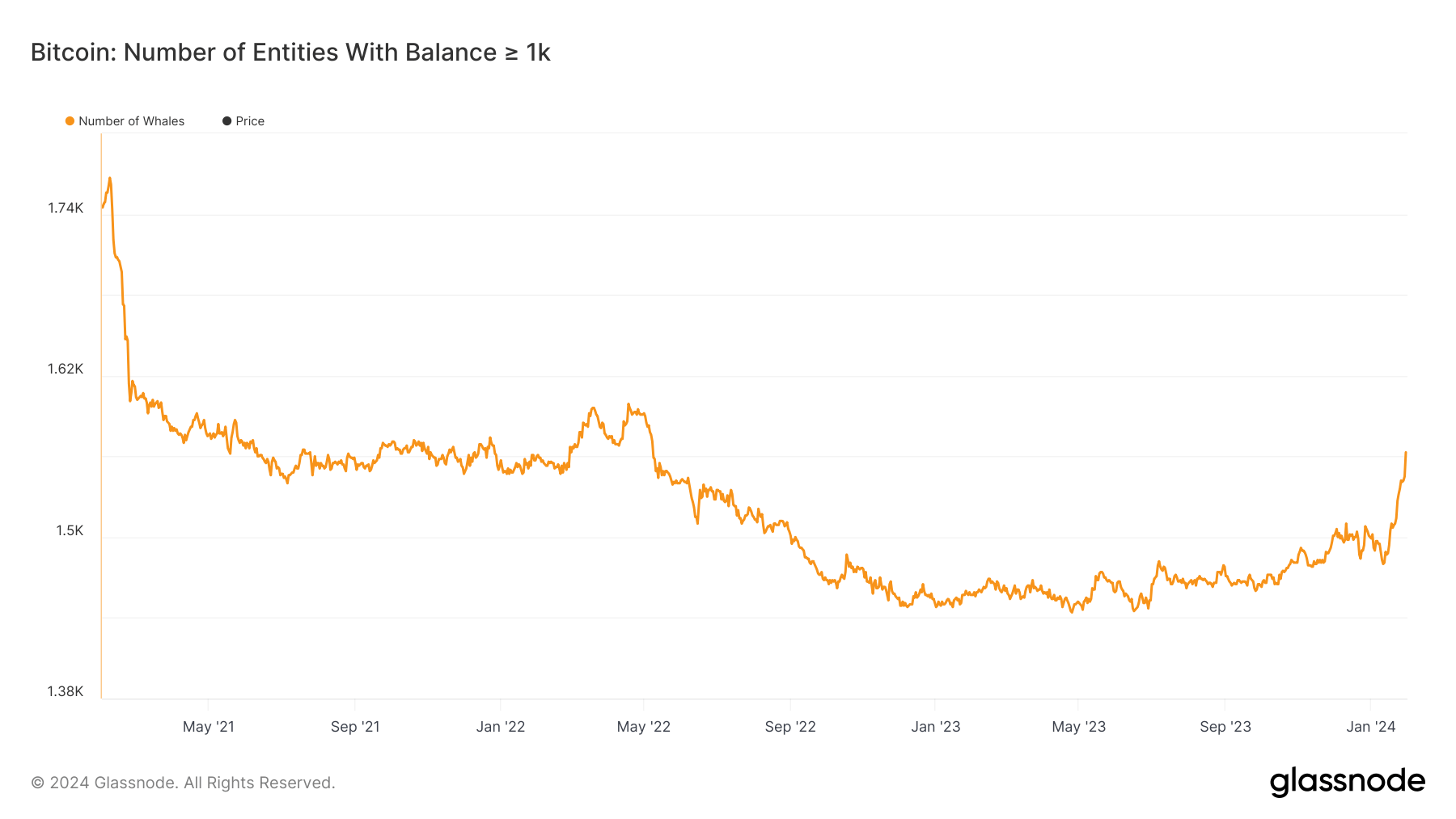

Remarkably, these whale entities have swelled from 1,513 to 1,563 in this timeframe. This increase is notable as it nearly nullifies the drop in whale entities observed in 2022, bringing the count perilously close to the peak of just under 1,600 seen last year.

Editor’s Note: Wallets with balances over 1,000 BTC will likely include ETFs such as Grayscale, which holds its Bitcoin across multiple wallet addresses. ETFs with assets under management above $42 million may now be considered whales per Glassnode metrics.