Bitcoin’s surging correlation with Nasdaq signals convergence with traditional finance

Bitcoin’s surging correlation with Nasdaq signals convergence with traditional finance Quick Take

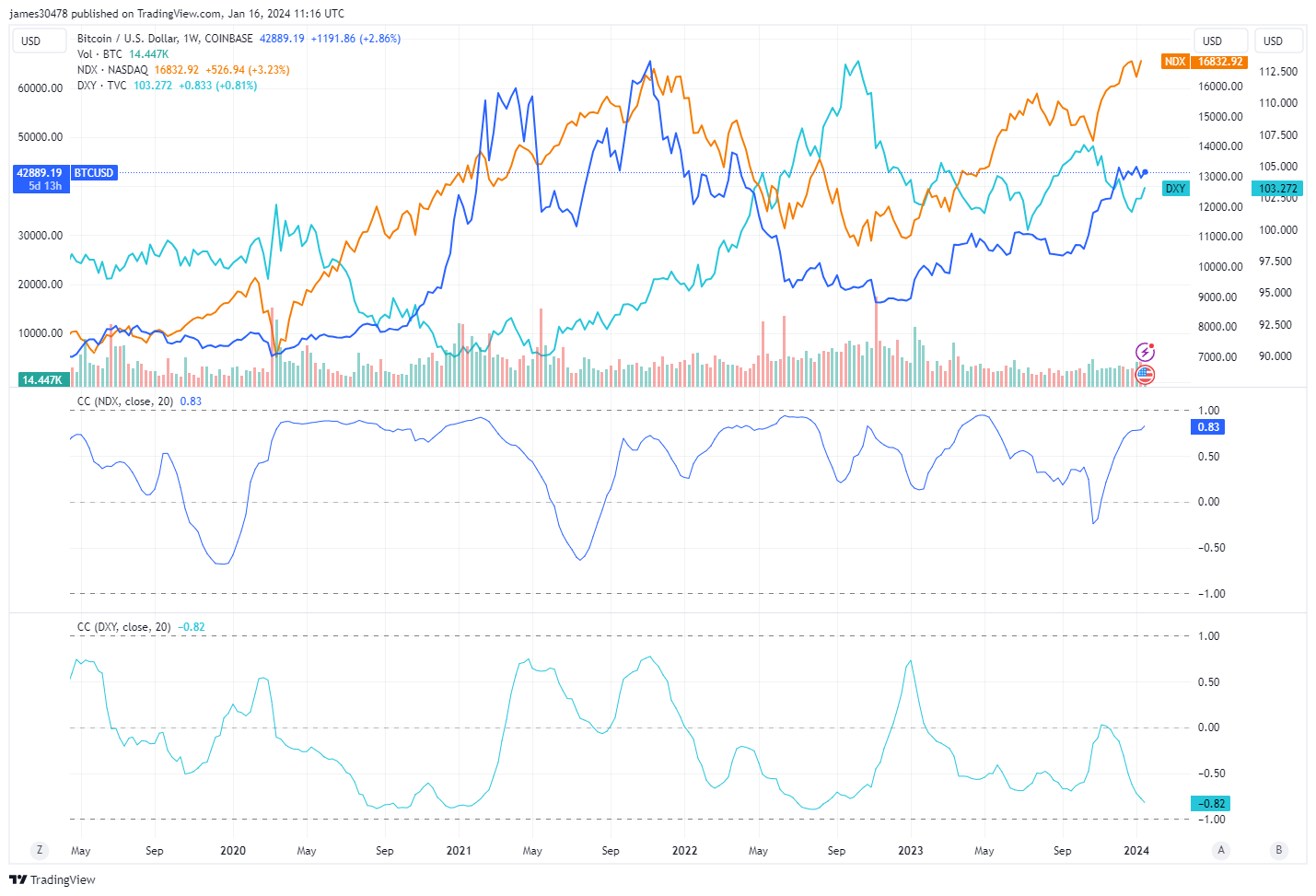

Following the launch of spot Bitcoin ETFs, Bitcoin appears to be realigning itself with the traditional finance ecosystem. Historical data shows that in 2022, despite a downward price trend, Bitcoin’s behavior was closely tied to equities such as Nasdaq and SPX, while it exhibited an inverse correlation with the rising Dollar Index (DXY), intensifying pressure on its value.

This trend is re-emerging. Analyzing a 5-year timeframe, Bitcoin now exhibits a 0.83 correlation with the Nasdaq, the highest since May 2023, and remains inversely correlated with the DXY at -0.82. These data points suggest a potential trend where the digital asset price dynamics might increasingly mirror traditional finance assets.

