Ethereum’s OFAC-Compliant blocks drop to 47%

Ethereum’s OFAC-Compliant blocks drop to 47% Ethereum’s OFAC-Compliant blocks drop to 47%

Gnosis CEO Martin Koppelmann pointed out that while news of Ethereum being less OFAC-compliant is great, there is still a need for more "systemic solutions."

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

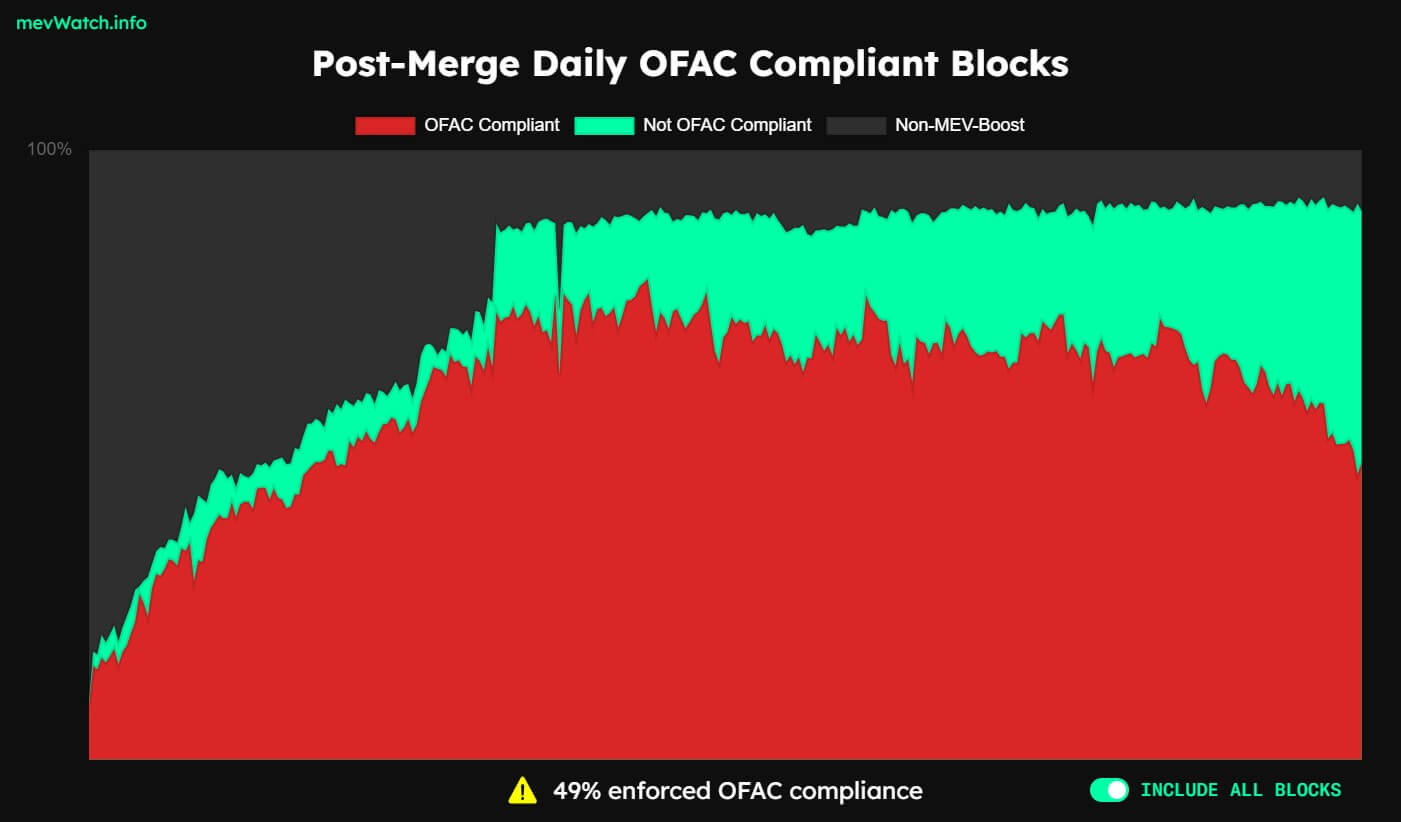

The number of Ethereum (ETH) blocks compliant with the United States Office of Foreign Asset Control (OFAC) fell to 47% on Feb. 13 — the lowest since Oct. 11 — according to MEV Watch data.

However, the number has slightly risen to 49% as of press time.

Immediately after Ethereum migrated to the proof-of-stake (PoS) consensus mechanism, one of the earliest issues community members raised was the growing number of blocks that were OFAC-compliant.

Since OFAC blacklisted several addresses related to the mixing protocol Tornado Cash, some Ethereum validators do not include transactions from these addresses in their blocks, raising concerns about the network’s censorship resistance level.

During this period, OFAC-compliant blocks peaked at 79% on Nov. 22, 2022. However, the numbers have steadily dropped in the current year, drawing praise from the community.

The reduction in OFAC-compliant blocks is due to more validators using MEV-boost relays that don’t sanction transactions.

Meanwhile, Gnosis CEO Martin Koppelmann pointed out that while news of Ethereum being less OFAC-compliant is great, there is still a need for more “systemic solutions.” Koppelmann added that only three relays make up “47% of uncensored block space.”

The MEV Watch displays a censorship offenders leaderboard showing all entities running a censoring MEV relay on their validators. The list included centralized exchanges like Binance, Bitfinex, Kraken, and Coinbase. Other platforms on the board include Celsius Network, Cream Finance, Lido, etc.