Gemini reveals $601M GUSD backing, 45+ licenses amid global exchange turmoil

Gemini reveals $601M GUSD backing, 45+ licenses amid global exchange turmoil Gemini reveals $601M GUSD backing, 45+ licenses amid global exchange turmoil

Winklevoss owned Gemini shows assets, FIAT holdings, and reserves in new 'Trust Center'

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Winklevoss Twins-backed exchange Gemini has announced a “Trust Center” to display a breakdown of funds held on the platform. The page, hosted on the Gemini website, reveals that it holds over $4.6 billion in crypto assets with $601 million in the treasury to back its stablecoin GUSD.

However, data from several sources, including CryptoSlate’s coin page, shows the market cap of GUSD to be $613.98 million, leaving a difference of $12.98 million.

Exchange assets comprise $2,257,474,294 BTC, $1,714,709,859 ETH, and $681,003,276 in other crypto assets. Further, it has $542,892,356 in FIAT, all held in FDIC-insured banks. A statement identified the funds were valid as of midnight ET on Nov. 29.

“Fiat assets held for the benefit of our customers as of 12am ET. U.S. dollars are held at FDIC-insured banks.”

The exchange also listed some 45+ relevant licenses across the U.S., United Kingdom, and Ireland. The licenses included a New York Trust license for virtual currency granted in 2015, alongside money transmission licenses in most U.S. states. Gemini also holds virtual asset and e-money licenses in the United Kingdom and Ireland.

The license in the notoriously tricky state of New York comes with strict criteria. Crypto licenses in New York are not easy to come by and “impose certain excess capital requirements for all assets held on Gemini.”

“At any given time, Gemini is required to hold capital in excess of customer deposits and must report any material changes in this capital to the NYDFS.”

Unlike the Binance proof of reserves release, Gemini’s ‘Trust Center’ does not include any ability for customers to verify assets or link to on-chain wallets. The page is in static form and will be “updated daily.”

While the information on specific assets, reserves, licenses, and certifications showcases Gemini’s comparable level of regulation to traditional financial counterparties, the lack of full transparency may not sway some crypto purists.

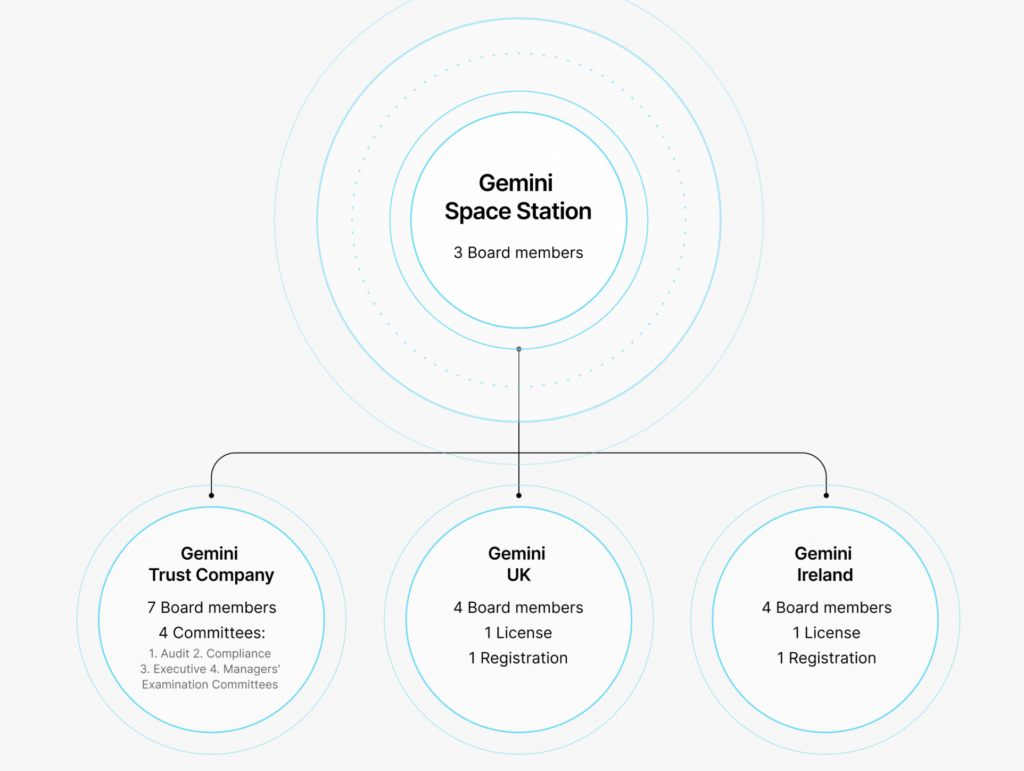

The chart below highlights Gemini’s corporate structure as outlined in its Trust Center. The Gemini Space Station is the parent company of the Gemini Trust, Gemini U.K., and Gemini Ireland. Each entity has its own board, licenses, and registrations. However, only the trust has committees focusing on audits, compliance, and executive and managers examination.

Gemini closed off the Trust Center page with a quote central to its mission.

“Ask for permission, not for forgiveness. From day one, Gemini has prioritized the security of your assets. We never have and never will compromise on that.”