How the Ethereum DeFi market just blasted past $2 billion to a record high

How the Ethereum DeFi market just blasted past $2 billion to a record high How the Ethereum DeFi market just blasted past $2 billion to a record high

Photo by Sergi Viladesau on Unsplash

Ethereum’s decentralized finance (DeFi) market is continuing to soar, as the demand for new platforms surges.

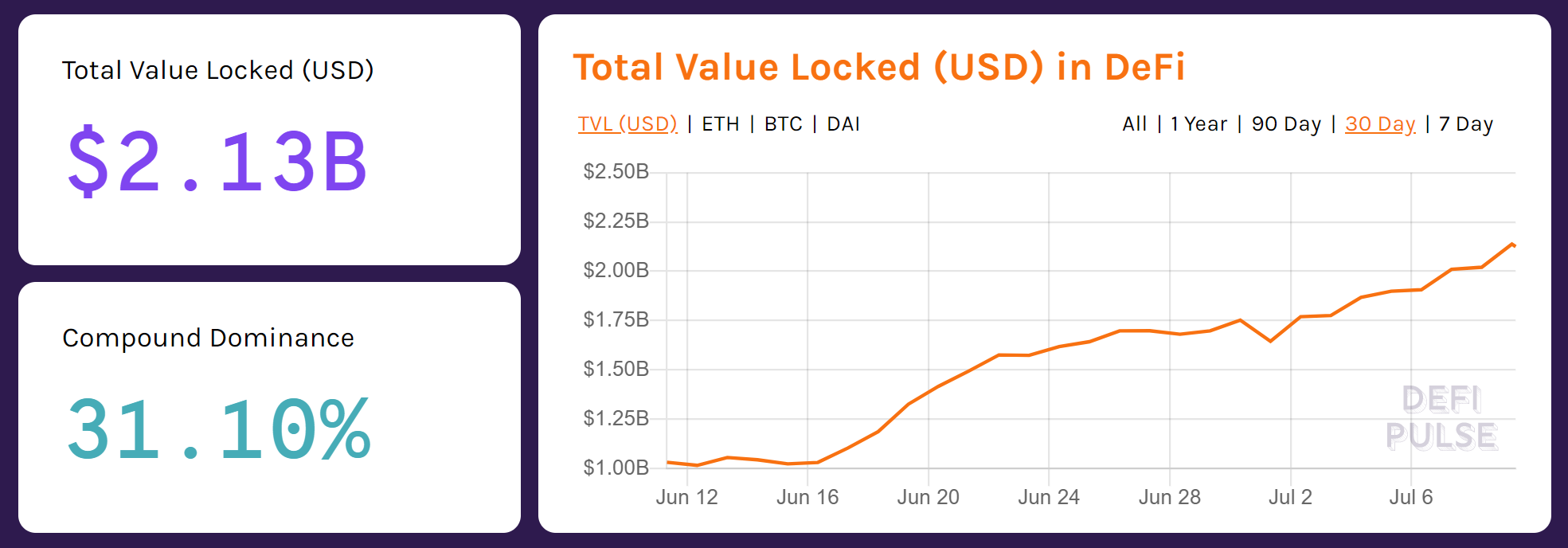

According to DeFiPulse.com, the total value locked in the DeFi market now exceeds $2.13 billion. The DeFi sector strongly rebounded from a near 60 percent drop-off in March.

At the time, the unexpected plunge in the price of Ethereum to below $100 led many DeFi contracts to become liquidated. Since then, the DeFi market has rallied, consistently achieving new all-time highs.

Why is Ethereum’s DeFi market seeing such explosive growth?

The DeFi market’s rapid expansion kickstarted in June when Ethereum-based protocol Compound released its COMP token. It incentivized users of the platform with COMP, causing the demand for DeFi services to spike.

As the price of COMP started to increase, the yield of services on the Compound protocol rose in tandem. That led the Ethereum DeFi market to explode within a short period.

Cryptocurrency researcher Jack Purdy explains that the mechanism employed by protocols on Ethereum to distribute tokens proved to be “incredibly effective.”

The model of Compound, for example, is to distribute its native token throughout the next four years to incentivize users. It successfully led the demand for DeFi applications to increase since late-June. Purdy said:

“Currently there’s around $25 million of tokens being distributed every month through yield farming opportunities on DeFi It’s proven to be an incredibly effective mechanism for building liquidity.”

The researcher further emphasized that the incentive mechanism implemented by protocols within the Ethereum-based DeFi space is not new.

Purdy noted that Jet.com, which Walmart acquired for $3.3 billion, used a similar system in 2014. The company distributed shares in the firm to people that drove signups on the Jet.com e-commerce platform.

He explained:

“In 2014, Jet.com was looking to take on Amazon in online retail Despite raising $80m from VCs they wanted to give up more equity, except for something more valuable than money.

