Public companies adopting Bitcoin as treasury asset see shares soar

Public companies adopting Bitcoin as treasury asset see shares soar Public companies adopting Bitcoin as treasury asset see shares soar

Performance review: BTC adoption boosts share prices.

Quick Take

Let’s examine the share price performance of publicly traded companies that have adopted Bitcoin (BTC) as a treasury asset, excluding mining companies.

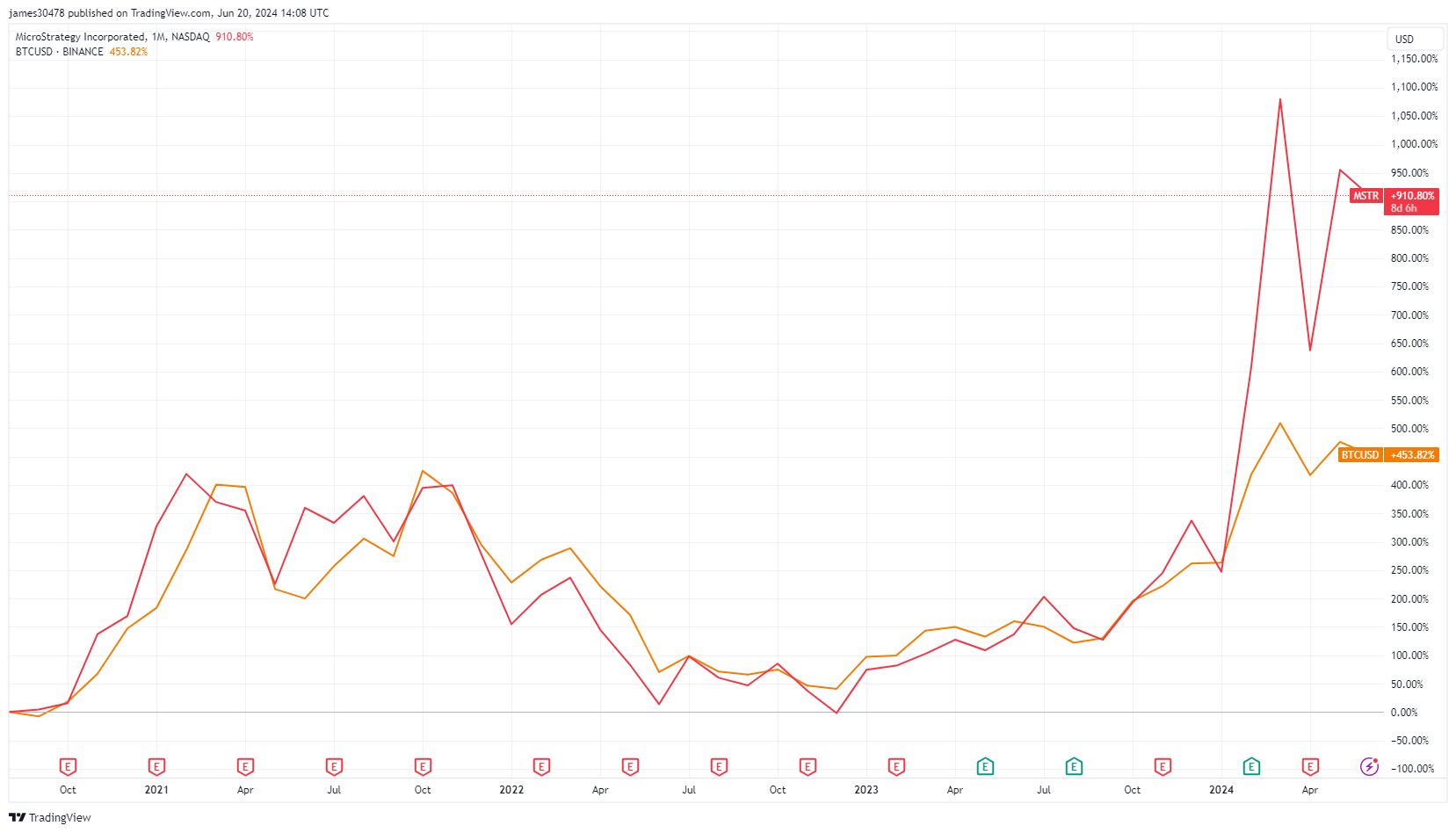

The most notable example is MicroStrategy, which adopted BTC in August 2020. At that time, its share price was around $130. By March 2021, it soared to $1,300. Despite hitting a bear market bottom of roughly $130 in January 2023, MicroStrategy’s share price is now trading just under $1,500. MicroStrategy’s stock has surged by over 900%, significantly outperforming Bitcoin, which has increased by over 450% during the same period.

Next, Metaplanet, a Japanese publicly traded company, announced its BTC adoption on April 8. Since then, its share price has surged by 326%, despite Bitcoin’s price declining by 6% in the same period. Metaplanet has continued to buy more Bitcoin since its initial announcement.

