Rising Ethereum futures open interest highlights impact of SEC’s ETF approval

Rising Ethereum futures open interest highlights impact of SEC’s ETF approval Onchain Highlights

DEFINITION: The total amount of funds allocated in open futures contracts.

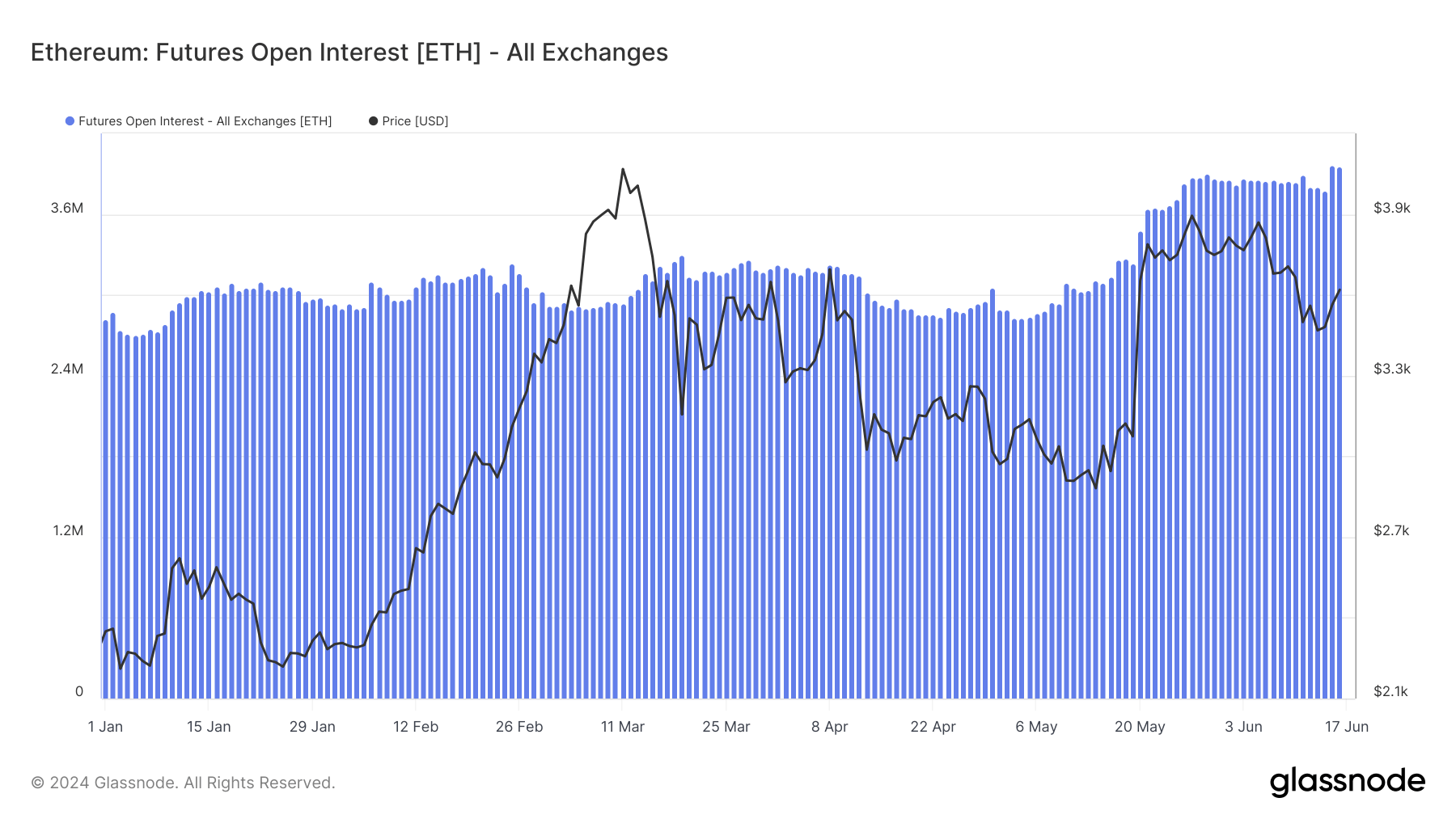

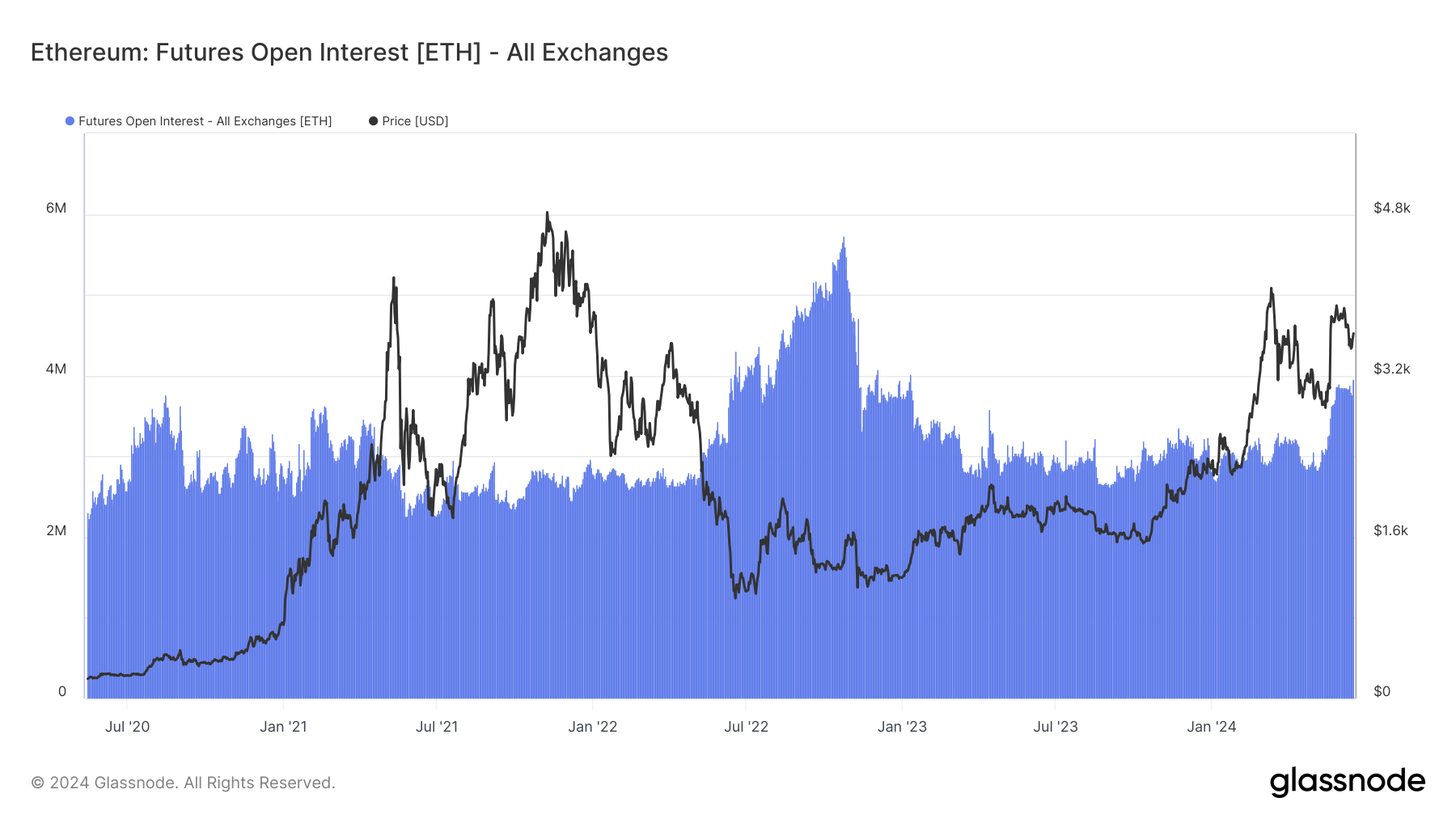

Ethereum futures open interest has shown substantial volatility throughout 2024, significantly influenced by recent regulatory developments.

Following the approval of spot Ethereum ETFs by the US Securities and Exchange Commission (SEC), open interest in Ethereum futures surged, reaching new highs.

On June 17, futures open interest across all exchanges neared 4.0 million ETH, coinciding with a price movement towards $3,600 per ETH.

The SEC’s approval of Ethereum ETFs marked a significant milestone, signaling increased regulatory acceptance and boosting investor confidence. The introduction of these ETFs has driven notable market activity, particularly in the derivatives sector, with futures open interest hitting record levels due to heightened speculative and institutional involvement.

This development highlights the strong interplay between regulatory actions and market trends, with the approval of Ethereum ETFs not only enhancing market legitimacy but also potentially setting the stage for further growth in Ethereum’s market infrastructure.