Bitcoin balances on top exchanges: What history tells us about future bull runs

Bitcoin balances on top exchanges: What history tells us about future bull runs Quick Take

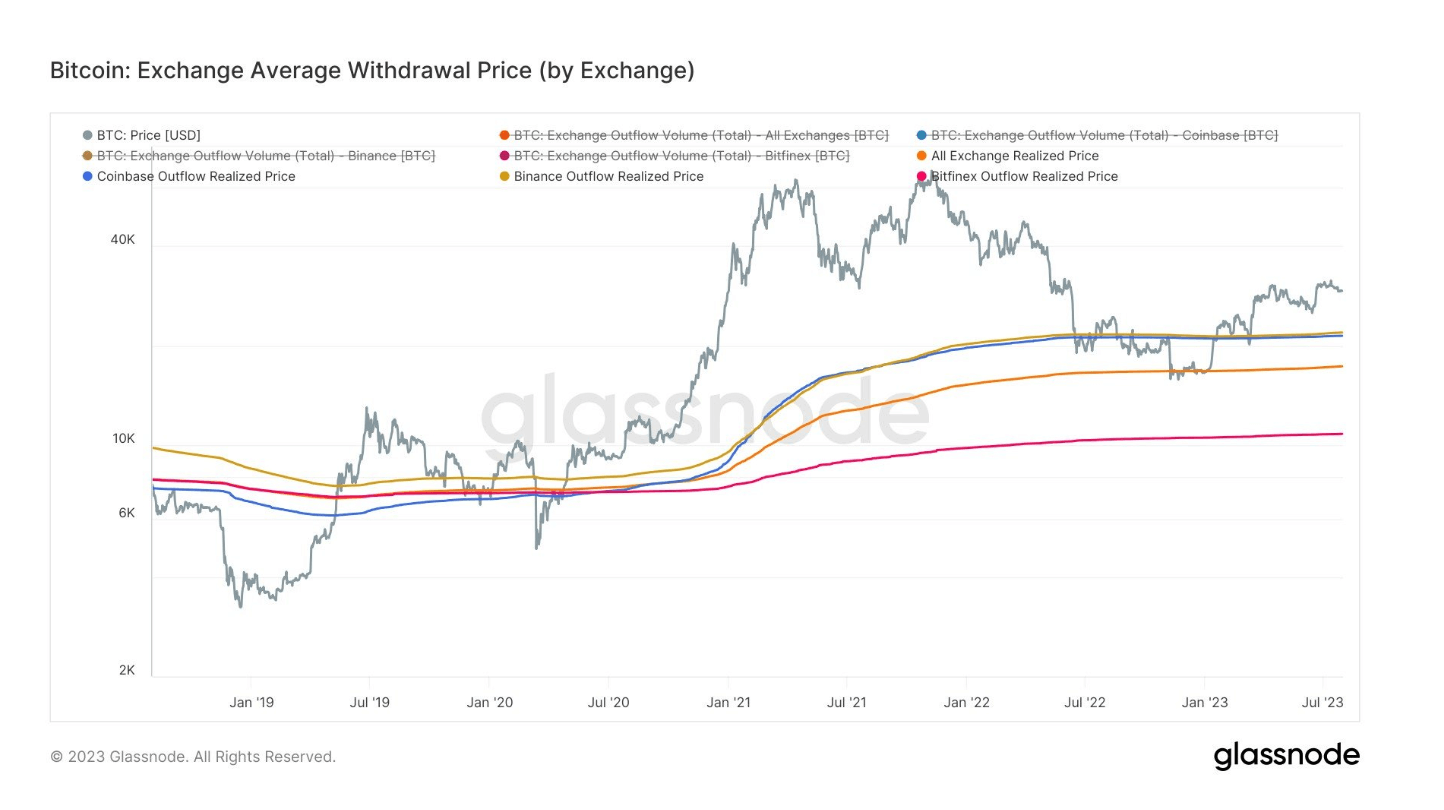

Of the three cryptocurrency exchanges holding the largest amounts of Bitcoin, Bitfinex has 320,000 BTC, Coinbase has 439,000 BTC, and Binance has 650,000 BTC.

When considering the average withdrawal price across all exchanges, Bitfinex’s cost basis for BTC is way below the current market price at 10,000 USD and thus is often referred to as ‘smart money.’

