Unprecedented series of Bitcoin inflows and outflows observed across exchanges

Unprecedented series of Bitcoin inflows and outflows observed across exchanges Quick Take

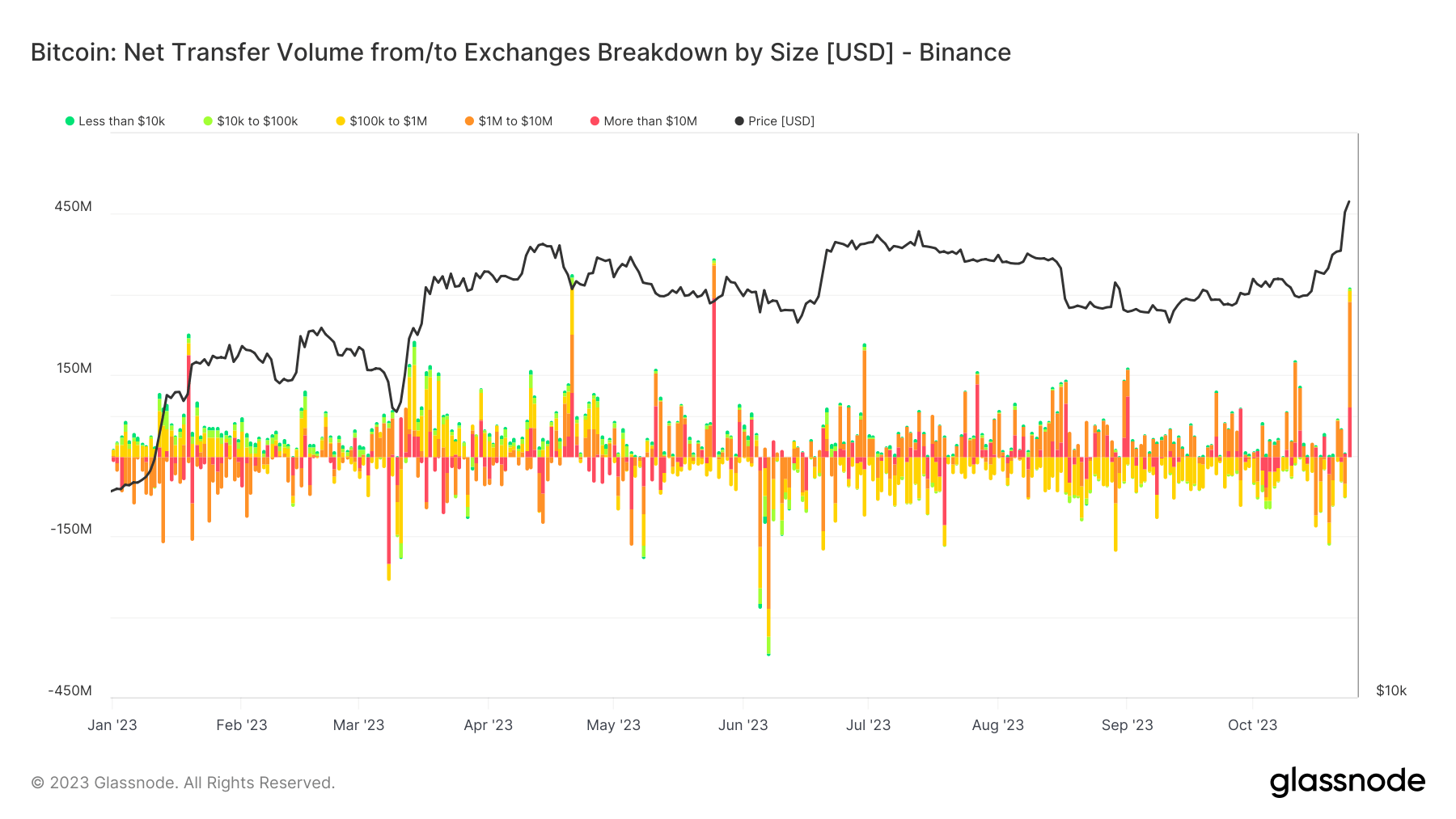

On Oct. 24, significant Bitcoin (BTC) exchange movements were recorded, signaling a potential market shift. Binance experienced its third major inflow of 2023, amassing approximately $320 million, a figure only surpassed on Apr. 21 and May. 25. Notably, transactions of $1 million or more dominated these inflows, hinting at substantial ‘whale’ activity.

