Here is how to check yield farming returns on Compound

Here is how to check yield farming returns on Compound Here is how to check yield farming returns on Compound

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

With the current DeFi locked amount crossing over $2 billion, doubling in a month, it’s imperative to discuss yield farming as it pulled the trigger for the explosive movement of DeFi.

Yield farming allows users of a protocol to use the protocol as they would typically do, while also earning the native token of the protocol as a reward. In the case of Compound.finance, the token is COMP token.

The token can be used for voting in governance decisions, and many holders speculate that later earnings of Compound would be distributed to holders of COMP tokens.

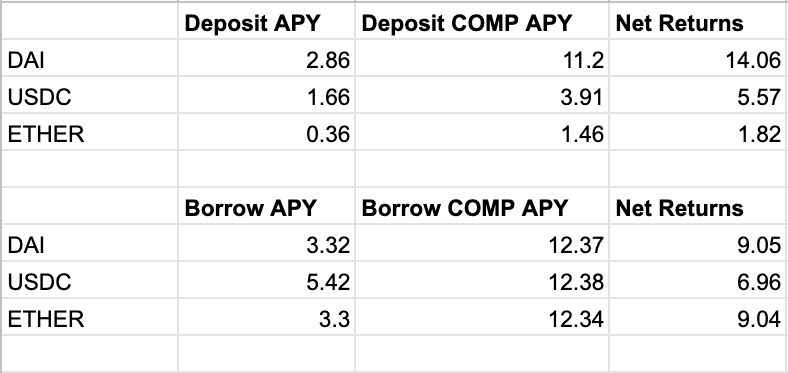

Compound allows users to deposit or borrow crypto-assets. Both borrowing and lending have a separate Annual Percent Yield (APY). On top of that, users also earn COMP tokens for their activity.

The APY is not fixed but a function of market conditions.

A Web3 wallet like MetMask is ideal for interacting with the Compound protocol.

The formulae for net returns in calculating the returns at Compound is = APY for borrow/deposit + COMP APY reward for borrow/deposit. COMP tokens earned will have to be manually claimed from the voting page.

The returns look as follows at the time of writing this article (GMT 9:00 PM, July 10, 2020):

These are the returns of basic yield farming on Compound. Sophisticated yield farmers employ various different strategies to leverage their positions and earn more interest while also facing more risk.

Capital Risks are Involved

There are various risks associated with Yield Farming as the smart contracts are for the first time managing such high amounts, and the whole capital is at risk if hackers manage to hack into the protocol.

The funds also face liquidation risks for those who are borrowing.

Another variable that should be kept in mind is that returns are variable in nature, and the Deposit COMP APY returns depend on the price of Compound and on the total liquidity available on the network.

Using Compound.finance also requires users to initiate costly Ethereum transactions that interact with multiple smart contracts. As a result, gas fees of up to $10 for a single transaction have become usual. Similar fees have to be paid while withdrawing the funds. The net effect is the whole proposal is not very lucrative for those who are dealing with small amounts like 500$.

StatFarm is a resource site managed by Compound community members, which provides a relatively accurate estimate of the returns on Compound.

There are various regulated and user-friendly, a bit more centralized options available to earn interest for those who are not feeling adventurous about dabbling into the world of DeFi. Check out platforms like Celsius, Cred, BlockFi, Crypto.com to earn interest on your Bitcoin and other cryptocurrencies.