Consequently, Bitcoin’s integration into mainstream finance could result in behaving more akin to established financial markets, potentially signaling a new norm for this digital asset class.

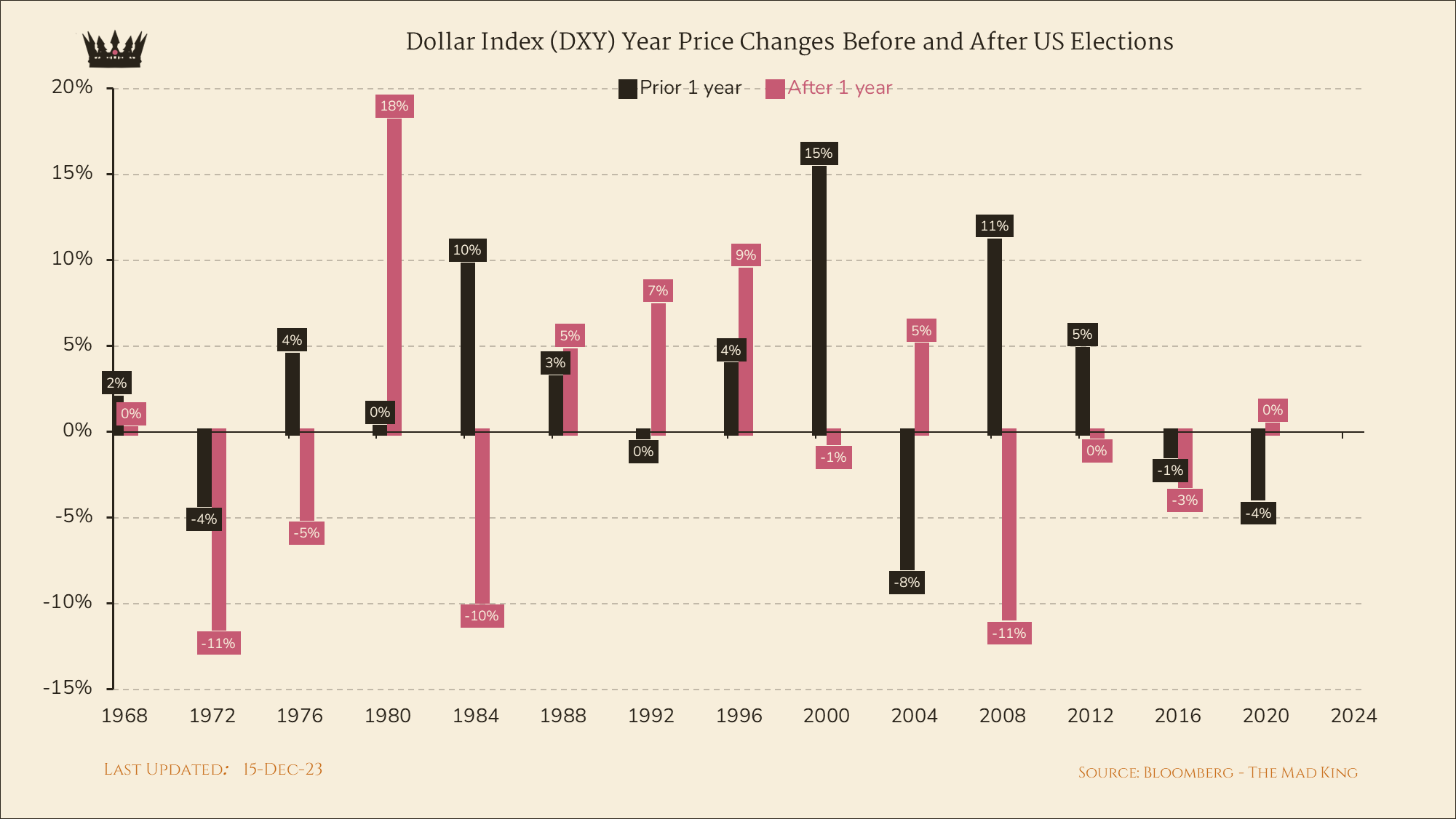

Real Vision Co-Founder @thekingcourt notes that the U.S. Dollar Index (DXY) typically rises in election years, having rallied 9 out of the past 14 election years. Given the inverse relationship between Bitcoin and the DXY, this trend could present additional challenges for Bitcoin’s performance.