El Salvador’s $1 billion Bitcoin bond called a “meme” by mainstream finance

El Salvador’s $1 billion Bitcoin bond called a “meme” by mainstream finance El Salvador’s $1 billion Bitcoin bond called a “meme” by mainstream finance

The Bitcoin bond receives $500 million in verbal commits, but some express skepticism on whether the program can work.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoiner Dennis Porter tweeted that El Salvador had raised $500 million for their Bitcoin bond program.

JUST IN – El Salvador raises over $500,000,000 for their #Bitcoin bond. 🌋🇸🇻

— Dennis Porter (@Dennis_Porter_) February 23, 2022

According to Blockstream’s Chief Strategy Officer Samson Mow, the $500 million raised is in the form of verbal commitments, thus, doesn’t constitute final pledges.

What’s more, the money raised so far is less than the $1 billion figure proposed when plans were first announced in November 2021. However, details of the timeline are not known at this point; only that issuance will take place in 2022.

Nonetheless, certain entities, including U.S credit agency Fitch, remain doubtful on whether the program will succeed.

How will the Bitcoin “volcano bond” work?

Soon after declaring Bitcoin legal tender in El Salvador, President Bukele also announced a $1 billion BTC bond issuance to build “Bitcoin City.”

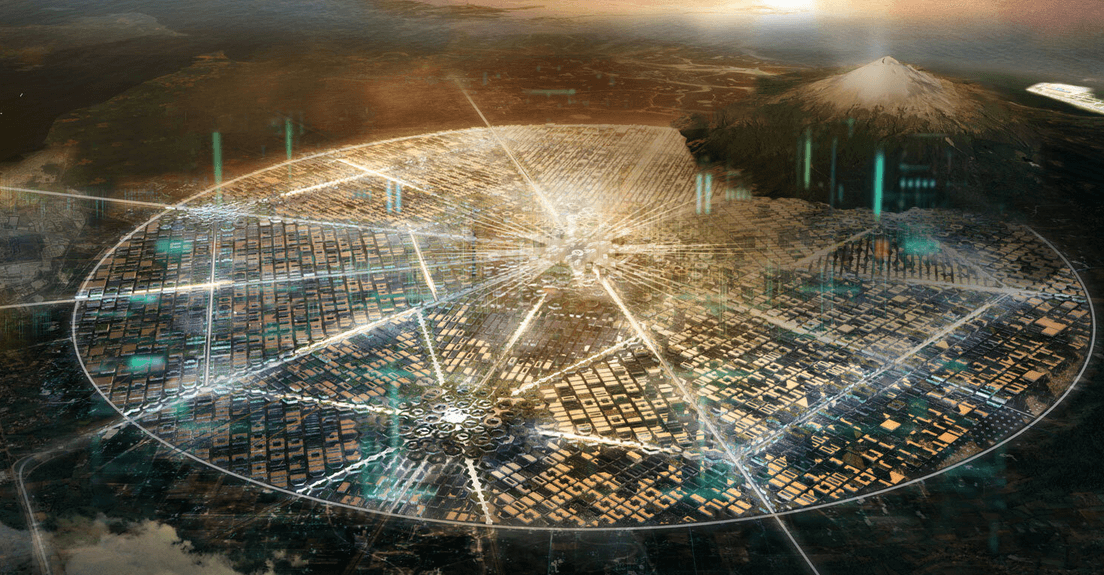

The city will be round to represent a coin. It will be built in the south-eastern region of La Unión at the base of the Conchagua Volcano to utilize geothermal energy. According to President Bukele, it will contain “everything devoted to Bitcoin.”

“Residential areas, commercial areas, services, museums, entertainment, bars, restaurants, airport, port, rail – everything devoted to Bitcoin.”

Explaining how the “volcano bond” would work, Mow said the first 10-year issue would be valued at $1 billion total and carry a coupon of 6.5%, all of which is backed by Bitcoin. Half the money will be converted to Bitcoin; the remainder will build infrastructure and fund mining operations.

After a five-year lock-in period, El Salvador will sell some of the initially purchased Bitcoin to provide investors with “an additional coupon.” There are no details on the value of this additional coupon at this time.

Also, for this to work, the price of Bitcoin in five years must be more than when the investors bought the bond. Although probable, it is still a risky venture to take on.

Forbes says while the 6.5% coupon is somewhat inviting versus current interest rates, inflationary risk should give investors pause for thought. They ask whether this rate is adjustable to account for the changing economic landscape.

“this nominal interest rate is perhaps not as appealing as it initially appear; rising inflation rates across the globe will continue to eat into these coupon payments.”

Mainstream finance pushes back

With uncertainty around the Bitcoin bond as a polished product, Fitch said it has reservations on whether El Salvador can raise the entire valuation.

This was a factor in the firm’s decision to downgrade El Salvador’s credit rating to CCC earlier this month, denoting a substantial credit risk.

“CCC National Ratings denote a very high level of default risk relative to other issuers or obligations in the same country or monetary union.”

Chiming in, an unnamed financial executive paid a backhanded compliment, saying the volcano bond, while lacking fundamentals, still has novelty appeal as a “meme” bond.

Mow dismissed such talk, saying El Salvador would have no problem raising the money.