Bitcoin advances as gold and markets show resilience amid geopolitical unrest

Bitcoin advances as gold and markets show resilience amid geopolitical unrest Quick Take

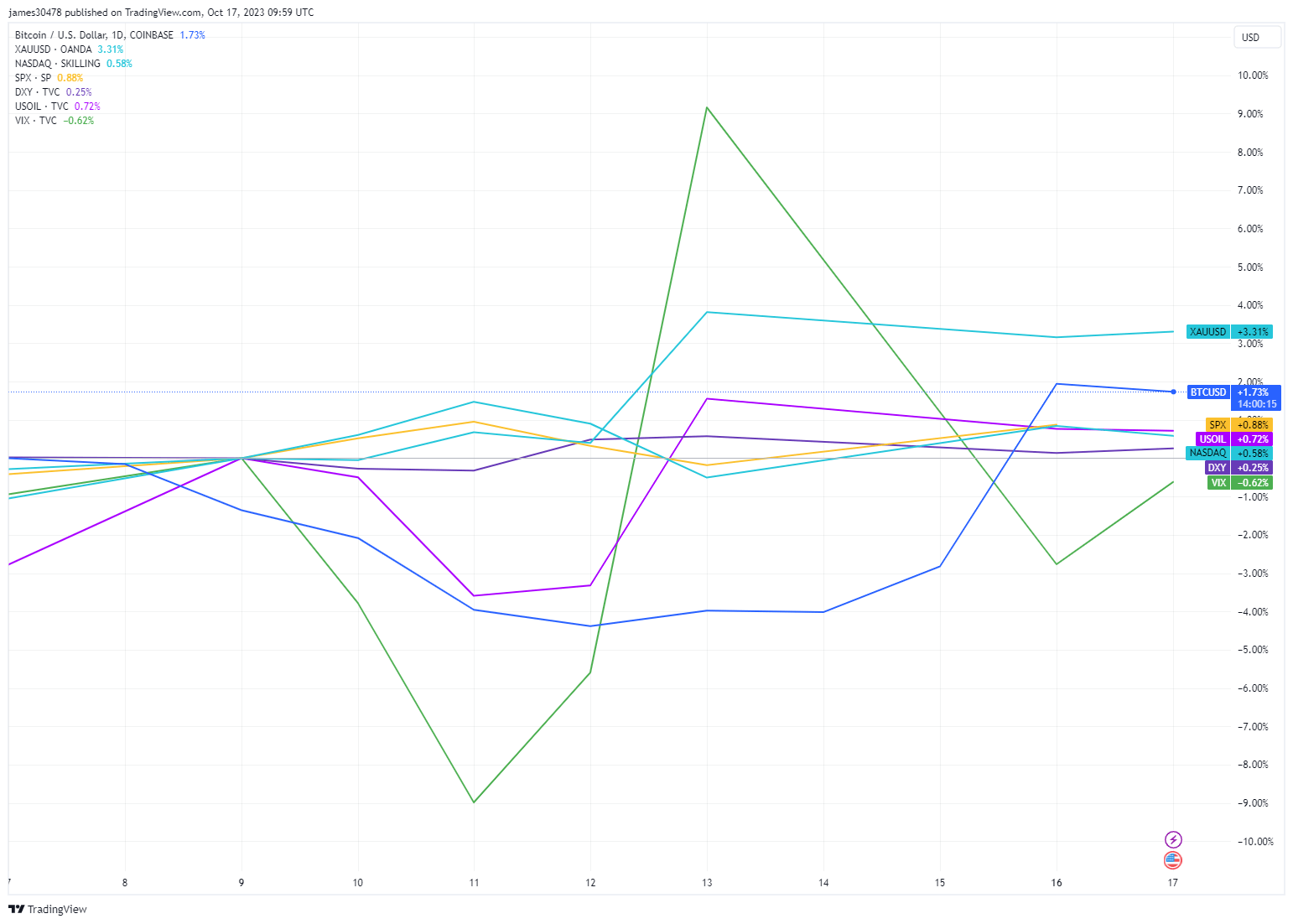

The recent conflict in the Middle East has surprisingly not destabilized the financial markets, as one might expect. Instead, data analysis reveals a slight increase across various financial assets. Gold, historically considered a safe haven during volatile periods, experienced a 3.31% hike. Bitcoin, the leading cryptocurrency, has also increased by 1.74% since the start of the war.

The SPX, Nasdaq, and DXY indices rose by 0.88%, 0.57%, and 0.27%, respectively, evidence of sustained market confidence. WTI Crude Oil, however, exhibited noticeable volatility, plunging from $90 to $82 per barrel before the war, regaining some ground to hover around $86. The Volatility Index (VIX) presented a similar scenario, jumping to 20 on Oct. 13 and then receding to just above 17 yesterday, Oct. 16.

The high volatility of traditional financial assets like WTI Crude Oil might indicate a potential ripple effect on Bitcoin and other cryptocurrencies.