Spot Bitcoin ETF introduction triggers Bitcoin’s largest daily fall since FTX crisis

Spot Bitcoin ETF introduction triggers Bitcoin’s largest daily fall since FTX crisis Quick Take

Bitcoin’s price underwent significant volatility in response to the spot Bitcoin ETF, according to a recent analysis.

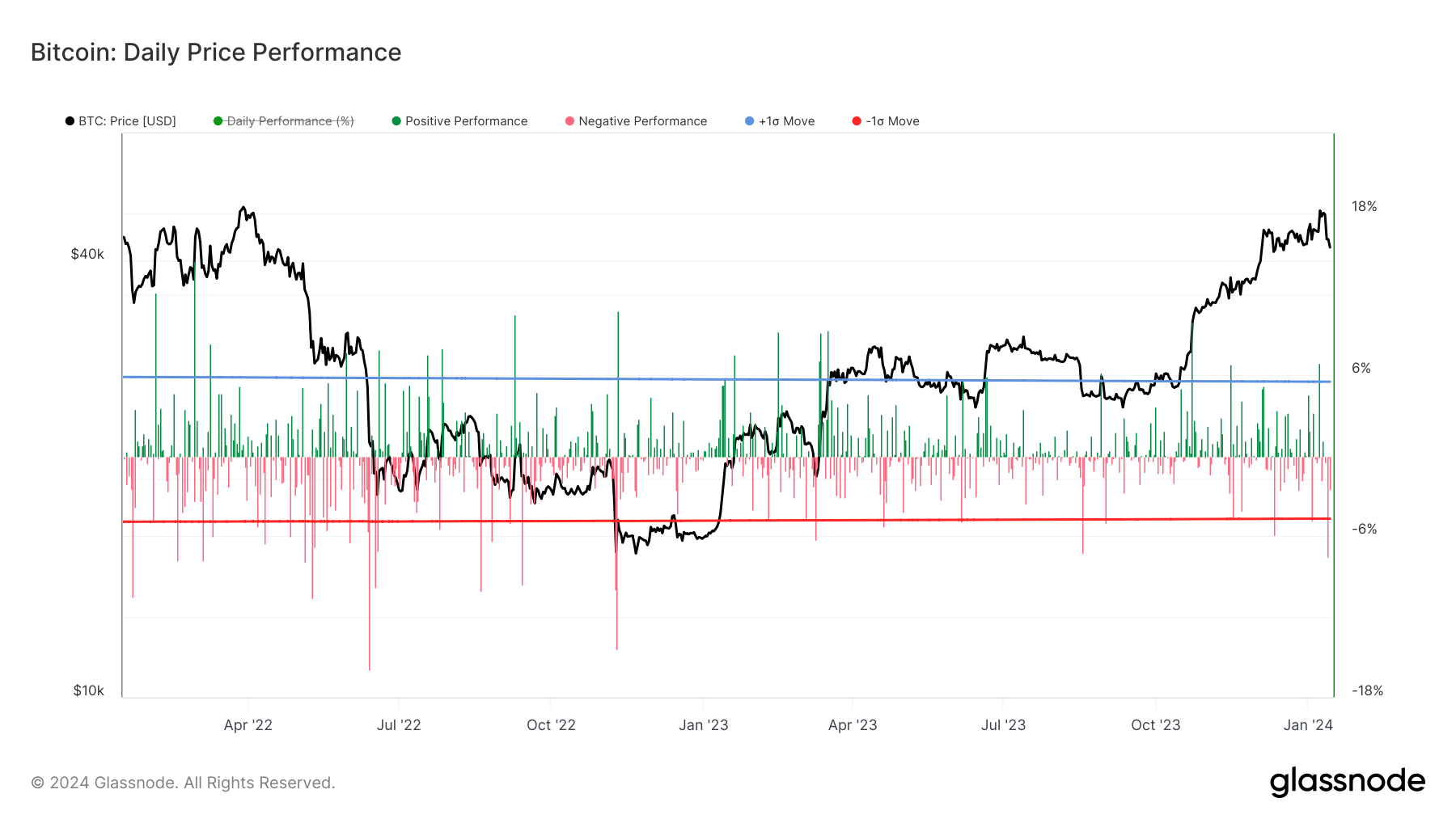

On Jan. 12, Bitcoin registered its largest one-day price drop since the FTX collapse in November 2022, plummeting by 7.5%. This event echoed the high volatility experienced during 2023, which saw several 5% drops coinciding with the SVB collapse in March 2023 and a 7% drop in August 2023 following a July high of $30,000.

Notably, the FTX collapse resulted in consecutive drops of 10% and 14%, raising concerns about whether future market disruptions could induce similar downturns. However, despite these pronounced fluctuations, Bitcoin has demonstrated resilience, posting a 1.15% increase in 2024, reaching a yearly high of $49,100 and a low of $41,500, all within 72 hours of the ETF trading.

This performance was recorded after the approval and trading initiation of the Bitcoin ETF, highlighting the impact of regulatory developments on the digital assets price behavior.