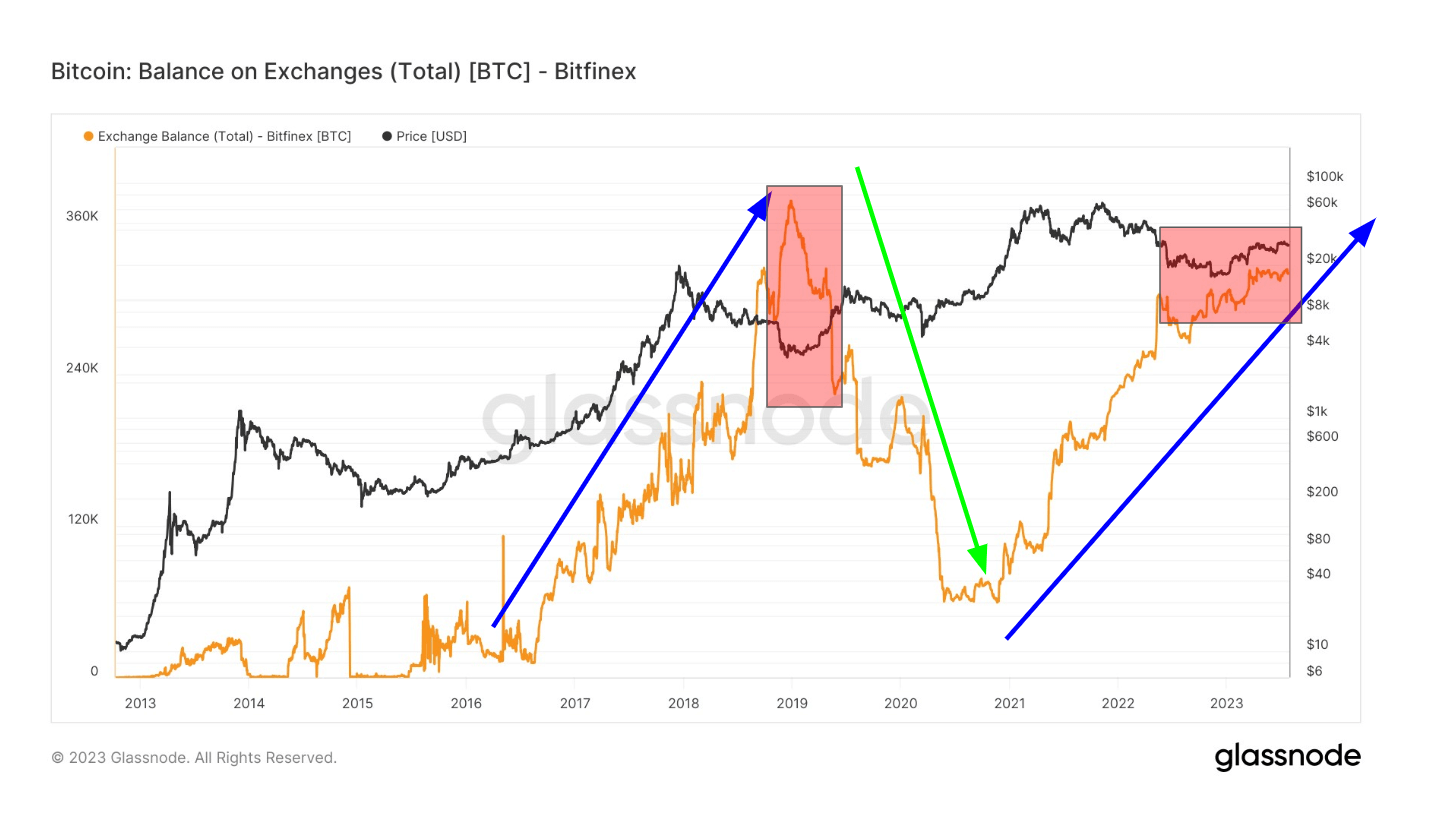

A historical look at the exchange balance indicates growth to 370,000 BTC from 11,000 BTC during the 2017 bull run, followed by withdrawals at a similar pace during the ensuing bear market. This pattern repeated during the 2021 bull run, with coins being offloaded at a comparable rate.

For those anticipating another bull run in the next 18 to 24 months, a critical indicator to watch is Bitfinex’s exchange balance. A decrease in this balance may signal the onset of the anticipated run.

It’s worth noting that this phenomenon isn’t only restricted to ‘smart money.’ In 2019, during the deep bear market, coins were swiftly bought up, as illustrated by specific red boxes in the second chart below. This pattern adds another layer of complexity to the prediction and understanding of future market movements.