How Abracadabra became one of the fastest-growing decentralized protocols

How Abracadabra became one of the fastest-growing decentralized protocols How Abracadabra became one of the fastest-growing decentralized protocols

The high volatility of cryptocurrencies makes them difficult to be used as a medium of exchange. Hence, stablecoins have become an essential part of the DeFi system.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

There is still no consensus about the best method of creating a stable currency on the blockchain.

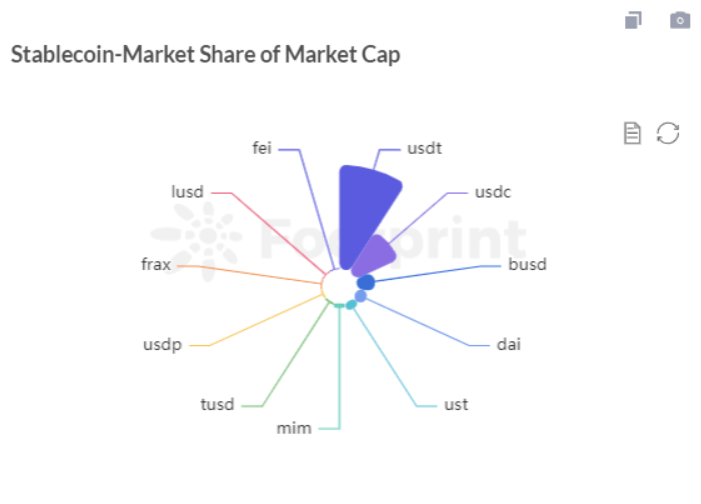

While USDT is the most popular stablecoin, many believe it is a giant house of cards capable of crashing the whole system.

On the other hand, the major decentralized stablecoin, DAI, has its own set of problems, such as the high percentage of USDC as the collateralized asset which is incompatible with hardcore decentralization advocates.

Many new products have entered the market trying to incorporate the best elements of the big players.

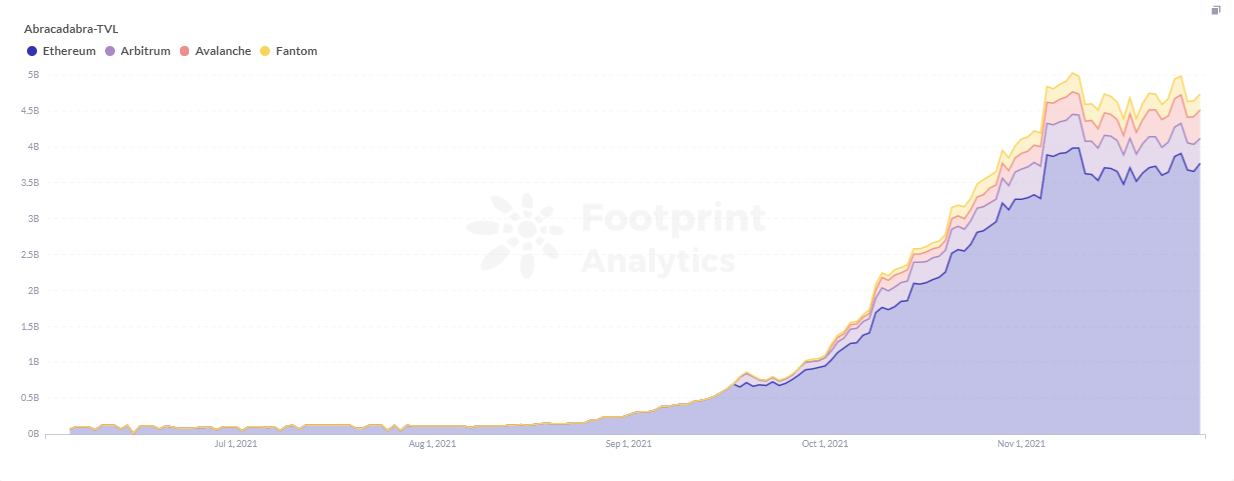

Enter Abracadabra, a polarizing project that has risen unstoppably from a TVL of less than $300 million at the beginning of September to $4.4 billion.

With Ethereum occupying 78% of its market share of TVL, Abracadabra is also gaining momentum on other blockchains, currently supporting Arbitrum, Avalanche and Fantom, and BSC.

Here’s how Abracadabra has grown so quickly.

