Ethereum, Solana see gains as Bitcoin’s rally above $50,000 causes $184 million liquidations

Ethereum, Solana see gains as Bitcoin’s rally above $50,000 causes $184 million liquidations Ethereum, Solana see gains as Bitcoin’s rally above $50,000 causes $184 million liquidations

Bitcoin price crossed the $50,000 threshold for the first time since late 2021.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s surge past $50,000 catalyzed a broader market upswing, propelling numerous large-cap alternative digital assets such as Ethereum (ETH), Solana (SOL), and others to significant gains.

According to data from CryptoSlate, Ethereum saw a 7% uptick, reaching $2,661, while SOL surged 8% to hit $114. Among the top 10 digital assets, Avalanche’s AVAX spiked 6% to $41, Cardano’s ADA rose by 3.74% to $0.5574, while BNB Coin (BNB) and Ripple’s XRP experienced more modest gains, each climbing by less than 3%.

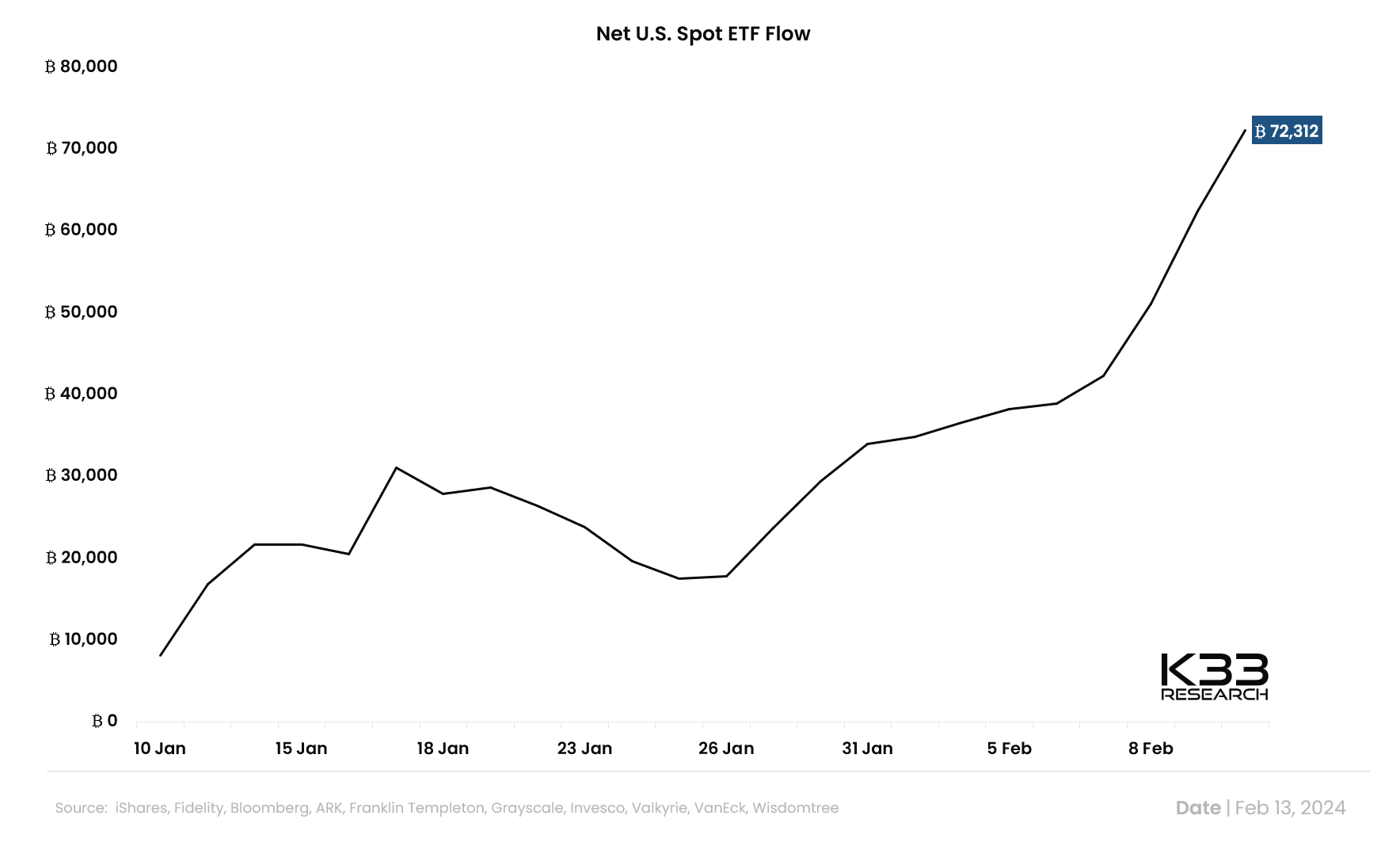

Market analysts attribute this bullish trend to the buzz surrounding the multiple spot Bitcoin exchange-traded funds (ETFs) in the US. Vetle Lunde, a senior analyst at K33 Research, noted that inflows into these ETFs have remained robust more than a month after their launch.

“Yesterday saw a net inflow of 9,870 BTC, pushing the net U.S. spot ETF flow since launch to 72,312 BTC. The new nine now hold 228,000 BTC,” Lunde added.

During the past day, BTC’s price crossed the $50,000 threshold for the first time since late 2021. The top crypto’s value has risen 4.2% to $50,146 as of press time, extending a positive run that had seen it gain 16% over the past week.

$184 million in liquidation

The broader crypto market rally resulted in a significant liquidation totaling over $184 million from more than 56,000 traders, according to Coinglass data.

Short traders, or speculators betting against price increases, bore losses amounting to $134 million, while long traders betting on price increases lost approximately $50 million.

Across assets, Bitcoin led the liquidation charts with a total loss of $69.80 million. Short Bitcoin traders accounted for $55.04 million in losses, while long traders lost $14.76 million. Ethereum followed closely, contributing $39.85 million to the overall liquidation.

Other assets like Solana, LINK, and ORDI also experienced liquidations of $10.14 million, $5.93 million, and $4.81 million, respectively.

Across exchanges, Binance witnessed the highest proportion of liquidations at 43.13%, totaling $79.42 million. Other platforms like OKX and ByBit recorded liquidations of $58.29 million and $18.73 million, respectively.

Notably, the most significant liquidation order occurred on Bitmex for LINKUSD, amounting to $3.14 million.