Futures traders anticipating further declines even after Bitcoin’s colossal drop

Futures traders anticipating further declines even after Bitcoin’s colossal drop Futures traders anticipating further declines even after Bitcoin’s colossal drop

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

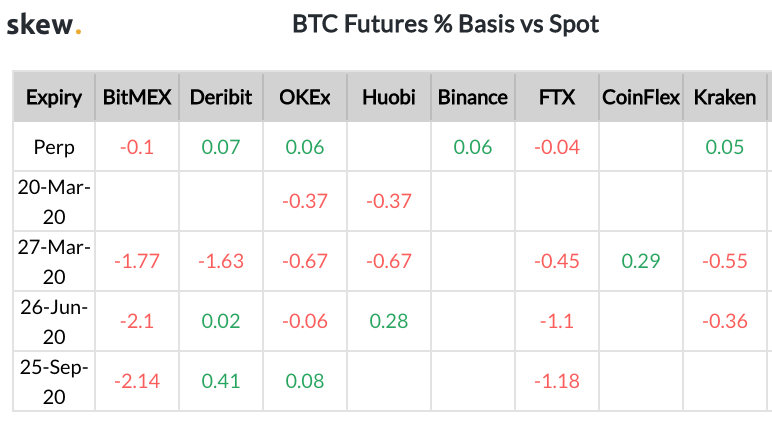

Back-month Bitcoin futures contracts are trading at a steep discount to spot on the leading exchanges, indicating that derivatives traders could have low expectations for a price recovery after the coin’s recent capitulation.

The basis, which measures the premium or discount between the spot price and the futures price, is often considered a useful gauge of sentiment in the futures market. When futures contracts have a negative basis on back months, it generally indicates traders are bearish on the asset and will be more liable to short the spot market.

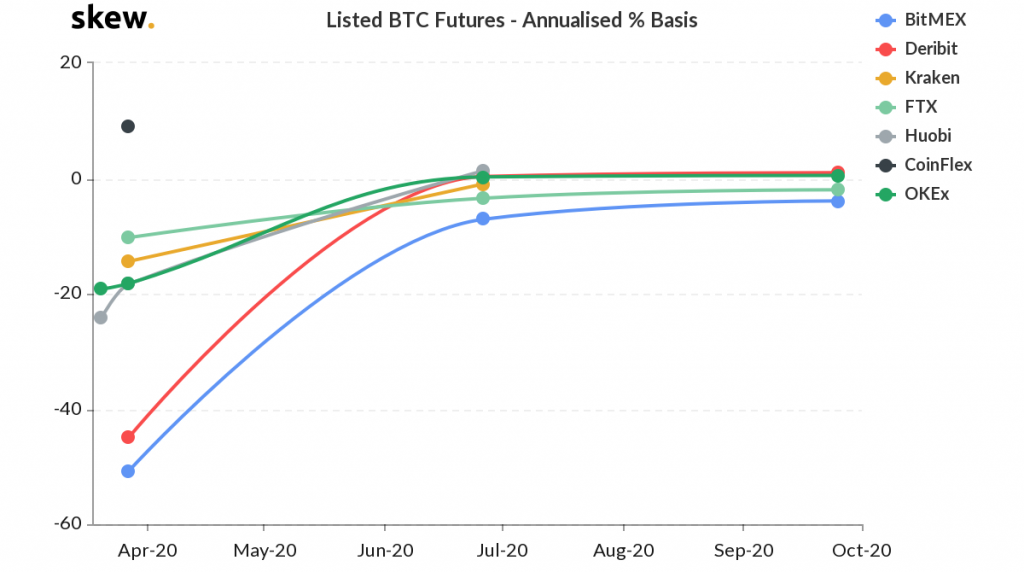

The BTC futures contracts for March and June are trading at a significantly negative basis (a.k.a. “backwardation”) on BitMEX, Deribit, FTX, Huobi, and OKEx, five of the largest leveraged Bitcoin derivatives venues.

Astonishingly, some of the contracts on BitMEX and Deribit are trading so far below spot price that their annualized discount to spot is almost 60 percent — hundreds of dollars below the current price of Bitcoin. Deribit’s March contract, for example, is trading at roughly $5,150, $110 lower than the BTC/USDT pair on Binance.

The Bakkt physically settled contract has also lurched into backwardation, to the extent Bakkt traders currently have an annual loss of 592 percent on their positions, according to data from IntotheBlock.

The turnover ratio of these five major exchanges is still higher than usual after the immense sell-off seen over Thursday and Friday, suggesting that Bitcoin’s recent volatility could continue.

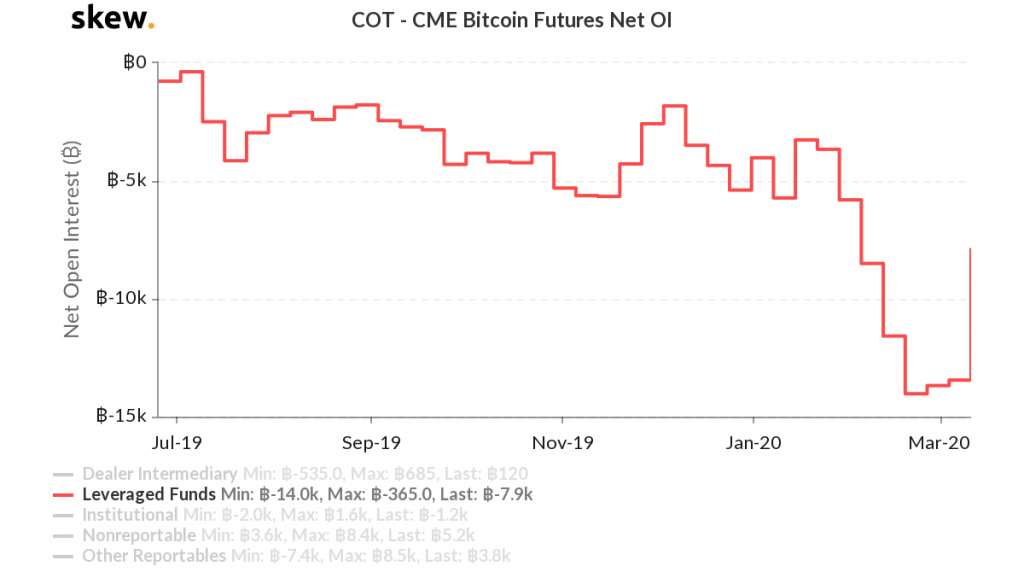

But there are two correlated metrics that suggest the market may have seen the worst of Bitcoin’s sell-off and are a little more encouraging for the prospects of a recovery.

Open interest has dropped sharply across all the BTC futures venues, shrinking to an all-time-low on the regulated CME contract. This indicates a weakening of bearish momentum, and, when considering net open interest on CME for leveraged funds, it looks like institutional speculators have sharply eased off on their short positions.

Bitcoin Market Data

At the time of press 1:18 am UTC on Apr. 6, 2020, Bitcoin is ranked #1 by market cap and the price is down 2.36% over the past 24 hours. Bitcoin has a market capitalization of $96.77 billion with a 24-hour trading volume of $33.21 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:18 am UTC on Apr. 6, 2020, the total crypto market is valued at at $151.88 billion with a 24-hour volume of $115.38 billion. Bitcoin dominance is currently at 63.71%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)