Creating a multi-functional, one-stop experience

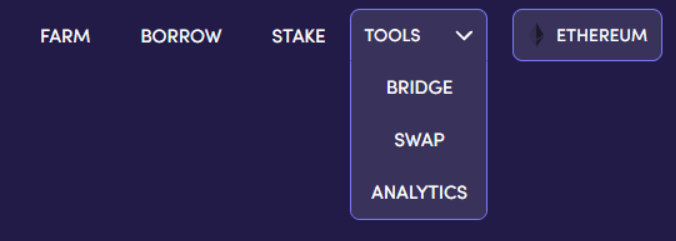

Abracadabra has slightly different functions for different chains. In the case of Ethereum, which has the highest TVL, it currently has farm, borrow, stake, and tools (including bridge, swap, and analytics) functions.

Borrow

Abracadabra’s main business is based on lending, and the outstanding difference from other over-collateralized lending protocols is the support of interest-bearing tokens (ibTKNS) as collateral.

For example, the ibTKNS certificates obtained from assets deposited in Yearn to yVaults can still be used as collateral to lend stablecoins in Abracadabra, which are MIM (Magic Internet Money). This allows the interest on the original asset to be preserved while also borrowing funds to obtain additional liquidity.

Most of the collateral currently backed by Abracadabra remains predominantly ibTKNS, along with tokens backing:

- AGLD, the community governance token of Loot, an NFT project

- ALCX, Alchemix’s token

- FTT, the token used to underpin the entire FTX ecosystem

- FTM, Fantom’s token

- UST, the native stablecoin of Terra

- SHIB

- SPELL and sSPELL, Abracadabra’s own tokens

The total MIM borrowed of these pools above is between 170,000 to 6,000,000, which is not large compared to the maximum 300 million of ibTKNS pools. However, we can see that Abracadabra is not satisfied with just using ibTKNS, and has expanded the users of these new chains by adding other chain tokens as collateral.

The fees to be paid for borrowing are not only interest but also a one-time borrowing fee paid at the time of borrowing. The borrowing fee follows the same pattern as Liquity and will be added directly to the amount of debt due from the borrower. The interest and borrowing fees charged by different pools vary.

Potentially, there are also liquidation fees, which in general are 3% for ibTKNS backed by stablecoins and 12.5% for ibTKNS with price volatility risk. However, liquidation is currently performed by robots, so there is no UI to operate.

The collateral rate is also based on whether the collateral is a stablecoin partition, which is basically 90% for stablecoins and around 50% to 90% for other collateral with price fluctuations.

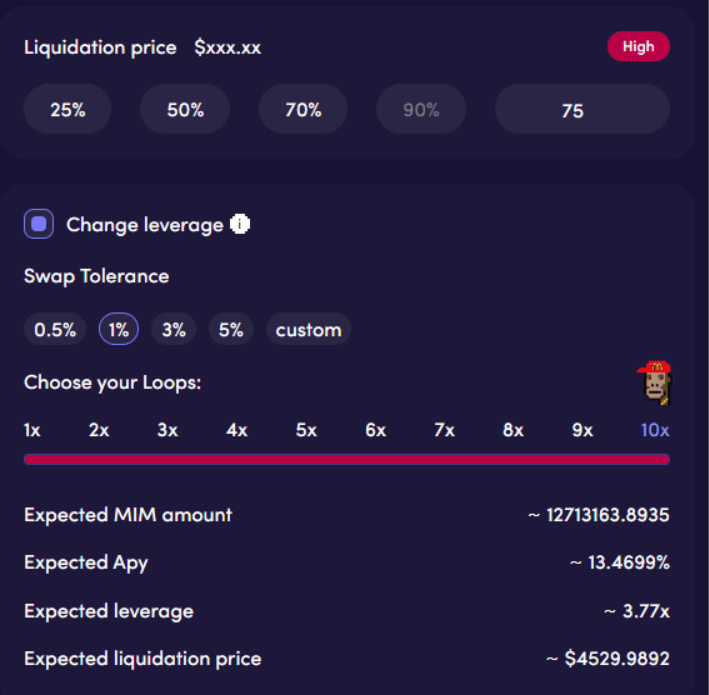

Abracadabra also allows the user to add leverage directly to the loan by adjusting the collateral ratio and the number of loops to increase leverage. This flashloan will be completed in one transaction, which can significantly reduce gas fees.

The leverage function automatically helps users convert borrowed MIM into USDT and deposit these USDT into the Yearn Vault to obtain yvUSDT, and these ibTKNS will be deposited back to Abracadabra for use as collateral. While the overall APY is increased, the user will not get any MIM.

