FTX CEO John Ray blames collapse on ‘inexperienced and unsophisticated individuals’ in testimony following SBF arrest

FTX CEO John Ray blames collapse on ‘inexperienced and unsophisticated individuals’ in testimony following SBF arrest FTX CEO John Ray blames collapse on ‘inexperienced and unsophisticated individuals’ in testimony following SBF arrest

A Dec. 12 press statement by the Bahamas Attorney General revealed that the U.S. government had filed criminal charges against SBF and is likely to request extradition.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

FTX CEO John Ray III Dec. 13 testimony to the U.S. Congress revealed that the bankrupt exchange commingled assets and stored wallets’ private keys without encryption.

According to Ray, FTX’s collapse was caused by the failure of corporate controls — the worst he has seen in over 40 years of handling bankruptcy cases. He noted that FTX’s operation was concentrated in the hands of a “very small group of grossly inexperienced and unsophisticated individuals” who failed to implement the form of control necessary for a company holding other people’s money.

SBF arrested

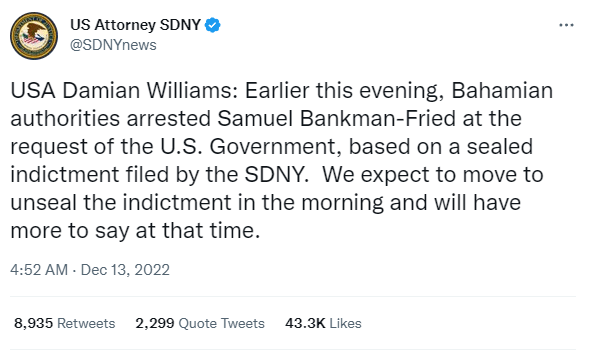

Earlier in the day, FTX co-founder Sam Bankman-Fried was arrested in the Bahamas on the orders of the U.S. government. A Dec. 12 press statement by the Bahamas Attorney General revealed that the U.S. government had filed criminal charges against SBF and is likely to request extradition.

The U.S. Attorney for the Southern District of New York, Damian Williams, confirmed the development. Williams said SBF “was arrested at the request of the U.S. Government, based on a sealed indictment filed by the SDNY.”

The unacceptable management practices at FTX

Ray’s testimony listed eight unacceptable management practices at FTX group. These included the commingling of assets, absence of audited financial statements, absence of independent governance, and lack of personnel to handle financial and risk management.

Additionally, the bankrupt exchange’s senior management had access to consumer funds, they did not properly document FTX investments, and Alameda had access to borrowing without limit.

Alameda’s role in FTX collapse

Ray also highlighted Alameda’s role in the collapse of the bankrupt exchange. According to the CEO, FTX commingled users’ assets with Alameda’s trading platform.

Apart from that, Alameda borrowed customers’ assets held at FTX without limits -these funds were used for margin trading and resulted in huge losses.

Also, Alameda deployed “funds to various third party exchanges which were inherently unsafe, and further exacerbated by the limited protections offered in certain foreign jurisdictions.”

FTX went on a $5B “spending binge”

The testimony further revealed that FTX went on a $5 billion spending binge between late 2021 and 2022. During this period, Ray said the company bought and invested in several companies that ” may be worth only a fraction of what was paid for them.”

Meanwhile, insiders also enjoyed special treatment, getting over $1 billion in personal loans.

Ray noted that efforts are ongoing to recover some of the missing funds, maximize value for customers and creditors, and repair FTX relationships with regulators worldwide.