Bitcoin stays resilient as global instability looms

Bitcoin stays resilient as global instability looms Quick Take

This past week has been chock-full of significant events within the financial and cryptocurrency markets, with potential global ramifications. In an episode earlier this week, Cointelegraph erroneously announced the approval of BlackRock’s spot Bitcoin ETF, which sent Bitcoin from roughly $27,500 to $29,000.

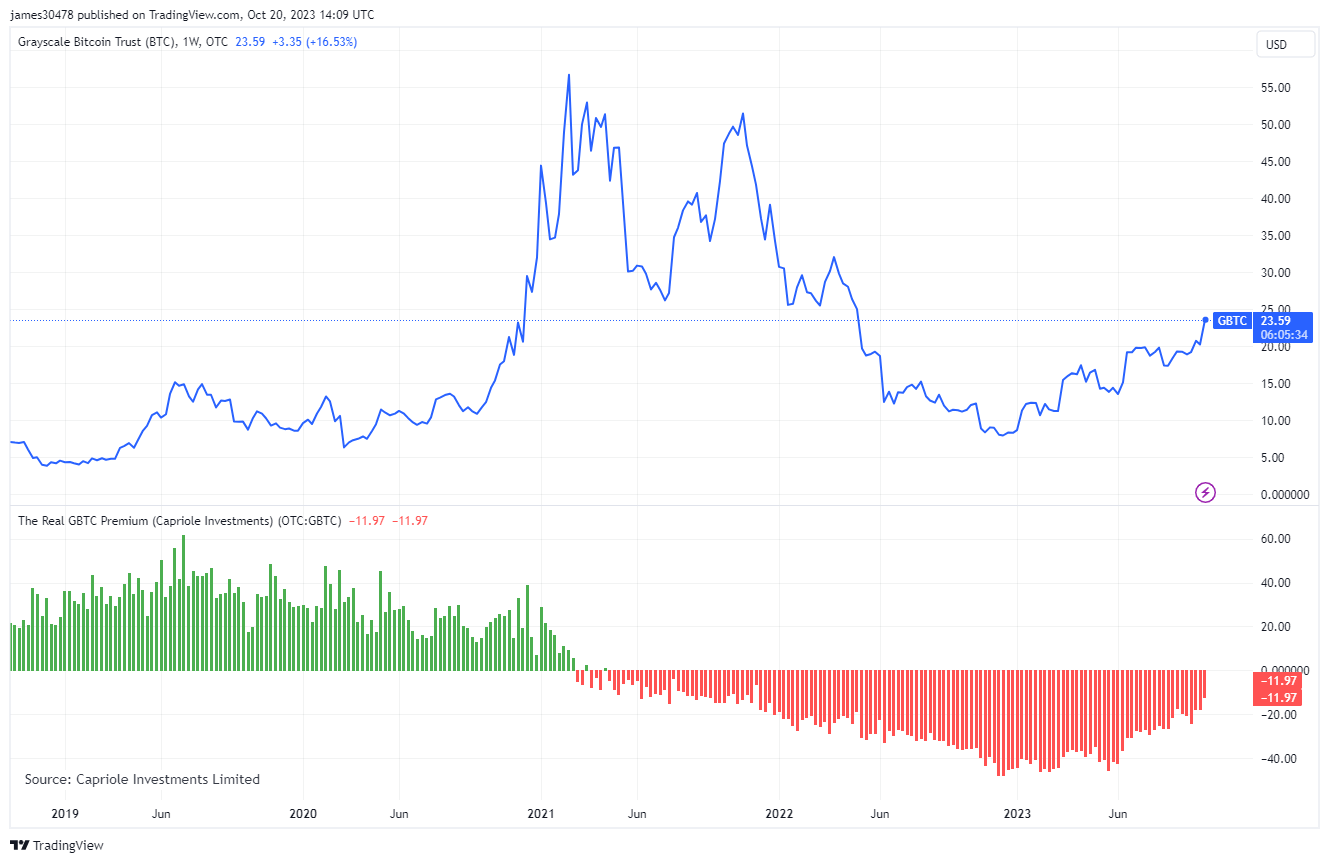

Grayscale Bitcoin Trust (GBTC) experienced a contraction in its discount to net asset value (NAV), reducing it to 12%. This movement suggests that investors are potentially anticipating approval of a spot Bitcoin ETF in the near future.