To simplify, here is an example:

- Users deposit $1,000 of assets in Yearn’s Curve stETH pool with an APY of 3.6%

- Get ibTKNS yvcrvSTETH to continue depositing to the yvcrvSTETH pool in Abracadabra to borrow MIM

- The Abracadabra pool’s borrowing interest is 0.5%, the maximum collateral ratio is 75%. In other words, the user can borrow up to 750 MIM

- Equivalent to the user actually only locked up $250 worth of assets but can get $1000 for the principal APY of 3.1%, the remaining $ 750 users can spend or make other investments.

- The fees involved in the entire process are 0.5% interest on the borrowed funds and a one-time borrowing fee of 0.5%.

- At this time, if you choose to increase the leverage, through 10 loops, you can borrow about 3.8 times the original MIM, at which point the APY can be increased to 13.5%, which is nearly four times larger than the original APY.

It is important to note that the liquidation price also increases as leverage increases, which means that the risk fluctuations that users can tolerate gradually narrow. Once liquidated, the user will no longer own any assets and users need to carefully assess their risk tolerance level when using high leverage.

Farm

Users can earn Abracadabra’s token SPELL by staking LP tokens. ETH-SPELL and MIM-ETH pairs of Sushiswap are currently supported on Ethereum, and LP tokens of MIM-3LP3CRV are supported on Curve for liquidity mining.

Abracadabra’s APY on Curve topped 10.9%, in addition to a 5.09% SPELL reward, and topped Curve’s volume ranking. Abracadabra is working quite strongly to maintain user confidence in the stablecoin MIM and to keep the MIM price stable in the market.

Stake

Users can stake SPELL obtained from Farm to receive sSPELL and participate in Abracadabra’s fee-sharing mechanism. Stakes have a 24-hour lock-up time.

Tools

Abracadabra also provides a Bridge directly integrated by AnySwap, which allows users’ MIMs to be exchanged directly with each other on Ethereum, Arbitrum, Avalanche, Fantom and BSC.

Swap can directly jump to Curve for swapping between MIM and DAI, USDC, USDT.

Recently, an Analytics function, you can directly view the overview of Abracadabra borrowing situation and liquidation data situation. You can also pay attention to the dashboard of Abracadabra in the official website of Footprint Analytics to understand the key data of the protocol.

Three main tokens: MIM, SPELL, sSPELL

Similar to Liquity’s model, Abracadabra lends a stablecoin of USD-pegged MIM; SPELL is its protocol incentive token. sSPELL is the token obtained by staking SPELL for fee-sharing and governance.

MIM

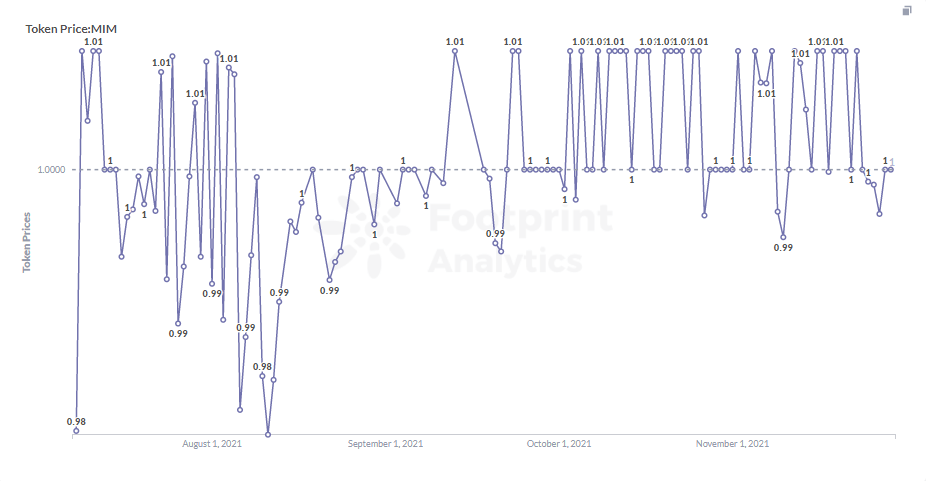

MIM’s stable currency mechanism relies heavily on arbitrage. Similar to DAI, the cost of capital of MIM is regulated through the minting rate as a way to influence the supply and demand for MIM’s currency. At the same time, the depth of the MIM pool is deepened through high APY and incentives on Curve to provide liquidity mining rewards for specific token pairs of Sushiswap in Farm to ensure the stability and liquidity of MIM in the market.

