Missing Bitcoin’s top 10 days a year could cost you all annual gains – Fundstrat

Missing Bitcoin’s top 10 days a year could cost you all annual gains – Fundstrat Quick Take

Bitcoin is notoriously unpredictable, rendering market timing an arduous task. Different investment strategies exist, including dollar-cost averaging and lump-sum buying, each with unique merits.

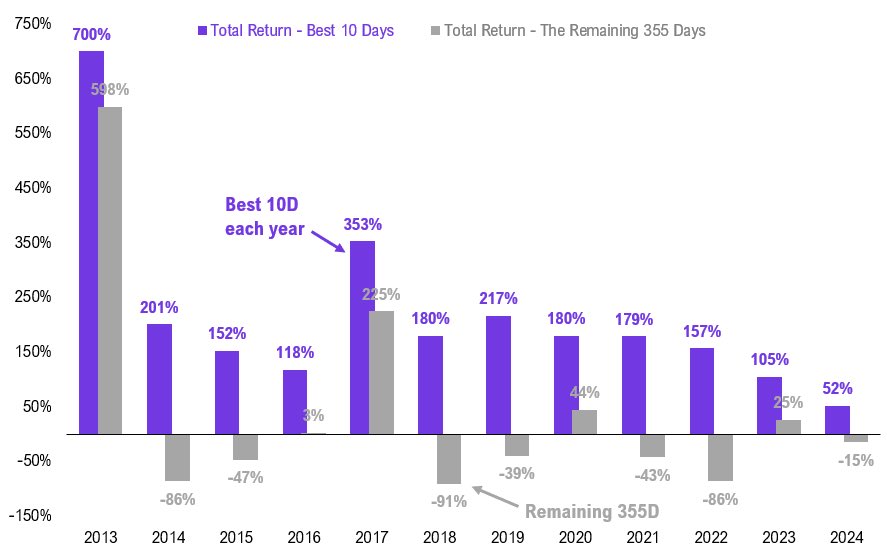

However, recent research from Fundstrat, shared by the CEO of Bitwise, Hunter Horsley, sketches a striking pattern: missing the ten best days of Bitcoin’s returns each year essentially causes you to miss out on the entire year’s profits.

This pattern has remained consistent since 2013. During 2021, a bull market, the top 10 days of the year saw an astounding 179% return compared to -43% return during the other 355 days. In contrast, in a bear market year like 2019, the best ten days still returned a substantial 217% against a -39% return for the rest of the year, according to Fundstrat.

Interestingly, this pattern seems to be repeating itself in 2024, with the best ten days garnering a 52% return, while the remaining days have generated a -15 % return, according to Fundstrat.