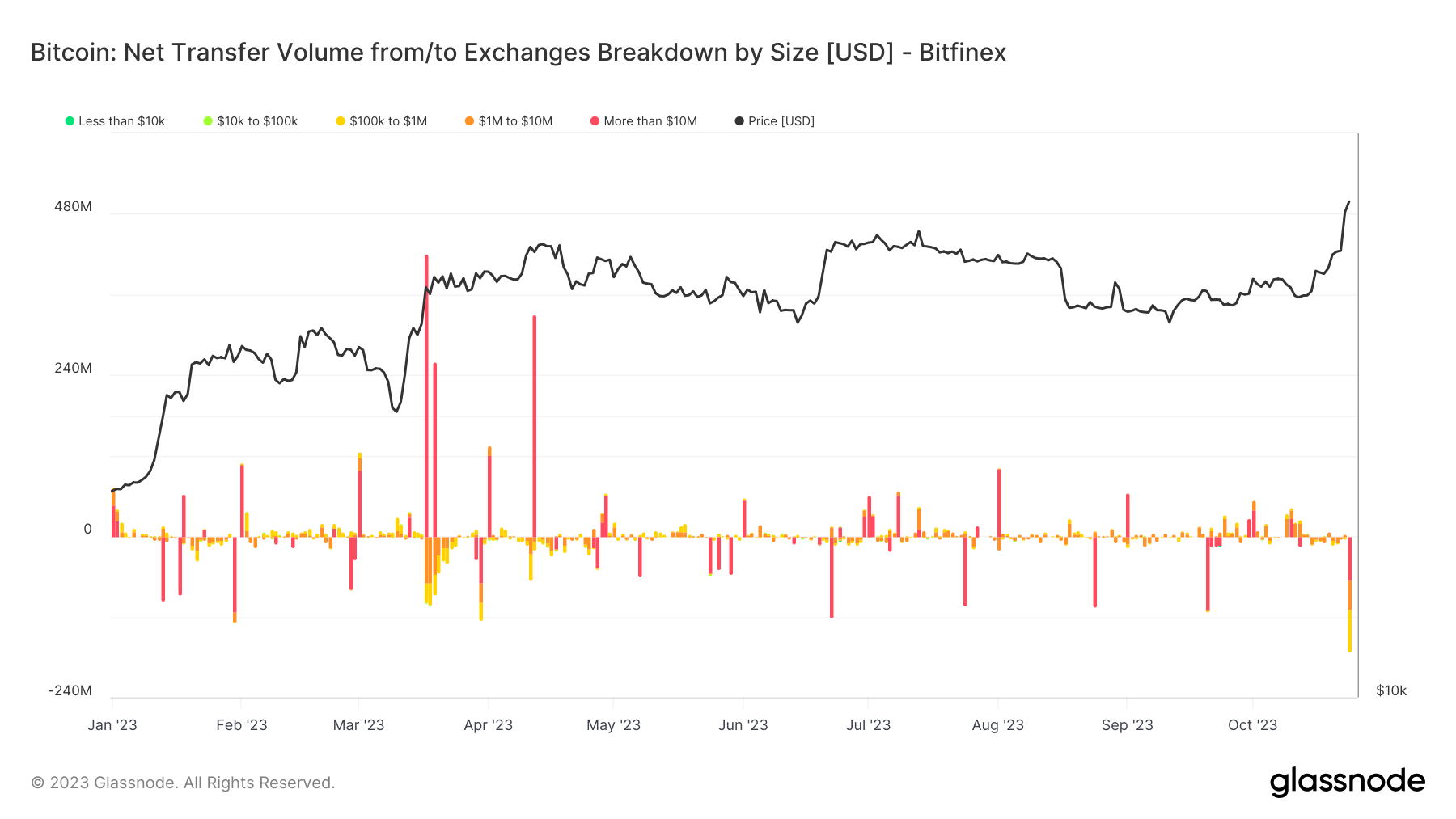

In contrast, Bitfinex noted the largest outflow in over a year, close to $200 million, similarly dominated by high-value transactions. This trend of significant outflows extended to Bithumb, which saw an unprecedented $140 million exit, the highest of the year, predominantly driven by ‘whales.’