As observed from Footprint Analytics data, the current price of MIM has remained relatively stable, basically fluctuating between $0.97 and $1.01, and has not yet been seriously unanchored.

The market cap of MIM has far surpassed that of its predecessor LUSD. MIM also ranks sixth after UST among stablecoins, which shows that when the liquidity of ibTKNS is tapped, the demand for this is also quite strong.

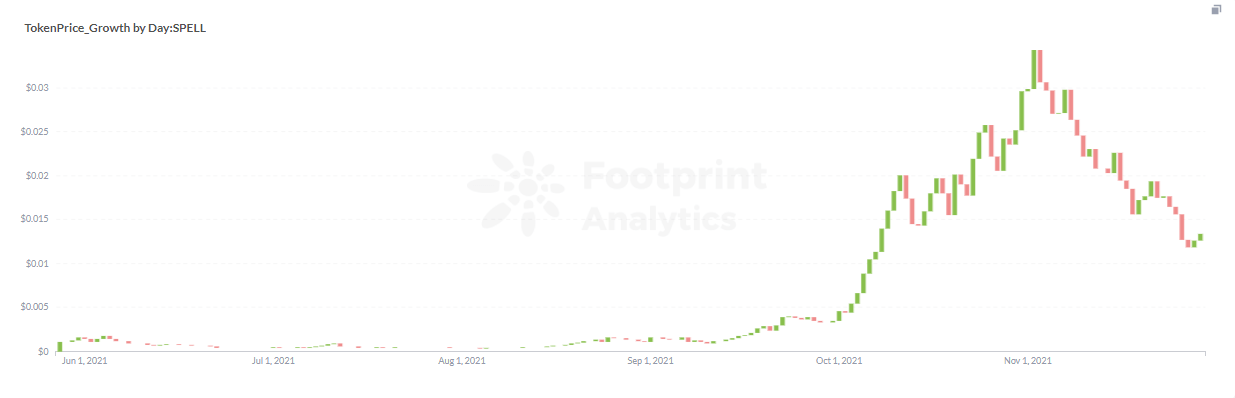

SPELL

SPELL is mainly earned by staking LP tokens in Farm (Curve’s pool needs to be jumped to Curve interface to operate). As a governance token, SPELL is similar to MKR in that it can be used to adjust the protocol’s parameters. The SPELL allocation ratio shows that the team has put a lot of effort into liquidity incentives, with 45% going to the MIM-3LP3CRV pool and 18% to the ETH-SPELL in the Sushiswap token pair.

SPELL’s price is only $0.18 as of Nov. 17, and Liquity’s token LQTY, which has a similar model, has a price of $13.73 (LQTY does not have governance functions), so SPELL is still far from its predecessor in terms of token price.

sSPELL

sSPELL is acquired primarily by staking SPELL in Stake. sSPELL, in addition to being a governance token, helps holders capture interest, borrowing fees and liquidation fees from the protocol. According to founder Squirrel, one of the secret sauces for Abracadabra’s success is the generous fee distribution mechanism that gives sSPELL holders a 75% share of the interest fee; and 10% of the liquidation fee is also distributed to the weekly sSPELL rewards.

Similar to the SUSHI/sSUSHI relationship, the number of sSPELLs represents a share in the fee pool. When a user withdraws his SPELL, he will receive additional revenue back in the form of SPELL. In the Stake interface the user is able to see the ratio sSPELL – SPELL and as more and more fees are added, the value of 1 sSPELL token will become higher and higher.

Conclusion

Abracadabra takes the good parts of MakerDAO and Liquity and puts another iteration on the over-collateralized stablecoin lending market. But it is more aggressive, with a greater variety of assets as collateral while also tying it to the risks of other protocols and chains.

The ability to quickly increase leverage is convenient, but also risky.

As with Liquity, Abacadabra’s founders are heavy proponents of the decentralized model for DeFI. And while Liquity has a clearer liquidation mechanism, Abracadabra is more aggressive in expanding external pools and use cases.

While it is impossible to choose a winner between these two projects yet, it is clear that DeFi will have strong decentralized projects going forward.

The above content represents the personal views and opinions of the author and does not constitute investment advice. If there are obvious errors in understanding or data, feedback is welcome.

This report was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.