They distributed 100,000 shares to whoever could get the most people to sign up with their referral link as well as 10,000 to the rest of the top 10 Like these liquidity mining programs… incentives work Jet.com had 350,000 sign up people through this.”

The DeFi space found a key to mainstream awareness and adoption

Decentralization alone is not a compelling incentive for users to suddenly move away from centralized platforms to using Ethereum or blockchain-based applications.

Decentralized applications (DApps) need to provide a proper incentive and a clear advantage to bring users outside of the cryptocurrency sector.

In the longer-term, the question remains whether the DeFi market can sustain its current rate of growth.

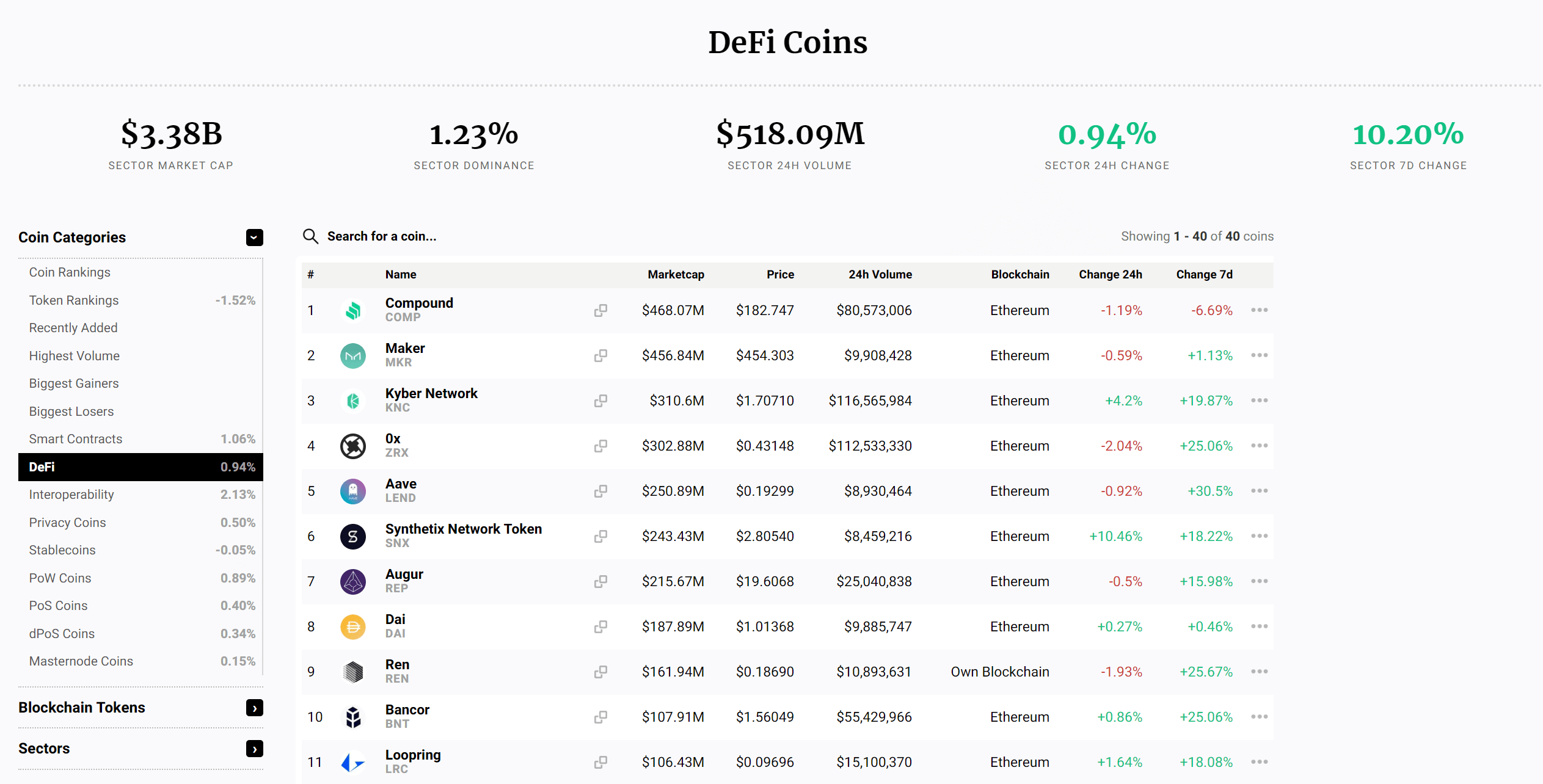

The combined market capitalization of all DeFi tokens remains below $7.5 billion. To put it into perspective, that is less than the market cap of the fourth biggest cryptocurrency in the global market, XRP.

Based on that metric, the entire market is evidently still in an early phase of growth with the potential for expansion.