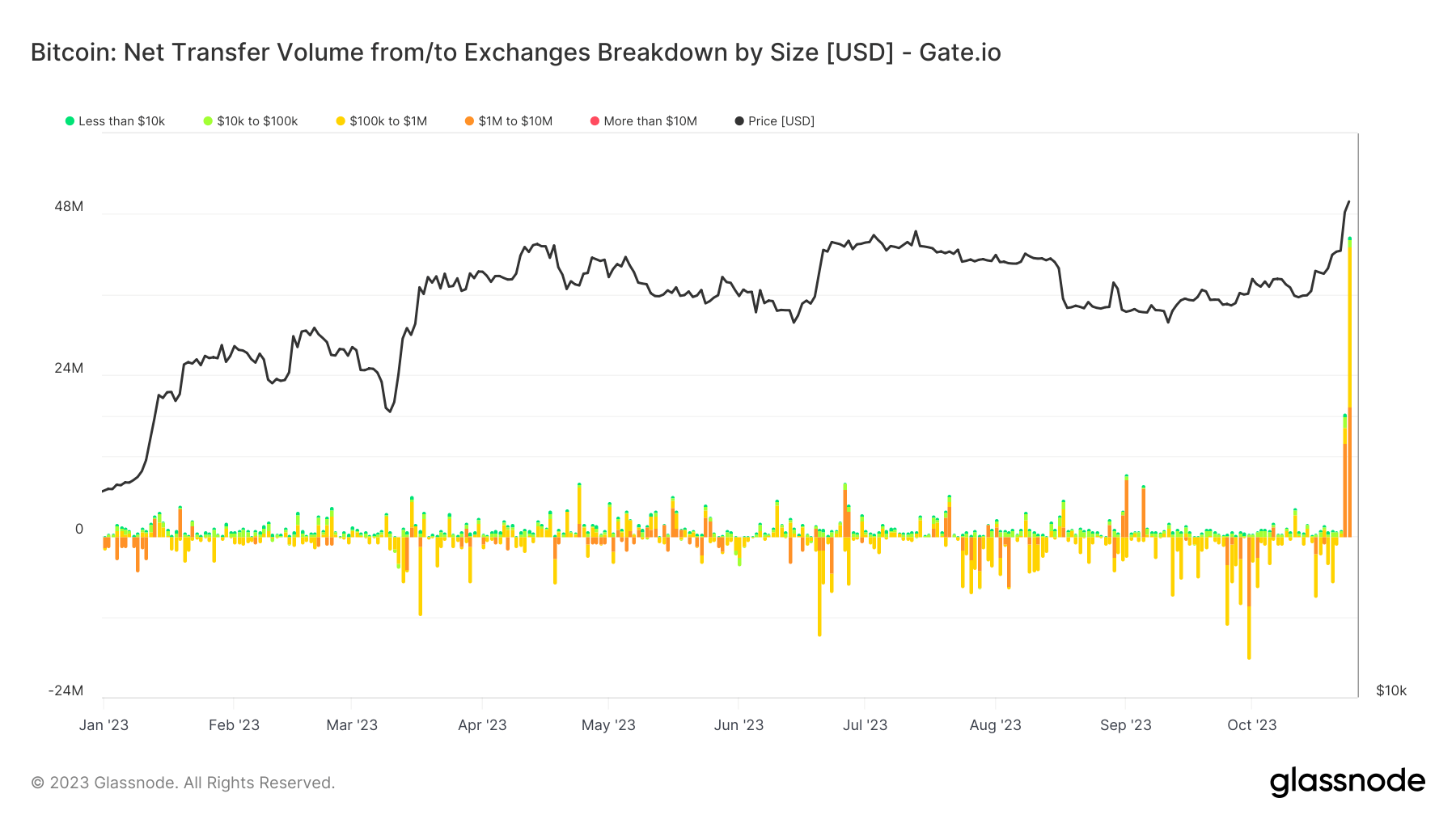

The lesser-known Gate.IO also made headlines with the largest inflow in the past five years, amounting to roughly $43 million. This series of record-setting inflows and outflows across multiple exchanges suggests a possible shift in Bitcoin’s market dynamics.

The movement at Bitfinex is particularly noteworthy, given its historical trend of withdrawing coins during previous bear markets, as previously analyzed by CryptoSlate. Could this be the start of a similar trend?

Other exchanges, including Deribit, Bybit, and Bitstamp, also saw notable inflows and outflows, indicating this is not an isolated incident.