In the meantime, Bitcoin has made headlines with substantial outflows from exchanges, leading to a year-to-date low. This, along with the cryptocurrency surpassing the milestone $30,000 level, indicates a shift in investor strategy towards a long-term holding pattern.

Notably, this week has marked Bitcoin’s fifth best week this year, with the cryptocurrency surging approximately 9%. These gains, impressive in their own right, assume greater significance given the backdrop of geopolitical uncertainty and financial instability.

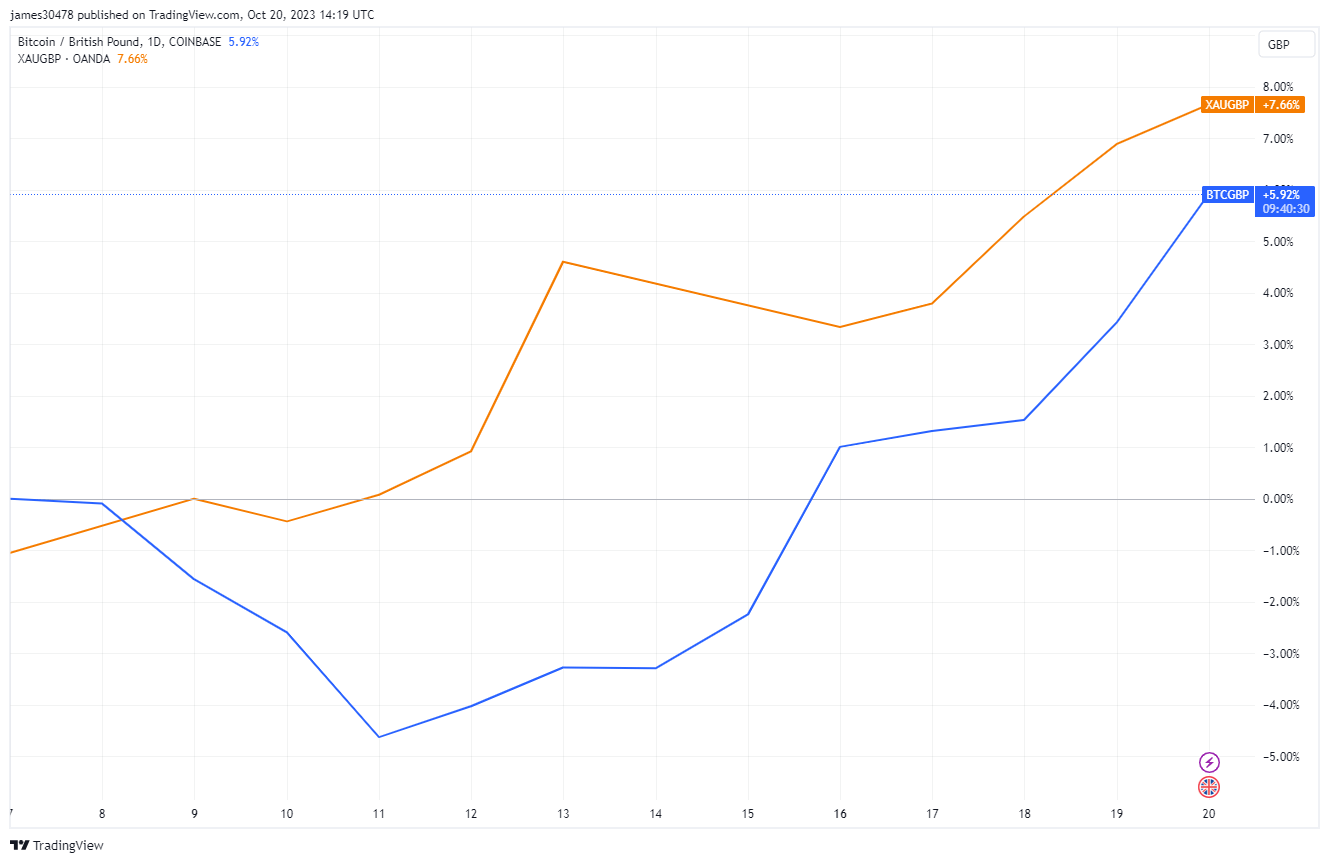

In the broader global context, the conflict in Israel has left its mark on the markets. Bitcoin and gold, often considered safe-haven assets, have appreciated roughly by 6%, indicating their resilience in uncertain times. Simultaneously, U.S. treasuries are making new cycle highs unseen in 15 years.