Here’s why simulations of Bitcoin’s post-halving price may disappoint investors

Here’s why simulations of Bitcoin’s post-halving price may disappoint investors Here’s why simulations of Bitcoin’s post-halving price may disappoint investors

Photo by chuttersnap on Unsplash

Bitcoin’s upcoming mining rewards halving has been looked upon as a potentially bullish catalyst for the cryptocurrency for years, with many investors predicting that the impact it has on its miner dynamics will help boost BTC’s price.

It is important to note, however, that there are some problems with this notion, and a recent report from a crypto hedge fund suggests that bullish halving narratives are underpinned by false assumptions.

Now, a statistical model that has accounted for a plethora of post-halving pricing possibilities seems to support this theory, with only a small minority of simulations accounting in any highly bullish price action in the time directly following the event.

Bullish Bitcoin halving narratives underpinned by “false assumptions” claims hedge fund

As reported by CryptoSlate earlier this month, the Seattle-based crypto hedge fund Strix Leviathan recently explained that the vast majority of the narratives surrounding the halving are underpinned by faulty assumptions.

The event, which is slated to occur in 21 days, is largely thought to be bullish in the short-term because the reduced block rewards will cause miners to stop selling their minted crypto until its price appreciates.

This will alleviate the steady stream of selling pressure placed on Bitcoin by miners, thus giving it room to climb.

In spite of this, Strix Leviathan notes that this narrative hinges on the assumption that miners are currently selling all of their crypto as soon as they mine it – which is false.

“Reality – Not all miner rewards are sold. A meaningful amount of mined BTC is sitting on balance sheets as miners both speculate and utilize BTC-collateralized loans to run and expand operations. The impact of a supply-side cut on price is uncertain at best and minimal at worst.”

Simulations show halving unlikely to catalyze major bull run

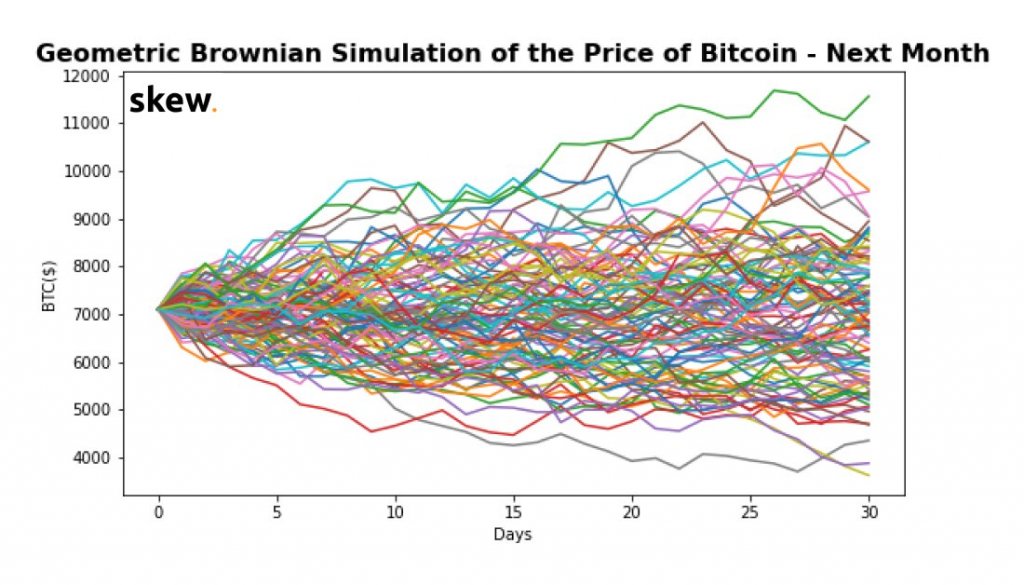

Newly conducted economic simulations also seem to confirm this sentiment, suggesting that there is an incredibly small likelihood that the halving leads Bitcoin to see any insanely bullish price action.

According to the simulations run by Skew – a blockchain research and analytics platform who shared the results of 100 simulations in a recent tweet – only 5% ended with Bitcoin’s price being at over $9,000, with an equal amount ending with its price below $5,000.

“The options market is pricing in limited extra volatility related to the Bitcoin halving next month. We simulated 100 iterations for the path of bitcoin over the next month using the May19 implied volatility of 80%. 5 series out of 100 ended > $9,076 and 5 < $4,947.”

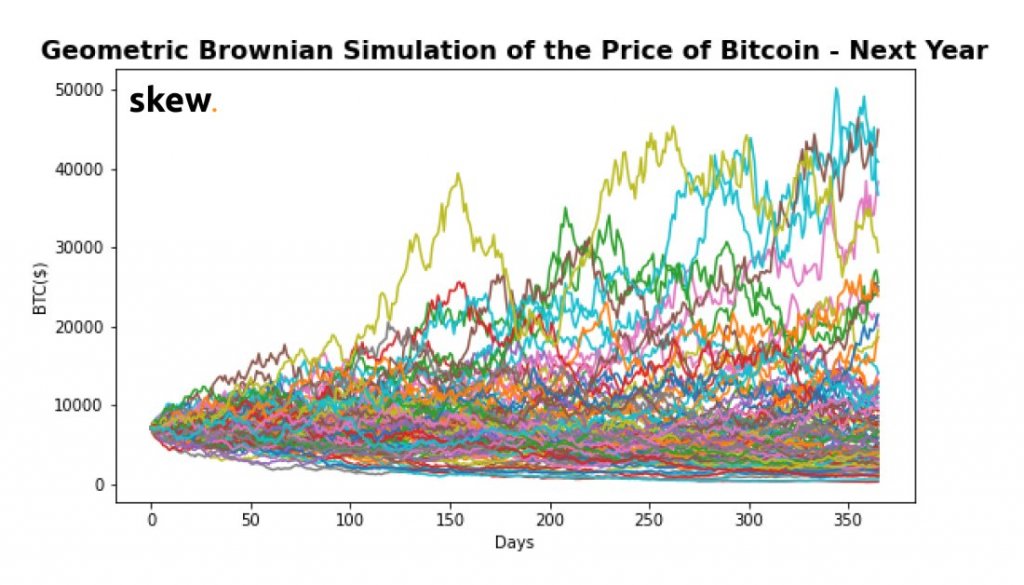

This model was run using the implied volatility seen in May of 2019, but a similar trend is seen while running the same model using December 2019’s implied volatility, which results in a 5% of the simulations ending with Bitcoin at over $25,000, while 5% end with it at under $1,300.

These models indicate that it appears to be statistically likely that the halving won’t result in Bitcoin seeing any immense bull-favoring volatility – which may come as a disappointment to investors.

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)