Semler Scientific announced on May 28 that it had purchased 581 BTC as a treasury asset. Since then, its share price has increased by over 60%, while Bitcoin’s price has fallen by 5%. Semler Scientific has also made additional Bitcoin purchases.

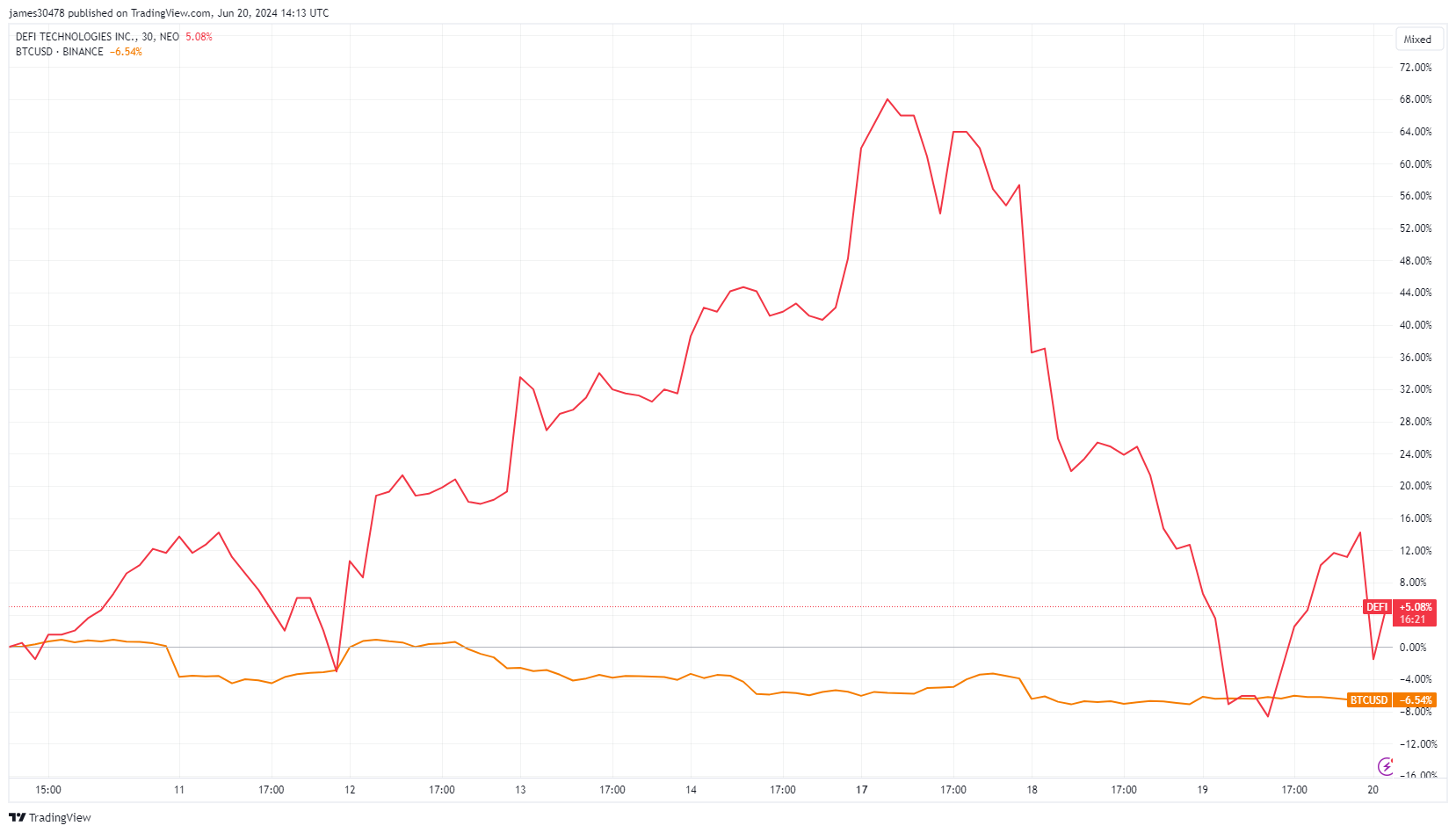

DeFi Technologies first announced its purchase of Bitcoin as a primary treasury reserve asset on June 10, 2024. The company’s share price has increased by over 6%, peaking at over 68% on June 17, despite Bitcoin’s price dropping by nearly 7%.

Tesla is excluded from this analysis as Elon Musk has not stated that it uses BTC as a treasury asset; the share price is currently down 30% from when Tesla first bought Bitcoin back in 2021 and sold at least 75% of it. Additionally, Coinbase is excluded because it held cryptocurrencies on its balance sheet before its IPO in 2021.