Here’s why a top VC thinks Ethereum could rally over 3,000% in the next bull run

Here’s why a top VC thinks Ethereum could rally over 3,000% in the next bull run Here’s why a top VC thinks Ethereum could rally over 3,000% in the next bull run

Photo by KEVIN CLYDE BERBANO on Unsplash

From its all-time high price just shy of $1,500, Ethereum down by just around 85 percent. To put that into context, Bitcoin is down only around 50 percent from its $20,000 high.

ETH is far from “dead,” but over recent months, the relatively dismal price performance has left some wondering if the cryptocurrency will ever see gains similar to those seen in 2017 and in 2018.

According to Chris Burniske of Placeholder Capital, it’s possible.

Ethereum could hit $7,500 in the coming years

The co-author of industry primer “Crypto-Assets” remarked on Jun. 14 that if Bitcoin passes $50,000 in the “next cycle” and if ETH returns to an all-time high, “expect to see ETH above $7,500.”

A rally to $7,500 would correspond with more than 3,000 percent in gains from the current price of $235.

If $BTC goes > $50,000 in the next cycle, and $ETHBTC returns to its former ATH, then expect to see $ETH > $7,500. pic.twitter.com/5tetUJdbCS

— Chris Burniske (@cburniske) June 14, 2020

This is more than a hypothetical scenario to Burniske though.

He explained in the Twitter thread that it’s almost inevitable Bitcoin breaks $50,000 and that “ETH surpasses its all-time highs against Bitcoin” due to Ethereum’s “strong on-chain economies.”

The mainstream realizing that Ethereum is the next big thing, the “new kid on the block,” will result in an investment “frenzy” as well, Burniske explained. Presumably, the investor is talking about how everyone knows the “why” and “what” of Bitcoin but the same is not true for Ethereum.

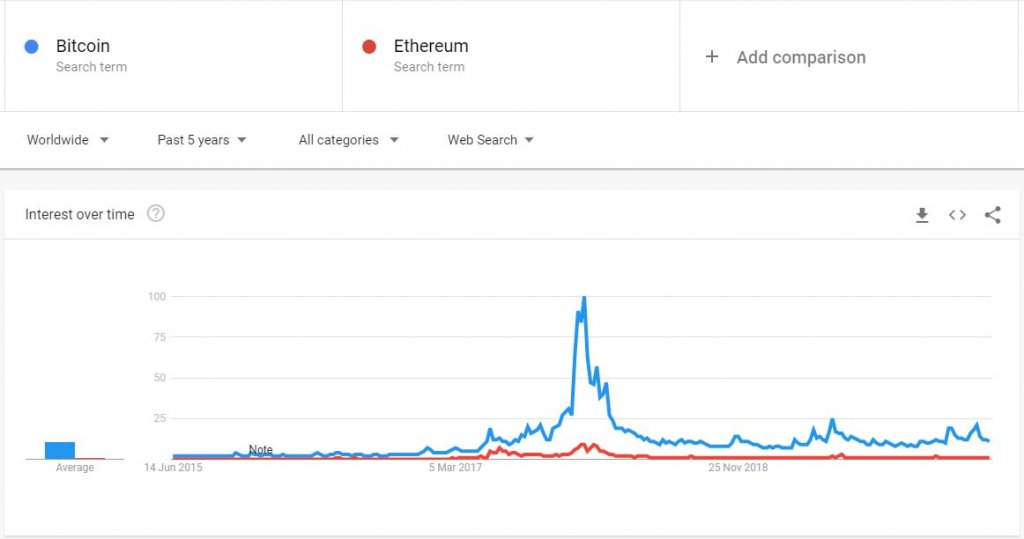

A perfect case in point is the chart below of the search interest worldwide Google users have had in the “Bitcoin” and “Ethereum” terms over the past five years. There are about an order of magnitude more searches for “Bitcoin” than “Ethereum,” the chart shows, suggesting that ETH’s clout is still minimal.

Burniske’s optimism about the two leading cryptocurrencies is tied to the ongoing pandemic and its potential effects on the way the world works.

As reported by CryptoSlate previously, the venture capitalist said that “new technologies rise as old systems break, and often it takes a crisis to reveal the flaws of the old system in full.”

This was likely in reference to the growing sentiment that as COVID-19 ravages the world economy, individuals are starting to lose faith in traditional institutions and systems as money printing takes place, firms collapse, and governments act in ways that don’t satisfy everyone.

DeFi strongly bolsters the ETH bull case

Bolstering the sentiment that Ethereum eclipses its all-time high against Bitcoin is decentralized finance.

Ryan Selkis, chief executive of crypto researcher and data provider Messari, explained that the introduction of decentralized finance gives “ETH a higher ceiling” to rally towards in the long run than 2017/2018’s rally.