How Bitcoin and Ethereum plunged in minutes amidst unexpected correction

How Bitcoin and Ethereum plunged in minutes amidst unexpected correction How Bitcoin and Ethereum plunged in minutes amidst unexpected correction

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

On May 17, the price of Bitcoin plunged from around $7800 to $6700 within minutes in a flash crash on BitMEX. Immediately after, the price of Ethereum dropped from $240 to $190.

The abrupt decline in the price of Bitcoin was triggered by the placement of a large sell order on Bitstamp and other major crypto exchanges, which triggered contracts on margin trading platforms like BitMEX to become liquidated.

Stop run on stamp to trigger Bitmex liquidations. pic.twitter.com/RBmtjr88mT

— Light (@LightCrypto) May 17, 2019

Eric Conner, a developer at Gnosis, said:

“For reference, someone put a 5,000 BTC sell on Bitstamp, which BitMEX uses for 50% of its feed and it appears to have tripped some algorithms which made a cascade on BitMEX.”

A whale crashes the entire crypto market 20% in 5 minutes with a single sell order on the books and people actually think an ETF is coming? ?

— Eric Conner (@econoar) May 17, 2019

Conner suggested that the manipulation of the crypto market, possibly by a single whale, may hurt the chances of an exchange-traded fund (ETF) approval in the near-term.

Bitcoin’s bullish momentum disrupted?

The 5,000 BTC sell wall on Bitstamp that led to the sell-off of both bitcoin and Ethereum on BitMEX, led to a $30 billion drop in the valuation of the crypto market overnight.

Still, in the past seven days, the price of Bitcoin has surged from around $6200 to $8300, by more than 26 percent against the U.S. dollar.

Some analysts, including global markets analyst Alex Krüger, have said that the overnight 10 percent drop of most crypto assets could serve as evidence that the narrative of the viability of crypto assets as a safe haven against global financial instability is flawed.

He said:

“We can now put aside that nonsensical narrative of bitcoin as a hedge for US-China trade wars. The move up was engineered by a handful of parties, and so was this crash. Not as sexy, I know.”

As the short-term price action of Bitcoin and other major crypto assets gets absorbed by the market, investors still expect the market to sustain its positive sentiment and trend over the coming months.

While a minor pullback in the crypto market was expected by many investors, the magnitude in which assets fell came as a surprise to traders.

More Reason Why Bakkt is Compelling

In a sense, the short-term correction was triggered by a whale’s exploit of the current structure of the crypto market.

If the market had more trusted, regulated, and widely utilized platforms, it may have been more difficult to manipulate the market and the prices of major crypto assets.

Peter Brandt, a respected trader and technical analyst, said on May 13 that the launch of Bakkt, which is scheduled to occur in July with the approval of the Commodities and Futures Trading Commission (CFTC) could have a long-lasting impact on the state of the crypto market. Brandt said:

“This contract will be the death-nail in dozens and dozens of dishonest and il-liquid exchanges across the world as the industry drives toward standardized price discovery with custodian protection and a trade settlement process.”

Bitcoin and the rest of the crypto market recovered relatively quickly following a 10 percent drop, leaving a sign of relief after a rapid downside price movement.

Bitcoin Market Data

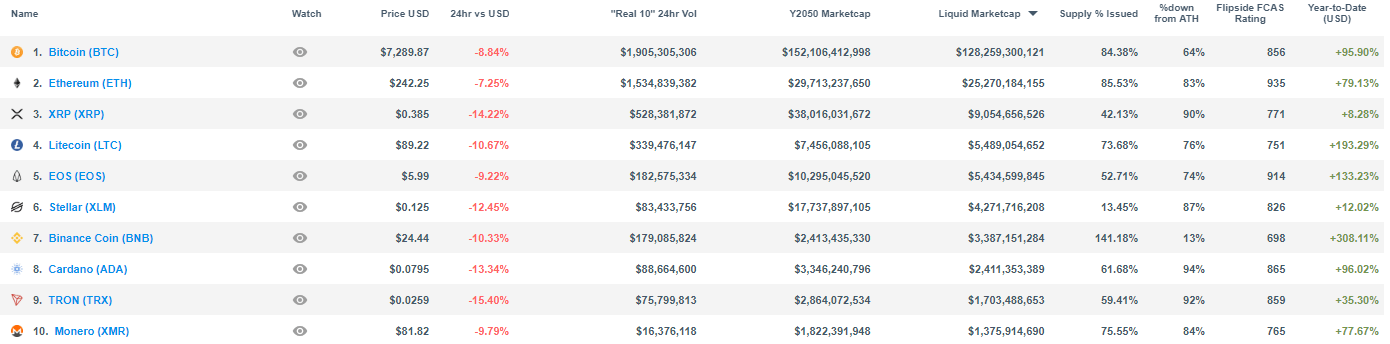

At the time of press 4:10 pm UTC on Dec. 7, 2019, Bitcoin is ranked #1 by market cap and the price is down 7.14% over the past 24 hours. Bitcoin has a market capitalization of $129.76 billion with a 24-hour trading volume of $29.95 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:10 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $231.3 billion with a 24-hour volume of $106.21 billion. Bitcoin dominance is currently at 56.02%. Learn more about the crypto market ›