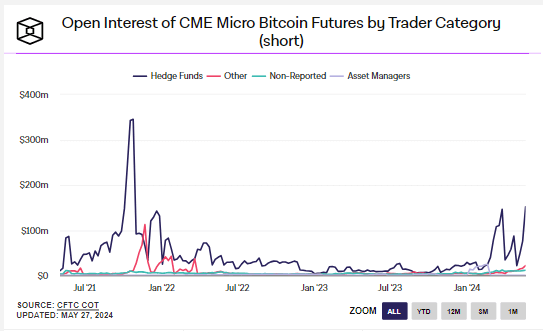

Hedge funds take largest bearish stance in CME Micro Bitcoin Futures since 2021

Hedge funds take largest bearish stance in CME Micro Bitcoin Futures since 2021 Quick Take

Data from The Block shows that as of May 2024, hedge funds have taken a notable bearish stance on Bitcoin, holding the largest net short positions in CME Micro Bitcoin Futures since the end of 2021. These micro contracts, each representing 0.1 BTC, cater to traders seeking precise exposure with lower capital requirements than standard CME Bitcoin Futures, representing 5 BTC per contract.

The chart from The Block indicates that hedge funds have markedly increased their short positions in micro contracts, reflecting a cautious or bearish outlook despite Bitcoin’s strong year-to-date price performance, which saw it rise from $40,000 to over $68,000. Hedge funds were also at similar short levels during Bitcoin’s all-time high in March. In contrast, other trader categories, like asset managers and non-reported traders, maintain relatively stable positions.

The increased hedge fund shorting in micro futures suggests they are hedging against potential downside risks, even as the spot market shows bullish sentiment.

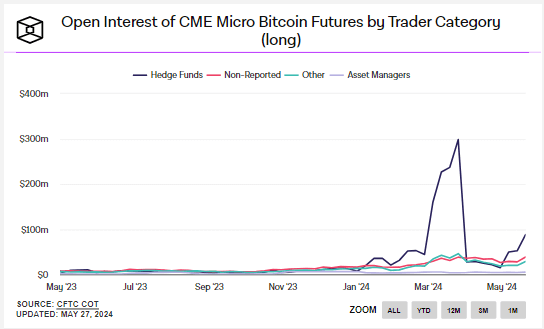

If we look at the inverse, hedge funds’ long positions in CME Micro Bitcoin Futures remain relatively muted compared to the levels during Bitcoin’s all-time high in March, according to data from The Block.

Data from Coinglass shows that the aggregate total open interest in CME Bitcoin futures is roughly $11 billion, encompassing both micro and standard contracts. CME is the leading exchange for Bitcoin futures trading.